Fill a Valid Dopl Ap 017 Template

Dos and Don'ts

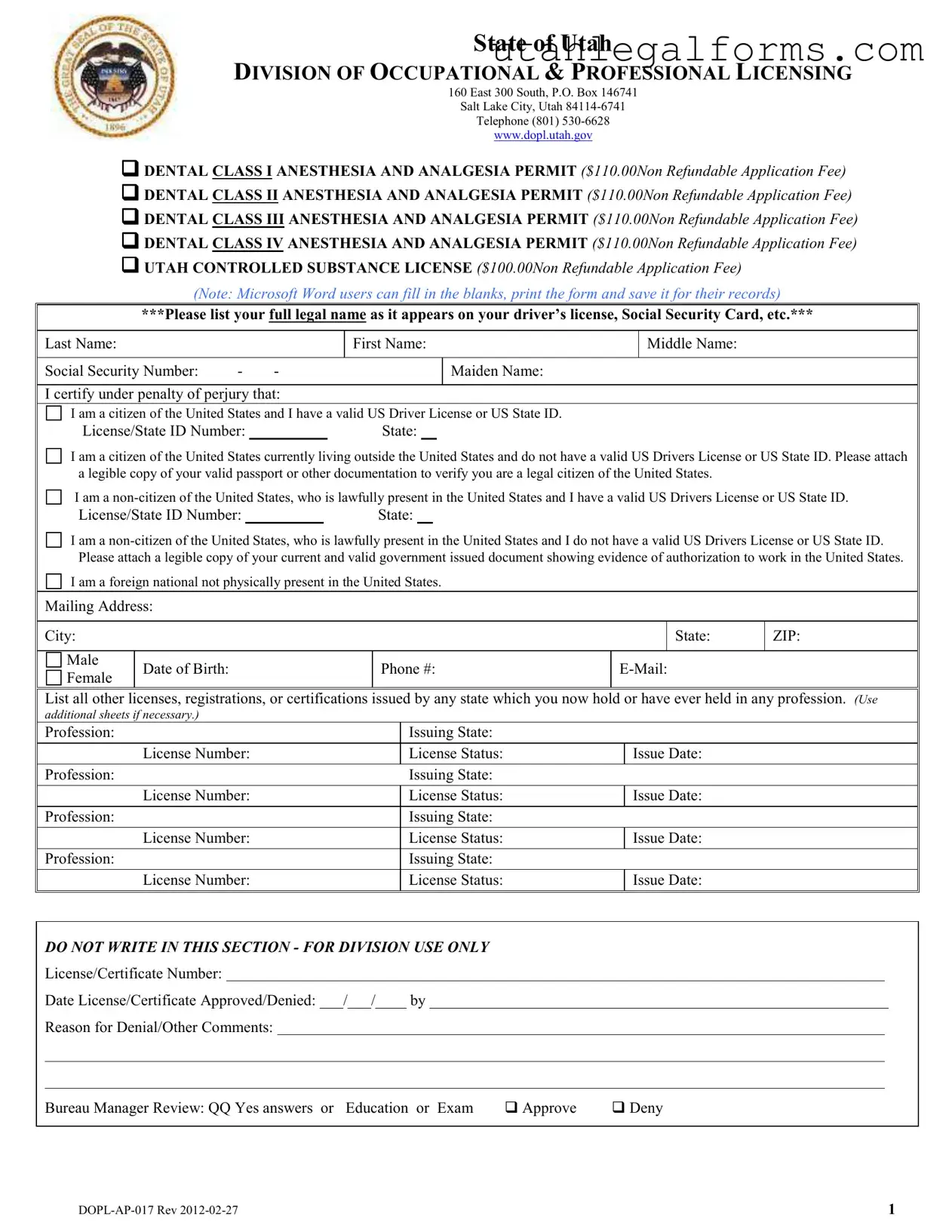

When filling out the Dopl Ap 017 form, it's important to follow specific guidelines to ensure accuracy and compliance. Here are some dos and don'ts to keep in mind:

- Do: Double-check all entries for accuracy before submission.

- Do: Use clear and legible handwriting or type the information if possible.

- Do: Provide all required documentation as specified in the instructions.

- Do: Keep a copy of the completed form for your records.

- Don't: Leave any required fields blank; ensure all sections are completed.

- Don't: Use correction fluid or tape to alter any information on the form.

- Don't: Submit the form without reviewing the instructions for specific requirements.

- Don't: Forget to sign and date the form where indicated.

More PDF Forms

Utah State Tax Form - Check all applicable box criteria before submitting your TC 8453.

In addition to providing legal protection during transactions, obtaining a Bill of Sale can be further simplified by utilizing resources such as legalpdf.org, which offers helpful templates and guidelines for completing these forms accurately.

Utah Real Estate Contract - Each change should be carefully considered before being agreed to by either party.

Utah Income Tax Forms - Property damage details must include estimated repair costs.

Listed Questions and Answers

-

What is the Dopl Ap 017 form used for?

The Dopl Ap 017 form is typically utilized for specific administrative processes within certain regulatory frameworks. It serves as a means to collect necessary information for compliance, reporting, or application purposes. Understanding its specific use is essential for ensuring that all required details are accurately provided.

-

Who needs to fill out the Dopl Ap 017 form?

Individuals or organizations that are involved in activities governed by the regulations associated with this form must complete it. This could include businesses seeking permits, licenses, or other forms of authorization. It is crucial for those affected by the regulations to be aware of their obligations regarding this form.

-

How can I obtain the Dopl Ap 017 form?

The Dopl Ap 017 form can typically be obtained from the relevant regulatory authority's website or office. Many agencies provide downloadable versions of their forms online, making it convenient for users to access them. If online access is not available, visiting the agency in person or contacting them directly can also yield a copy of the form.

-

What should I do if I make a mistake on the Dopl Ap 017 form?

If a mistake is made on the Dopl Ap 017 form, it is advisable to correct it promptly. Depending on the agency's guidelines, you may need to cross out the error and write the correct information next to it, or you might be required to complete a new form entirely. Always check the instructions provided with the form to ensure compliance with the correction process.

Key takeaways

Ensure that all required fields are filled out completely. Missing information can lead to delays in processing.

Use clear and legible handwriting or type the form to avoid misinterpretation of your entries.

Double-check the accuracy of the information provided. Errors can result in complications or rejections.

Keep a copy of the completed form for your records. This can be useful for future reference or follow-up.

Submit the form to the correct department or agency as specified in the instructions. Misplaced forms can cause significant delays.

Be aware of any deadlines associated with the form. Timely submission is crucial to ensure compliance.

Documents used along the form

The Dopl Ap 017 form is often accompanied by several other important documents. Each of these documents serves a specific purpose and helps to ensure that the necessary information is provided for processing. Below are four common forms that are typically used alongside the Dopl Ap 017 form.

- Application for Employment: This form collects basic information about the applicant, including their work history, education, and references. It helps employers assess candidates for job positions.

- Background Check Authorization: This document gives permission for the employer to conduct a background check on the applicant. It may include criminal history, credit checks, and verification of past employment.

- Tax Form W-4: This form is used by employees to indicate their tax situation to their employer. It determines the amount of federal income tax to withhold from paychecks.

- Ohio Horse Bill of Sale Form: For those interested in equine transactions, the detailed Ohio horse bill of sale guidelines provide essential information for a smooth transfer of ownership.

- Direct Deposit Authorization: This document allows employees to authorize their employer to deposit their pay directly into their bank account. It streamlines the payment process and ensures timely access to funds.

Having these documents ready can help facilitate a smoother application process. It’s always a good idea to check for any additional requirements that may be specific to your situation or location.

File Specifications

| Fact Name | Fact Details |

|---|---|

| Form Purpose | The Dopl Ap 017 form is used for specific applications related to licensing or permits within a state. |

| Governing Law | This form is governed by state regulations pertaining to administrative procedures and licensing. |

| Submission Requirements | Applicants must complete the form accurately and submit it to the appropriate state agency along with any required fees. |

| Deadline | Submission deadlines vary by state and specific application type; applicants should check local regulations for details. |