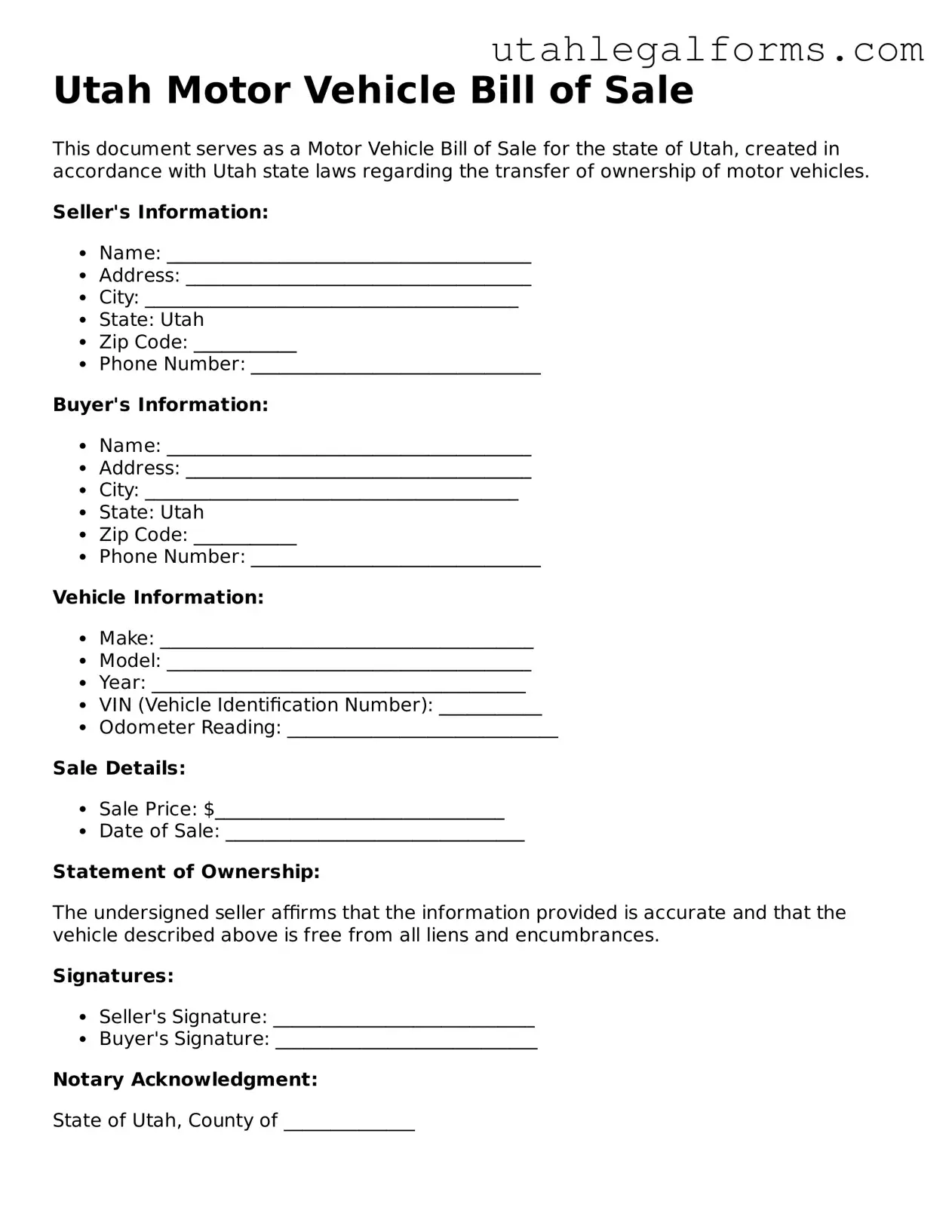

Official Motor Vehicle Bill of Sale Form for Utah State

Dos and Don'ts

When filling out the Utah Motor Vehicle Bill of Sale form, it's essential to follow specific guidelines to ensure accuracy and compliance. Here are some important dos and don'ts to keep in mind:

- Do provide accurate vehicle information, including the make, model, year, and VIN.

- Do include the full names and addresses of both the buyer and seller.

- Do clearly state the sale price of the vehicle.

- Do sign and date the form to validate the transaction.

- Do keep a copy of the completed Bill of Sale for your records.

- Don't leave any fields blank; incomplete forms can lead to issues.

- Don't use nicknames or abbreviations for names; use full legal names instead.

- Don't alter the document after it has been signed.

- Don't forget to check for typos or errors before submitting the form.

Consider Some Other Templates for Utah

Utah Living Will - This document can be updated to reflect changes in your healthcare preferences over time.

For anyone looking to understand the legal requirements in Ohio, this essential guide to the Horse Bill of Sale is invaluable. It provides clarity on the responsibilities involved in buying and selling a horse, ensuring both parties are informed during the transaction. For additional resources and templates, visit this essential guide on Horse Bill of Sale.

Is Utah a 50 50 Divorce State - Spouses can specify how health insurance will be handled post-separation.

Transfer on Death Deed Utah - This deed enables the owner to maintain full control of the property during their lifetime.

Listed Questions and Answers

-

What is a Utah Motor Vehicle Bill of Sale?

A Utah Motor Vehicle Bill of Sale is a legal document used to record the sale of a motor vehicle. It serves as proof of the transaction between the seller and the buyer. This document includes important details such as the vehicle's identification number (VIN), make, model, year, and the sale price.

-

Why is a Bill of Sale important?

The Bill of Sale is crucial for several reasons. First, it protects both the buyer and seller by providing a record of the transaction. Second, it helps establish ownership, which is essential for registering the vehicle with the state. Lastly, it can be useful in case of disputes regarding the sale or vehicle condition.

-

What information is required on the form?

The form should include the following information:

- The full names and addresses of both the buyer and the seller.

- The vehicle's make, model, year, and VIN.

- The sale price of the vehicle.

- The date of the sale.

- Any additional terms or conditions agreed upon by both parties.

-

Do I need to have the Bill of Sale notarized?

In Utah, notarization is not a requirement for the Bill of Sale. However, having it notarized can add an extra layer of protection and authenticity. It may also be beneficial if you plan to use the document in a legal context.

-

Can I create my own Bill of Sale?

Yes, you can create your own Bill of Sale as long as it includes all necessary information. However, using a standardized form can help ensure that you do not miss any important details. Various templates are available online that comply with Utah's requirements.

-

What should I do after completing the Bill of Sale?

Once the Bill of Sale is completed and signed by both parties, each should keep a copy for their records. The seller should also provide the buyer with any necessary documents, such as the title, to facilitate the vehicle registration process.

-

Is there a fee associated with the Bill of Sale?

There is no fee for creating a Bill of Sale itself, but there may be fees associated with transferring the vehicle title or registering the vehicle with the state. These fees can vary based on the vehicle's value and other factors.

-

What if the vehicle has a lien?

If the vehicle has a lien, the seller must disclose this information to the buyer. The Bill of Sale should indicate whether the lien has been paid off or if it will be settled at the time of sale. It is important for the buyer to understand any outstanding obligations related to the vehicle before completing the transaction.

Key takeaways

When filling out and using the Utah Motor Vehicle Bill of Sale form, it is essential to keep several key points in mind to ensure a smooth transaction.

- Accurate Information: Provide accurate details for both the buyer and seller, including names, addresses, and contact information.

- Vehicle Details: Include comprehensive information about the vehicle, such as the make, model, year, VIN (Vehicle Identification Number), and odometer reading.

- Sale Price: Clearly state the agreed-upon sale price. This figure is important for tax purposes.

- Signatures: Both the buyer and seller must sign the document. This step confirms the agreement and is legally binding.

- Date of Sale: Record the date of the transaction. This date is crucial for ownership transfer and registration.

- Notarization: While notarization is not required in Utah, it can add an extra layer of protection for both parties.

- Keep Copies: Each party should retain a copy of the Bill of Sale for their records. This documentation can be useful for future reference.

- Transfer of Ownership: The Bill of Sale serves as proof of ownership transfer. It may be required when registering the vehicle in the new owner's name.

- State Requirements: Be aware of any specific state requirements related to vehicle sales, including emissions testing or lien releases.

Understanding these key takeaways can facilitate a more efficient and effective vehicle sale process in Utah.

Documents used along the form

The Utah Motor Vehicle Bill of Sale form is an essential document for transferring ownership of a vehicle in Utah. When completing this transaction, several other forms and documents may be necessary to ensure a smooth process. Below is a list of related documents that are often used in conjunction with the Bill of Sale.

- Utah Title Certificate: This document proves ownership of the vehicle. It must be signed over to the buyer at the time of sale to complete the transfer process.

- Application for Utah Title: If the vehicle is newly purchased or has not been titled in Utah before, this application must be filled out to obtain a new title in the buyer's name.

- Bill of Sale: Crucial for documenting the exchange of ownership, this form serves as a receipt for the buyer and seller. For more information, visit legalpdf.org.

- Vehicle Emissions Certificate: In certain areas of Utah, vehicles are required to pass an emissions test. This certificate confirms that the vehicle meets state emissions standards.

- Odometer Disclosure Statement: This form is required to record the vehicle's mileage at the time of sale. It helps prevent odometer fraud and is a legal requirement for most vehicle transactions.

- Bill of Sale for Trade-in Vehicles: If the buyer is trading in a vehicle as part of the transaction, a separate Bill of Sale for the trade-in may be necessary to document that transfer as well.

- Proof of Insurance: Before registering the vehicle, the buyer must provide proof of insurance. This document ensures that the vehicle is covered as required by state law.

Collecting these documents helps facilitate a clear and legal transfer of ownership. Each form plays a critical role in ensuring compliance with state regulations and protecting both the buyer and seller during the transaction.

Form Information

| Fact Name | Description |

|---|---|

| Purpose | The Utah Motor Vehicle Bill of Sale form serves as a legal document to record the sale of a vehicle between a buyer and a seller. |

| Governing Law | This form is governed by the Utah Code Title 41, Chapter 3, which outlines motor vehicle registration and title transfer laws. |

| Required Information | The form requires details such as the vehicle identification number (VIN), make, model, year, and the sale price. |

| Signatures | Both the buyer and the seller must sign the form to validate the transaction and acknowledge the transfer of ownership. |

| Notarization | While notarization is not mandatory, having the form notarized can provide additional legal protection for both parties. |

| Record Keeping | It is advisable for both parties to keep a copy of the completed Bill of Sale for their records, as it may be needed for future reference. |

| Use in Title Transfer | The completed Bill of Sale is often required when applying for a new title at the Utah Department of Motor Vehicles (DMV). |