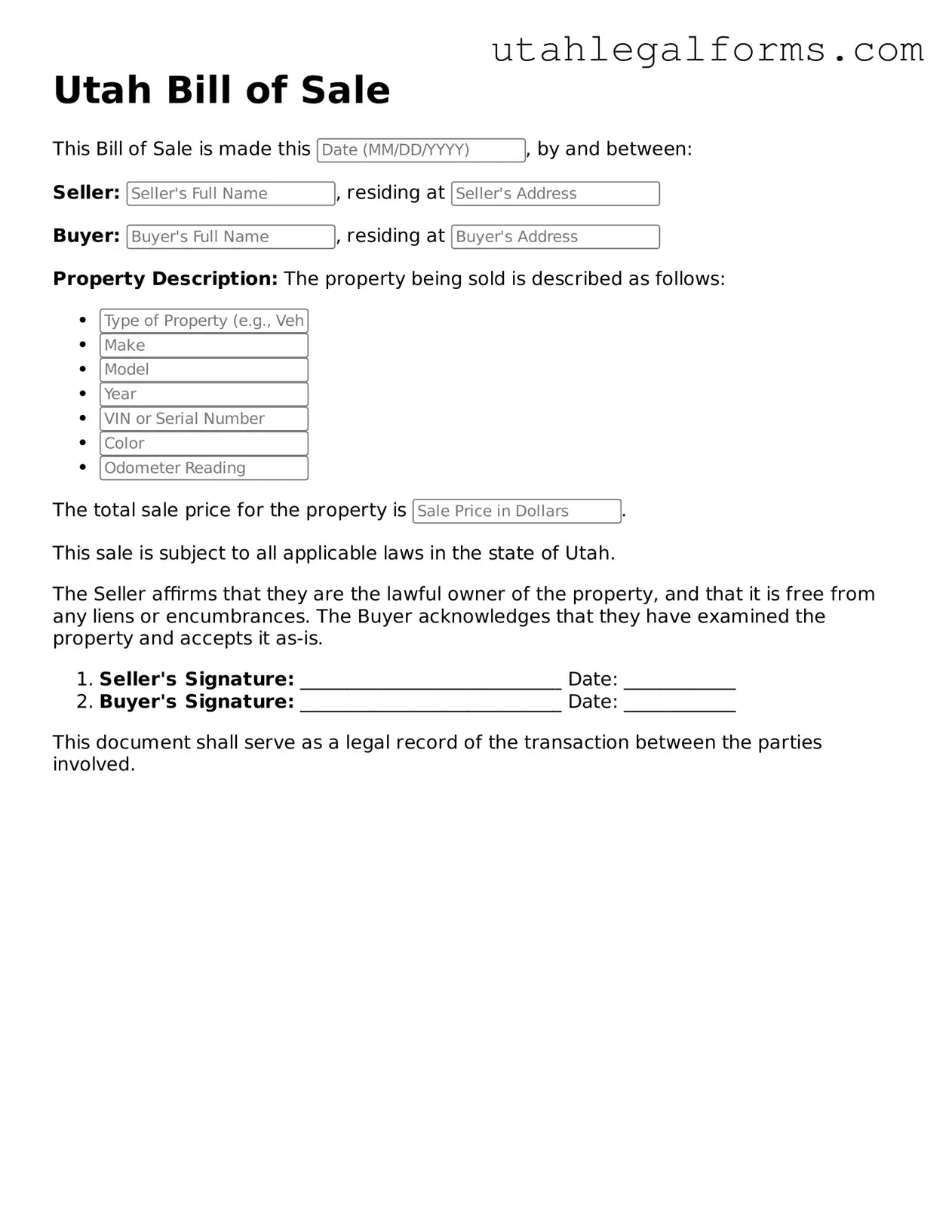

Official Bill of Sale Form for Utah State

Dos and Don'ts

When filling out the Utah Bill of Sale form, it is important to follow certain guidelines to ensure accuracy and legality. Here are some things you should and shouldn't do:

- Do provide accurate and complete information about the buyer and seller.

- Do include a detailed description of the item being sold, including any identifying numbers.

- Don't leave any sections of the form blank; incomplete forms may cause issues later.

- Don't forget to sign and date the form; both parties must acknowledge the transaction.

Consider Some Other Templates for Utah

Utah Residential Lease Agreement Word Document - Provides instructions for emergency contact information.

When considering the establishment of an LLC, it's crucial to have a solid foundation. Prepare your essential Operating Agreement document to specify the roles and responsibilities of each member, ensuring clarity in governance. For more information, visit the necessary Operating Agreement guidelines.

Utah Promissory Note - Both the borrower and lender sign the document to denote acceptance of its terms.

Listed Questions and Answers

-

What is a Bill of Sale in Utah?

A Bill of Sale is a legal document that serves as proof of a transaction between a buyer and a seller. In Utah, it typically includes details about the item being sold, the purchase price, and the parties involved. This document is especially important for transferring ownership of vehicles, boats, and other personal property.

-

When do I need a Bill of Sale?

You should use a Bill of Sale whenever you buy or sell personal property, especially items like vehicles, trailers, or boats. It provides a record of the transaction and can protect both the buyer and seller in case of disputes.

-

What information should be included in a Utah Bill of Sale?

A typical Bill of Sale should include:

- The names and addresses of both the buyer and seller

- A detailed description of the item being sold, including any identifying numbers (like VIN for vehicles)

- The purchase price

- The date of the transaction

- Any warranties or guarantees, if applicable

-

Is a Bill of Sale required in Utah?

While a Bill of Sale is not legally required for every transaction, it is highly recommended, especially for high-value items. For vehicle transactions, Utah law requires a Bill of Sale to register the vehicle with the Department of Motor Vehicles (DMV).

-

Can I create my own Bill of Sale?

Yes, you can create your own Bill of Sale. Just make sure it includes all necessary details and is signed by both parties. There are also templates available online that can help ensure you cover all the essential information.

-

Do I need to have the Bill of Sale notarized?

In Utah, notarization is not required for a Bill of Sale. However, having it notarized can add an extra layer of security and authenticity to the document, which may be beneficial in case of future disputes.

-

What if there are issues after the sale?

If issues arise after the sale, the Bill of Sale can serve as evidence of the transaction and the terms agreed upon. It’s important to keep a copy of the document for your records. If disputes escalate, you may need to consult a legal professional for guidance.

-

How long should I keep a Bill of Sale?

It’s advisable to keep a Bill of Sale for as long as you own the item, plus a few years after selling it. This can help protect you if any legal questions arise regarding the sale.

-

Where can I find a Bill of Sale template for Utah?

You can find Bill of Sale templates online, including on legal websites and state government pages. Make sure to choose a template that complies with Utah laws to ensure it meets all necessary requirements.

Key takeaways

When filling out and using the Utah Bill of Sale form, keep these key takeaways in mind:

- Provide Accurate Information: Ensure that all details about the buyer, seller, and the item being sold are correct. This includes names, addresses, and a clear description of the item.

- Include Sale Price: Clearly state the sale price of the item. This is important for both parties and may be needed for tax purposes.

- Signatures Required: Both the buyer and seller must sign the form. This confirms that both parties agree to the terms of the sale.

- Consider Notarization: While notarization is not required, having the document notarized can provide an extra layer of security and verification.

- Keep Copies: After completing the form, both parties should keep a copy for their records. This helps in case any disputes arise later.

- Check Local Laws: Be aware of any specific local laws or regulations that may apply to the sale of certain items, such as vehicles or firearms.

Documents used along the form

The Utah Bill of Sale form is an essential document for transferring ownership of personal property, particularly vehicles. However, several other forms and documents are often used in conjunction with it to ensure a smooth transaction. Below is a list of these commonly associated documents, each serving a specific purpose in the sales process.

- Title Transfer Document: This document is crucial for transferring ownership of a vehicle. It includes details about the vehicle and the parties involved in the sale.

- Vehicle Registration Application: After a sale, the new owner must register the vehicle in their name. This application provides necessary information to the state for updating ownership records.

- General Goods Sale Document: This document provides essential details about the exchange of personal property, ensuring that both parties understand their rights and obligations. For more information, visit the General Goods Sale Document.

- Odometer Disclosure Statement: Required for vehicle sales, this statement records the vehicle's mileage at the time of sale. It helps prevent fraud and ensures transparency.

- Affidavit of Sale: This sworn statement serves as proof of the sale and can be used in case of disputes. It outlines the terms agreed upon by both parties.

- Sales Tax Form: In Utah, sales tax may apply to certain transactions. This form helps calculate and report the tax owed to the state after the sale.

- Warranty Bill of Sale: If the seller provides any warranties or guarantees regarding the item sold, this document outlines the specifics, ensuring both parties understand the terms.

- Power of Attorney: In some cases, a seller may authorize another person to act on their behalf during the sale. This document grants that authority, facilitating the transaction.

- Purchase Agreement: This contract details the terms of the sale, including price, payment methods, and conditions. It serves as a binding agreement between the buyer and seller.

Each of these documents plays a vital role in ensuring that the sale is legally sound and that both parties are protected. Utilizing them alongside the Utah Bill of Sale can help facilitate a smoother transaction and minimize potential disputes in the future.

Form Information

| Fact Name | Description |

|---|---|

| Purpose | The Utah Bill of Sale form is used to document the transfer of ownership of personal property between a seller and a buyer. |

| Governing Law | The form is governed by the Utah Code Title 70A, which covers the Uniform Commercial Code (UCC) in Utah. |

| Property Types | This form can be used for various types of personal property, including vehicles, boats, and equipment. |

| Notarization | While notarization is not required, having the form notarized can provide additional legal protection for both parties. |

| Information Required | The form typically requires details such as the names of the buyer and seller, a description of the property, and the sale price. |

| Tax Implications | Sales tax may apply to the transaction, and it is the buyer's responsibility to report and pay any applicable taxes. |

| Record Keeping | Both the buyer and seller should keep a copy of the completed Bill of Sale for their records, as it serves as proof of the transaction. |