Official Deed Form for Utah State

Dos and Don'ts

When filling out the Utah Deed form, it’s important to follow certain guidelines. Here’s a list of things you should and shouldn’t do:

- Do ensure all names are spelled correctly.

- Don’t leave any blank spaces on the form.

- Do use clear and legible handwriting or type the information.

- Don’t use abbreviations unless they are standard and widely accepted.

- Do include the correct legal description of the property.

- Don’t forget to sign and date the document.

- Do check for any additional requirements specific to your county.

- Don’t submit the form without reviewing it for errors.

- Do keep a copy of the completed form for your records.

By following these guidelines, you can help ensure that your deed is processed smoothly.

Consider Some Other Templates for Utah

Utah Quit Claim Deed - A Quitclaim Deed may be a suitable option when a property is given as part of an inheritance.

To facilitate a smooth transaction, it is advisable for both parties to utilize the Arizona Motorcycle Bill of Sale form, which can be accessed at arizonapdfforms.com/motorcycle-bill-of-sale/. This legally binding document provides a clear framework for the sale and helps ensure that all necessary details are recorded, thus protecting the interests of both the buyer and the seller.

Utah Promissory Note - A promissory note enhances accountability in lending arrangements.

Listed Questions and Answers

-

What is a Utah Deed form?

A Utah Deed form is a legal document used to transfer ownership of real property from one party to another within the state of Utah. This document outlines the details of the property being transferred, including its legal description, and identifies the parties involved in the transaction.

-

What types of deeds are available in Utah?

In Utah, there are several types of deeds, including:

- Warranty Deed: This deed guarantees that the seller has clear title to the property and has the right to sell it.

- Quitclaim Deed: This deed transfers any interest the seller has in the property without making any guarantees about the title.

- Special Warranty Deed: This deed provides some assurances from the seller but only for the time they owned the property.

-

How do I fill out a Utah Deed form?

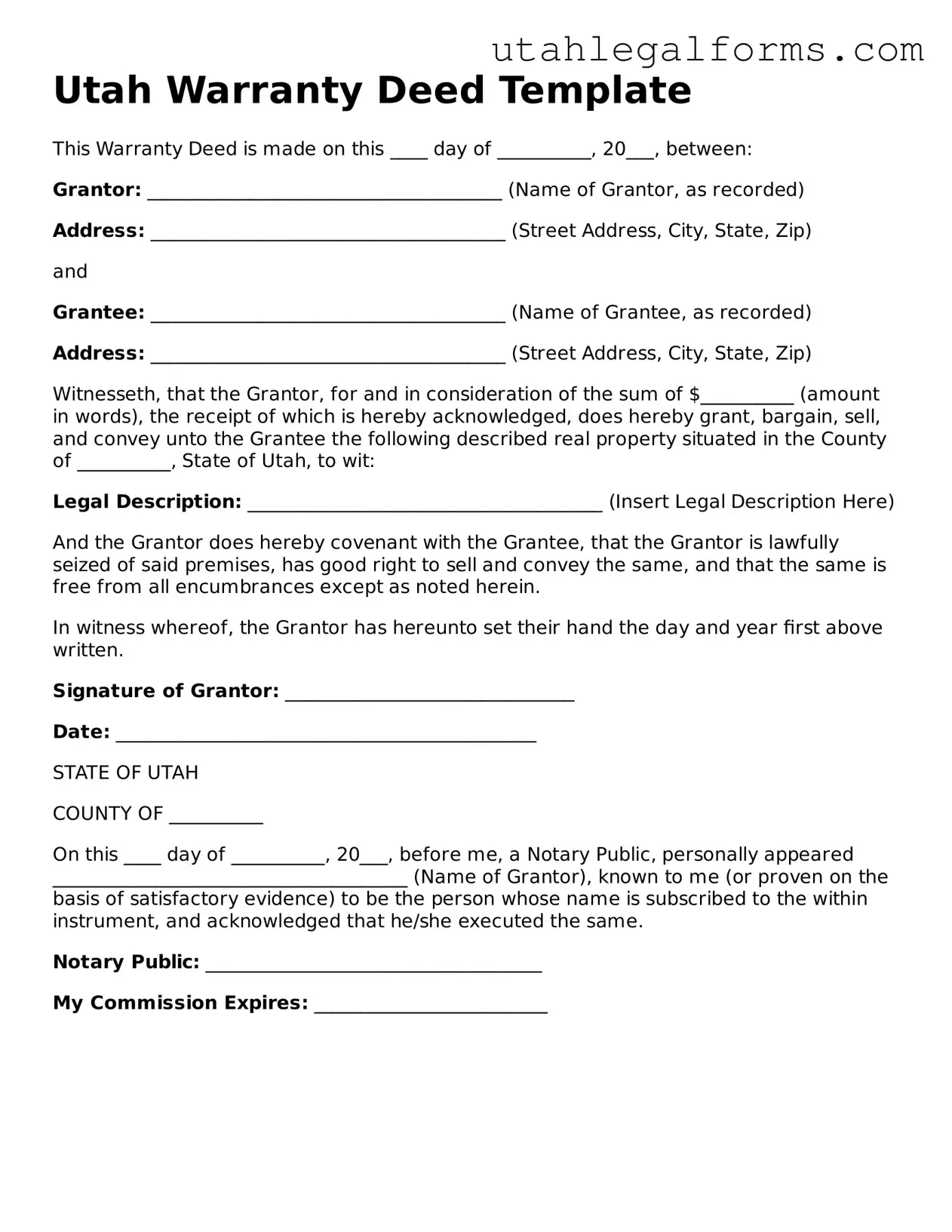

Filling out a Utah Deed form requires careful attention to detail. Start by entering the names and addresses of both the grantor (seller) and grantee (buyer). Next, include the legal description of the property, which can usually be found in previous deed documents or property tax records. Finally, ensure that the form is signed and dated by the grantor, and consider having it notarized for added legal protection.

-

Do I need to have the deed notarized?

Yes, in Utah, it is generally required for the deed to be notarized. This adds an extra layer of authenticity and helps prevent fraud. Notarization ensures that the signatures on the deed are valid and that the parties involved understand the document they are signing.

-

Where do I file the Utah Deed form?

After completing the deed, it must be filed with the county recorder’s office in the county where the property is located. Filing the deed officially records the transfer of ownership and makes it part of the public record. Be sure to check if there are any local fees associated with filing.

-

Are there any fees associated with filing a Utah Deed?

Yes, there are typically fees involved when filing a Utah Deed. These fees can vary by county and may depend on the type of deed being filed. It’s advisable to contact your local county recorder’s office for specific information regarding their fees and payment methods.

-

What happens after I file the deed?

Once the deed is filed, the county recorder will process it and update the public records to reflect the new ownership. You should receive a copy of the recorded deed for your records. This document serves as proof of ownership and may be required for future transactions involving the property.

Key takeaways

When filling out and using the Utah Deed form, there are several important points to keep in mind. Here are some key takeaways:

- Understand the Types of Deeds: Familiarize yourself with the different types of deeds available in Utah, such as warranty deeds and quitclaim deeds. Each serves a different purpose.

- Provide Accurate Information: Ensure that all names, addresses, and property descriptions are correct. Mistakes can lead to legal complications.

- Signatures Matter: The deed must be signed by the grantor (the person transferring the property). In some cases, a notary public may need to witness the signature.

- Consider Recording the Deed: After completing the deed, it’s advisable to record it with the county clerk. This step protects your ownership rights and provides public notice.

- Check for Additional Requirements: Depending on the property type or location, there may be additional forms or disclosures needed. Research local regulations to avoid issues.

- Seek Legal Advice if Needed: If you’re unsure about any part of the process, consulting with a real estate attorney can provide clarity and help ensure everything is done correctly.

Documents used along the form

When preparing to transfer property ownership in Utah, several forms and documents may accompany the Utah Deed form. Each of these documents plays a crucial role in ensuring a smooth transaction and compliance with state laws.

- Property Transfer Tax Declaration: This document is required to report the sale of the property and calculate any applicable transfer taxes. It provides essential information about the property, including its sale price.

- Affidavit of Value: This affidavit is often used to declare the value of the property being transferred. It helps establish the fair market value and can be important for tax purposes.

- Title Search Report: A title search report verifies the legal ownership of the property and identifies any liens or encumbrances. This document is crucial for ensuring that the seller has the right to transfer ownership.

- Boat Bill of Sale: Essential for recording the sale and transfer of ownership of a boat in New York, this document is crucial for both parties and can be reliably sourced from legalpdf.org to ensure accuracy and compliance.

- Settlement Statement: This document outlines the financial details of the transaction, including closing costs and adjustments. It provides a clear breakdown of what both parties owe and what they will receive.

- Power of Attorney: If one party is unable to be present for the signing, a power of attorney allows another individual to act on their behalf. This document must be executed properly to be valid.

- Real Estate Purchase Agreement: This contract outlines the terms of the sale, including the purchase price, contingencies, and any other conditions. It serves as the foundation for the transaction.

Each of these documents is integral to the property transfer process in Utah. Ensuring that they are completed accurately and submitted in a timely manner can help prevent legal complications and delays.

Form Information

| Fact Name | Description |

|---|---|

| Purpose | The Utah Deed form is used to transfer ownership of real property from one party to another. |

| Types of Deeds | Common types include Warranty Deed, Quitclaim Deed, and Special Warranty Deed. |

| Governing Laws | Utah Code Title 57, Chapter 1 governs the laws related to property deeds in Utah. |

| Notarization Requirement | The deed must be notarized to be legally valid in Utah. |

| Recording | To protect ownership rights, the deed should be recorded with the county recorder's office. |

| Tax Implications | Transfer taxes may apply when the deed is executed, depending on the property's value. |