Official Operating Agreement Form for Utah State

Dos and Don'ts

When filling out the Utah Operating Agreement form, it's essential to approach the task carefully. Here are five things you should and shouldn't do:

- Do read the instructions thoroughly before starting.

- Don't leave any sections blank unless specified.

- Do provide accurate and up-to-date information.

- Don't use jargon or complex language that may confuse readers.

- Do review your completed form for errors before submission.

Consider Some Other Templates for Utah

Utah Real Estate Contract - Addresses the implications of any existing leases or tenants.

In order to streamline the process of buying or selling a dirt bike in New York, it is essential to have the appropriate documentation ready. The New York Dirt Bike Bill of Sale allows both the buyer and seller to outline the details of the transaction clearly, ensuring that all essential information is captured. For further assistance in preparing this document, you can visit legalpdf.org for helpful resources and templates.

Notary Utah - It serves as proof that a person signed a document in the notary’s presence.

Listed Questions and Answers

-

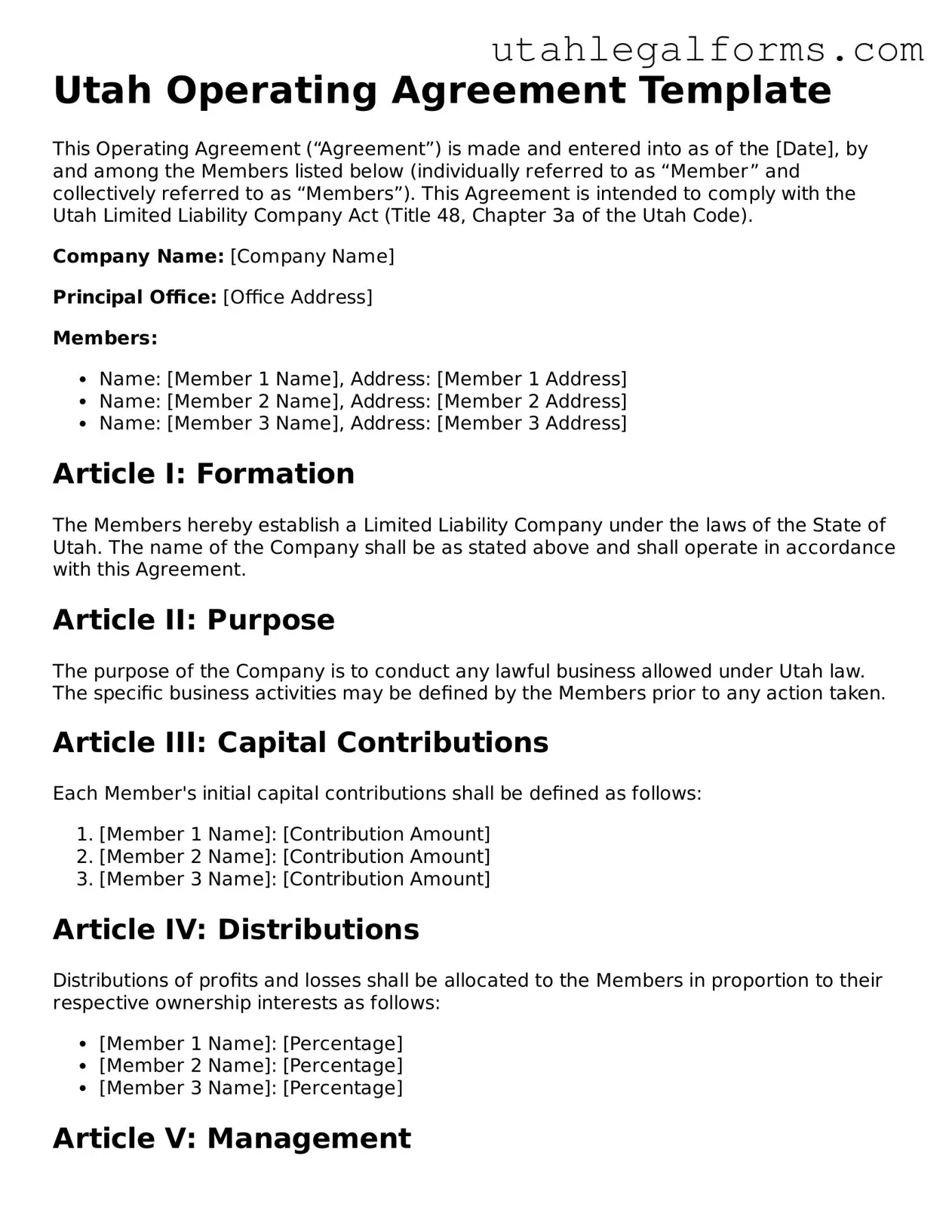

What is a Utah Operating Agreement?

A Utah Operating Agreement is a legal document that outlines the management structure and operating procedures of a limited liability company (LLC) in Utah. This agreement serves as a foundational framework for how the LLC will operate, detailing the rights and responsibilities of its members, as well as the rules governing the company’s internal affairs.

-

Is an Operating Agreement required in Utah?

While Utah law does not mandate that LLCs have an Operating Agreement, it is highly recommended. Having an Operating Agreement can help prevent misunderstandings among members and provides a clear structure for decision-making and conflict resolution.

-

What should be included in a Utah Operating Agreement?

An effective Operating Agreement typically includes:

- The name and address of the LLC

- The purpose of the LLC

- The names and contributions of the members

- Management structure (member-managed or manager-managed)

- Voting rights and procedures

- Distribution of profits and losses

- Procedures for adding or removing members

- Dispute resolution methods

- Amendment procedures for the agreement

-

How do I create a Utah Operating Agreement?

Creating a Utah Operating Agreement involves drafting the document to reflect the specific needs and preferences of the LLC members. You can use templates available online or consult with a legal professional to ensure that the agreement complies with state laws and adequately addresses all necessary elements.

-

Do I need to file the Operating Agreement with the state?

No, the Operating Agreement is an internal document and does not need to be filed with the state of Utah. However, it should be kept in a safe place and be readily accessible to all members, as it may be needed for reference in the future.

-

Can I amend the Operating Agreement?

Yes, the Operating Agreement can be amended. The process for making amendments should be outlined within the agreement itself. Typically, a majority or unanimous vote of the members is required to approve any changes.

-

What happens if there is no Operating Agreement?

If an LLC does not have an Operating Agreement, it will be governed by Utah's default LLC laws. This may not reflect the members' intentions and could lead to disputes or confusion regarding management and profit distribution.

-

Can a single-member LLC have an Operating Agreement?

Absolutely. A single-member LLC can and should have an Operating Agreement. This document helps clarify the separation between personal and business assets, which is crucial for maintaining limited liability protection.

-

What are the benefits of having an Operating Agreement?

Having an Operating Agreement provides numerous benefits, including:

- Clarifying management roles and responsibilities

- Establishing a clear process for decision-making

- Preventing disputes among members

- Providing a roadmap for handling changes in membership

- Enhancing the credibility of the LLC in the eyes of banks and investors

-

Where can I find a sample Operating Agreement for Utah?

Sample Operating Agreements for Utah can be found online through various legal resources, business websites, and templates. However, it is advisable to customize any template to suit your specific needs and to consult with a legal professional if you have any questions.

Key takeaways

When it comes to filling out and using the Utah Operating Agreement form, there are several important points to keep in mind. Here are five key takeaways:

- Understand the Purpose: The Operating Agreement serves as a foundational document for your business. It outlines the management structure, ownership, and operational procedures of your limited liability company (LLC).

- Customize Your Agreement: While there are standard templates available, it's essential to tailor the agreement to reflect your specific business needs and the unique relationships among members.

- Include Essential Details: Be sure to cover critical elements such as member contributions, profit distribution, and procedures for adding or removing members. This clarity helps prevent disputes later on.

- Review Regularly: As your business evolves, so should your Operating Agreement. Regular reviews ensure that it remains relevant and compliant with any changes in laws or business circumstances.

- Seek Professional Guidance: Consulting with a legal professional can provide valuable insights. They can help ensure that your Operating Agreement complies with Utah laws and effectively protects your interests.

Documents used along the form

When forming a limited liability company (LLC) in Utah, an Operating Agreement is a crucial document that outlines the management structure and operating procedures of the business. Along with this agreement, several other forms and documents are commonly used to ensure compliance and smooth operation of the LLC. Below is a list of related documents that you may find helpful.

- Articles of Organization: This is the foundational document that officially establishes your LLC with the state. It includes essential information such as the name of the LLC, the registered agent, and the business address.

- Operating Agreement: To ensure a thorough understanding of your LLC's governance, review the essential operating agreement resources available for your use.

- Employer Identification Number (EIN): An EIN is a unique number assigned by the IRS for tax purposes. It is required for opening a business bank account, hiring employees, and filing taxes.

- Membership Certificates: These certificates serve as proof of ownership for each member of the LLC. They outline the percentage of ownership and can be useful for establishing member rights and responsibilities.

- Bylaws: While not required for LLCs, bylaws can provide additional structure and governance. They detail the internal rules and procedures for the management of the LLC and can help prevent disputes among members.

- Business Licenses and Permits: Depending on the nature of your business, you may need specific licenses and permits to operate legally. These can vary by industry and location, so it's essential to check local regulations.

- Annual Report: In Utah, LLCs must file an annual report to maintain good standing with the state. This report typically includes updated information about the LLC's members and any changes in the business structure.

Understanding these documents and their importance can greatly assist in the successful formation and management of your LLC in Utah. Taking the time to ensure that all necessary forms are completed and filed correctly will provide peace of mind as you move forward with your business endeavors.

Form Information

| Fact Name | Description |

|---|---|

| Purpose | The Utah Operating Agreement outlines the management structure and operational procedures of a limited liability company (LLC) in Utah. |

| Governing Law | This agreement is governed by the Utah Limited Liability Company Act, specifically Title 48, Chapter 3 of the Utah Code. |

| Flexibility | LLCs in Utah have the flexibility to customize their operating agreements to suit their specific business needs and member preferences. |

| Member Rights | The agreement defines the rights and responsibilities of each member, including profit sharing, decision-making processes, and procedures for adding or removing members. |