Fill a Valid Jobs Utah Gov Template

Dos and Don'ts

When filling out the Jobs Utah Gov form, it is essential to follow specific guidelines to ensure accuracy and compliance. Here are some dos and don'ts to consider:

- Do use clear and legible handwriting or machine print when completing the form.

- Do double-check all information for accuracy before submitting.

- Do ensure that the registration number is correctly entered.

- Do submit the form online if possible, as this is the preferred method.

- Don't leave any required fields blank; provide all necessary information.

- Don't forget to include the quarter end date and due date.

- Don't submit the form late; be aware of the deadlines to avoid penalties.

Following these guidelines will help ensure a smooth filing process for your quarterly wage report.

More PDF Forms

How to Transfer a Car Title to a Family Member in Utah - The form reflects Utah's commitment to effective vehicle registration and security.

The California Boat Bill of Sale form is an essential document that ensures a smooth transfer of ownership when buying or selling a boat in the state. It acts as a formal record that legitimizes the transaction, making it vital for the registration and titling of the vessel. For assistance in preparing this document, you can refer to resources available at legalpdf.org, which provides guidance on filling out the form accurately.

Utah Tax Lien - The TC-142 includes payment instructions for processing fees.

Listed Questions and Answers

-

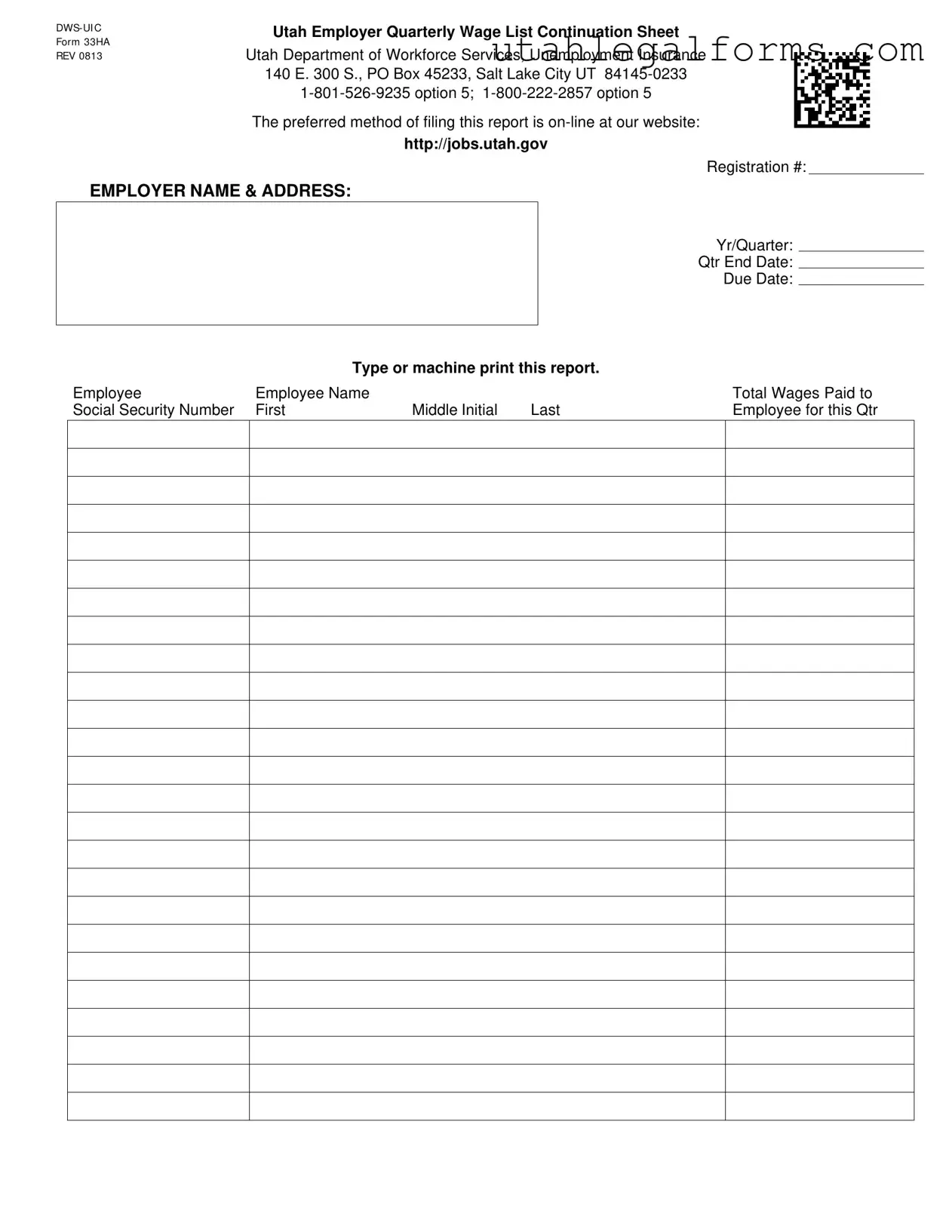

What is the Jobs Utah Gov form?

The Jobs Utah Gov form, specifically the DWS-UI C Form 33HA, is a report used by employers in Utah to submit their quarterly wage information to the Department of Workforce Services. This form helps track wages paid to employees and ensures compliance with unemployment insurance requirements.

-

Who needs to fill out this form?

All employers in Utah who have employees and are subject to unemployment insurance laws must complete this form. This includes businesses of all sizes, from small startups to large corporations.

-

When is the form due?

The due date for submitting the form corresponds to the end of each quarter. Employers should ensure they file the report by the specified due date to avoid penalties. The quarters end on:

- March 31

- June 30

- September 30

- December 31

-

How can I file the report?

The preferred method for filing the report is online through the Utah Department of Workforce Services website at jobs.utah.gov. This method is efficient and allows for quicker processing of your information.

-

What information is required on the form?

The form requires several key pieces of information, including:

- Your registration number

- Your employer name and address

- The year and quarter for which you are reporting

- The total wages paid to each employee for the quarter

- Each employee's Social Security number

- The names of all employees, including first, middle initial, and last name

-

What happens if I miss the due date?

Missing the due date can result in penalties and interest on unpaid unemployment insurance taxes. It is crucial to file on time to avoid these additional costs. If you anticipate a delay, contact the Department of Workforce Services as soon as possible.

-

Can I make corrections after submitting the form?

If you discover an error after submitting the form, you should contact the Department of Workforce Services immediately. They can guide you on the process for making corrections to ensure your records are accurate.

-

Where can I get assistance if I have questions?

If you have questions or need assistance, you can contact the Utah Department of Workforce Services at 1-801-526-9235, option 5, or 1-800-222-2857, option 5. They can provide the necessary support and information regarding the form and its requirements.

Key takeaways

Filling out the Jobs Utah Gov form requires attention to detail and adherence to specific guidelines. Here are key takeaways to keep in mind:

- Online Filing Preferred: The Utah Department of Workforce Services encourages employers to file the report online for efficiency and accuracy.

- Accurate Registration: Ensure that your registration number is correct. This number is crucial for identifying your business in the system.

- Complete Employer Information: Fill in the employer name and address completely. This information is necessary for proper processing.

- Quarterly Reporting: Be aware of the reporting period. Each report corresponds to a specific quarter, and deadlines must be met to avoid penalties.

- Employee Details Required: Include all required employee information, such as names and Social Security numbers, to ensure compliance with reporting requirements.

- Wage Reporting: Accurately report total wages paid to each employee for the quarter. This information is critical for unemployment insurance calculations.

By following these guidelines, employers can ensure that their submissions are accurate and timely, minimizing the risk of complications with unemployment insurance reporting.

Documents used along the form

When completing the Jobs Utah Gov form, it is essential to be aware of other documents that may be necessary or beneficial in conjunction with your filing. These documents can provide additional information or support your claims, ensuring compliance with state regulations. Below is a list of commonly used forms and documents that you may encounter.

- W-2 Form: This form reports an employee's annual wages and the taxes withheld from their paycheck. Employers must provide this form to employees and the IRS by the end of January each year.

- W-3 Form: This is a summary form that accompanies the W-2 forms when submitted to the Social Security Administration. It provides a total of all wages and taxes withheld for the year.

- 1099 Form: Used to report income received by individuals who are not classified as employees. This form is often utilized for independent contractors or freelancers.

- Arizona Motor Vehicle Bill of Sale: Completing the arizonapdfforms.com/motor-vehicle-bill-of-sale/ is vital for ensuring the accurate transfer of vehicle ownership and can facilitate a smoother registration process.

- Employer Registration Form: This document is necessary for businesses to register with the state for unemployment insurance. It includes essential information about the employer and their business operations.

- Employee Eligibility Verification (Form I-9): This form is required to verify an employee's identity and eligibility to work in the United States. Employers must complete this form for every new hire.

- Quarterly Contribution Report (DWS-UI C Form): This report details the unemployment insurance contributions made by the employer for each quarter. It is essential for maintaining accurate records with the Department of Workforce Services.

- Payroll Records: Maintaining accurate payroll records is crucial for employers. These records include employee hours worked, wages paid, and any deductions taken.

- State Tax Registration: Employers must register with the state tax authority to withhold state income taxes from employee wages. This registration ensures compliance with state tax laws.

- Benefits Enrollment Forms: These forms are used to enroll employees in benefit programs, such as health insurance or retirement plans. It is important for employers to keep these records updated.

- Workplace Safety Records: Employers are required to maintain records related to workplace safety and compliance with OSHA regulations. This documentation helps ensure a safe work environment for all employees.

By understanding these documents and their purposes, employers can better navigate the requirements associated with the Jobs Utah Gov form. Ensuring that all necessary paperwork is completed accurately and submitted on time is essential for compliance and the smooth operation of your business.

File Specifications

| Fact Name | Details |

|---|---|

| Form Title | Utah Employer Quarterly Wage List Continuation Sheet (DWS-UI C Form 33HA REV 0813) |

| Governing Law | Utah Code Title 35A, Chapter 4 (Unemployment Insurance Act) |

| Submitting Agency | Utah Department of Workforce Services |

| Contact Information | 140 E. 300 S., PO Box 45233, Salt Lake City, UT 84145-0233 |

| Phone Numbers | 1-801-526-9235 option 5; 1-800-222-2857 option 5 |

| Preferred Filing Method | Online submission via the Utah Department of Workforce Services website |

| Required Information | Employer name, address, registration number, year/quarter, quarter end date, due date |

| Employee Information | Employee name (first, middle initial, last) and total wages paid for the quarter |

| Filing Frequency | Quarterly, as specified by the due dates set by the state |

| Deadline for Submission | Due dates vary by quarter; timely submission is crucial to avoid penalties |