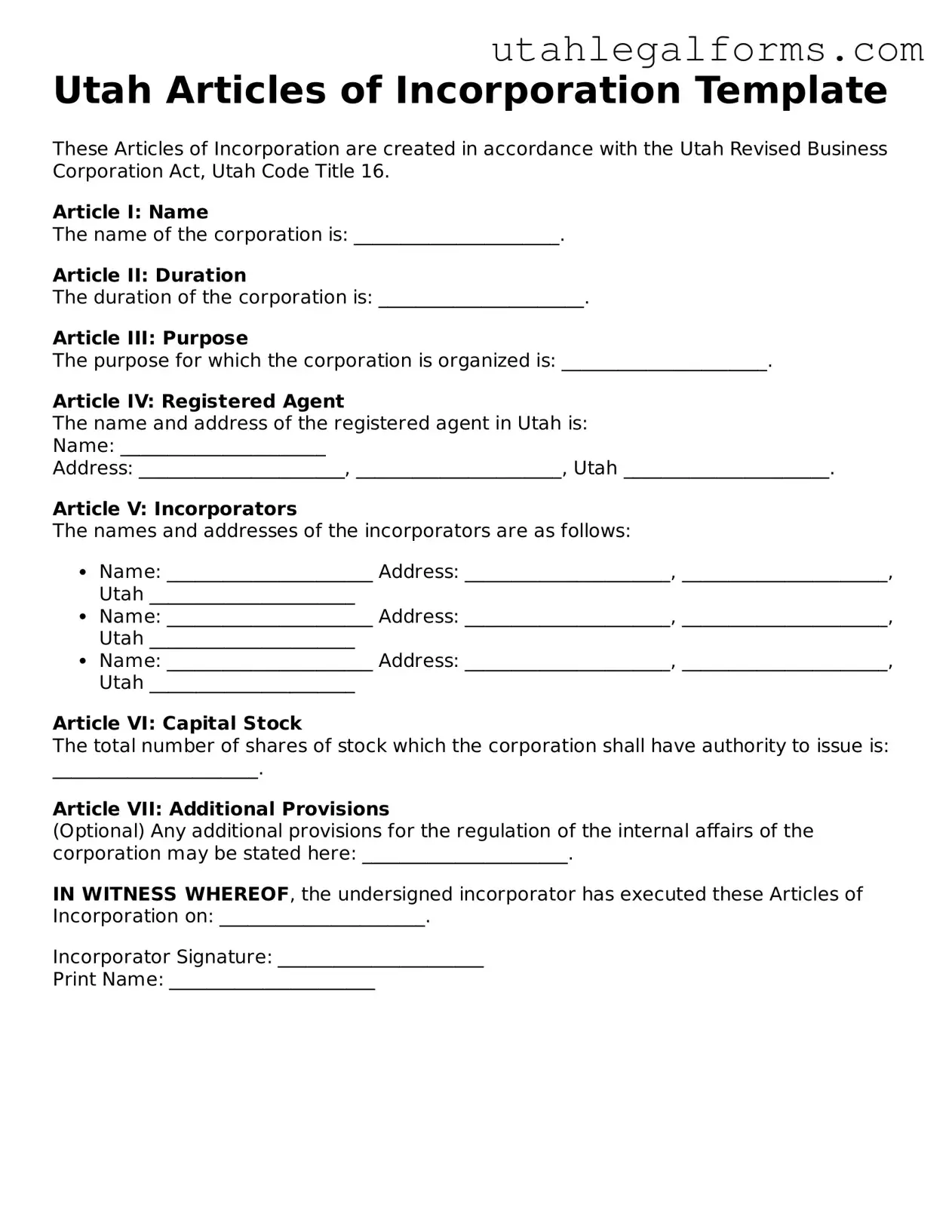

Official Articles of Incorporation Form for Utah State

Dos and Don'ts

When filling out the Utah Articles of Incorporation form, it is essential to follow certain guidelines to ensure accuracy and compliance. Here are some important do's and don'ts:

- Do provide the name of the corporation exactly as you wish it to appear.

- Do include the principal office address, ensuring it is a physical location.

- Do list the registered agent and their address correctly.

- Do specify the purpose of the corporation clearly and concisely.

- Don't use vague terms when describing the business purpose.

- Don't forget to include the names and addresses of the incorporators.

- Don't leave any required fields blank; this may delay processing.

- Don't forget to sign and date the form before submission.

Consider Some Other Templates for Utah

Utah Divorce Court - Can be amended in the future if circumstances change.

Utah Dmv Report Sold Vehicle - A Bill of Sale may be necessary to facilitate tax deductions or claims for a business.

To ensure your wishes are honored during critical times, consider using a reliable form for your Power of Attorney needs. You can access additional information and templates by visiting the comprehensive Power of Attorney document guide.

Utah Quit Claim Deed - Using a Quitclaim Deed can simplify the process of changing property ownership between known parties.

Listed Questions and Answers

-

What are the Articles of Incorporation?

The Articles of Incorporation is a legal document filed with the state to establish a corporation. It outlines the basic details of the corporation, including its name, purpose, registered agent, and the number of shares it is authorized to issue.

-

Why do I need to file Articles of Incorporation in Utah?

Filing Articles of Incorporation is necessary to legally create a corporation in Utah. This document provides the state with essential information about your business and ensures compliance with state laws.

-

What information is required in the Articles of Incorporation?

- The name of the corporation.

- The duration of the corporation, if not perpetual.

- The purpose of the corporation.

- The address of the principal office.

- The name and address of the registered agent.

- The number of shares the corporation is authorized to issue.

-

Who can file the Articles of Incorporation?

Any individual or entity can file the Articles of Incorporation. However, it is typically done by the incorporators, who may be the founders or attorneys representing the corporation.

-

What is a registered agent?

A registered agent is an individual or business entity designated to receive legal documents on behalf of the corporation. The registered agent must have a physical address in Utah and be available during business hours.

-

How much does it cost to file Articles of Incorporation in Utah?

The filing fee for Articles of Incorporation in Utah is subject to change. As of the latest information, the fee is typically around $70. It is advisable to check the Utah Division of Corporations for the most current fee schedule.

-

How long does it take to process the Articles of Incorporation?

The processing time for Articles of Incorporation can vary. Generally, it takes about 1 to 2 weeks for the state to process the filing. Expedited services may be available for an additional fee, which can significantly reduce the processing time.

-

Can I amend the Articles of Incorporation after filing?

Yes, amendments to the Articles of Incorporation can be made after the initial filing. This requires submitting a formal amendment form along with the appropriate fee to the state.

-

What happens if I do not file Articles of Incorporation?

If you do not file Articles of Incorporation, your business cannot operate as a corporation. This may limit your personal liability protection and affect your ability to raise capital or enter into contracts.

Key takeaways

Ensure you have the correct form for the Articles of Incorporation specific to Utah. This form is essential for establishing a corporation in the state.

Gather all necessary information before starting the form. This includes the corporation's name, address, and the names and addresses of the initial directors.

Choose a unique name for your corporation. The name must not be similar to any existing business registered in Utah.

Decide on the type of corporation you are forming, such as a profit or nonprofit corporation. This choice affects various aspects of your business.

Provide the registered agent's information. This person or business will receive legal documents on behalf of the corporation.

Include the purpose of the corporation. A clear statement of purpose helps define the business's activities.

Review the form for accuracy. Mistakes can delay the incorporation process or lead to rejection.

Submit the completed form along with the required filing fee to the Utah Division of Corporations. Keep a copy for your records after submission.

Documents used along the form

When forming a corporation in Utah, several documents may accompany the Articles of Incorporation. Each document serves a specific purpose and helps ensure that your corporation is established and operated legally. Below is a list of common forms and documents you might encounter.

- Bylaws: This document outlines the internal rules and procedures for managing the corporation. Bylaws cover topics such as the roles of officers, how meetings are conducted, and how decisions are made.

- Initial Report: After filing the Articles of Incorporation, an Initial Report must be submitted. This report provides the state with basic information about the corporation, including its address and the names of its officers and directors.

- Dirt Bike Bill of Sale: For those engaging in the sale or purchase of a dirt bike in New York, completing the Dirt Bike Bill of Sale form is a crucial step toward ensuring the legality and transparency of the transaction. For more information, visit legalpdf.org.

- Employer Identification Number (EIN) Application: An EIN is necessary for tax purposes. This number is obtained from the IRS and is used for reporting taxes and hiring employees.

- Business License: Depending on the type of business and its location, a business license may be required. This license allows the corporation to legally operate within the city or county.

- State Tax Registration: Corporations may need to register for state taxes. This registration ensures compliance with state tax laws and regulations.

- Shareholder Agreements: If there are multiple shareholders, a shareholder agreement can clarify the rights and responsibilities of each party. This document helps prevent disputes and outlines how shares can be transferred.

- Meeting Minutes: Keeping records of meetings is essential. Meeting minutes document the discussions and decisions made during corporate meetings, ensuring transparency and accountability.

- Annual Reports: Most corporations are required to file annual reports with the state. These reports provide updated information about the corporation's status and activities over the past year.

- Resolutions: Resolutions are formal decisions made by the board of directors or shareholders. They may cover various corporate actions, such as approving budgets or authorizing contracts.

Understanding these documents is crucial for anyone looking to establish a corporation in Utah. Each plays a vital role in ensuring that your business is compliant with legal requirements and is set up for success.

Form Information

| Fact Name | Description |

|---|---|

| Purpose | The Utah Articles of Incorporation form is used to officially create a corporation in the state of Utah. |

| Governing Law | This form is governed by the Utah Business Corporation Act, found in Title 16 of the Utah Code. |

| Filing Requirement | Corporations must file the Articles of Incorporation with the Utah Division of Corporations and Commercial Code. |

| Information Needed | Key details required include the corporation's name, duration, purpose, and registered agent information. |

| Filing Fee | A filing fee is required when submitting the Articles of Incorporation, which varies based on the type of corporation. |

| Effective Date | The corporation can specify an effective date for the Articles, which can be the filing date or a future date. |