Official Promissory Note Form for Utah State

Dos and Don'ts

When filling out the Utah Promissory Note form, it is important to follow certain guidelines to ensure accuracy and compliance. Below are ten recommendations, divided into things you should do and things you should avoid.

Things You Should Do:

- Read the entire form carefully before starting to fill it out.

- Provide accurate and complete information for all required fields.

- Clearly state the loan amount in both numbers and words.

- Include the interest rate, if applicable, and specify whether it is fixed or variable.

- Sign and date the form in the designated areas.

Things You Shouldn't Do:

- Do not leave any required fields blank.

- Avoid using unclear or ambiguous language.

- Do not alter the form's structure or add additional terms without consulting a professional.

- Refrain from signing the document without fully understanding its terms.

- Do not forget to keep a copy for your records after submission.

By adhering to these guidelines, you can help ensure that your Promissory Note is completed correctly and is legally binding.

Consider Some Other Templates for Utah

Is Utah a 50 50 Divorce State - It can clarify each spouse’s responsibilities for household expenses.

To facilitate a smooth transaction, it is important to utilize the Arizona Motorcycle Bill of Sale form, which you can find at arizonapdfforms.com/motorcycle-bill-of-sale, ensuring that all necessary details are documented and both parties are protected under Arizona law.

Notary Utah - A notary public can provide additional information about the notarization process.

Listed Questions and Answers

-

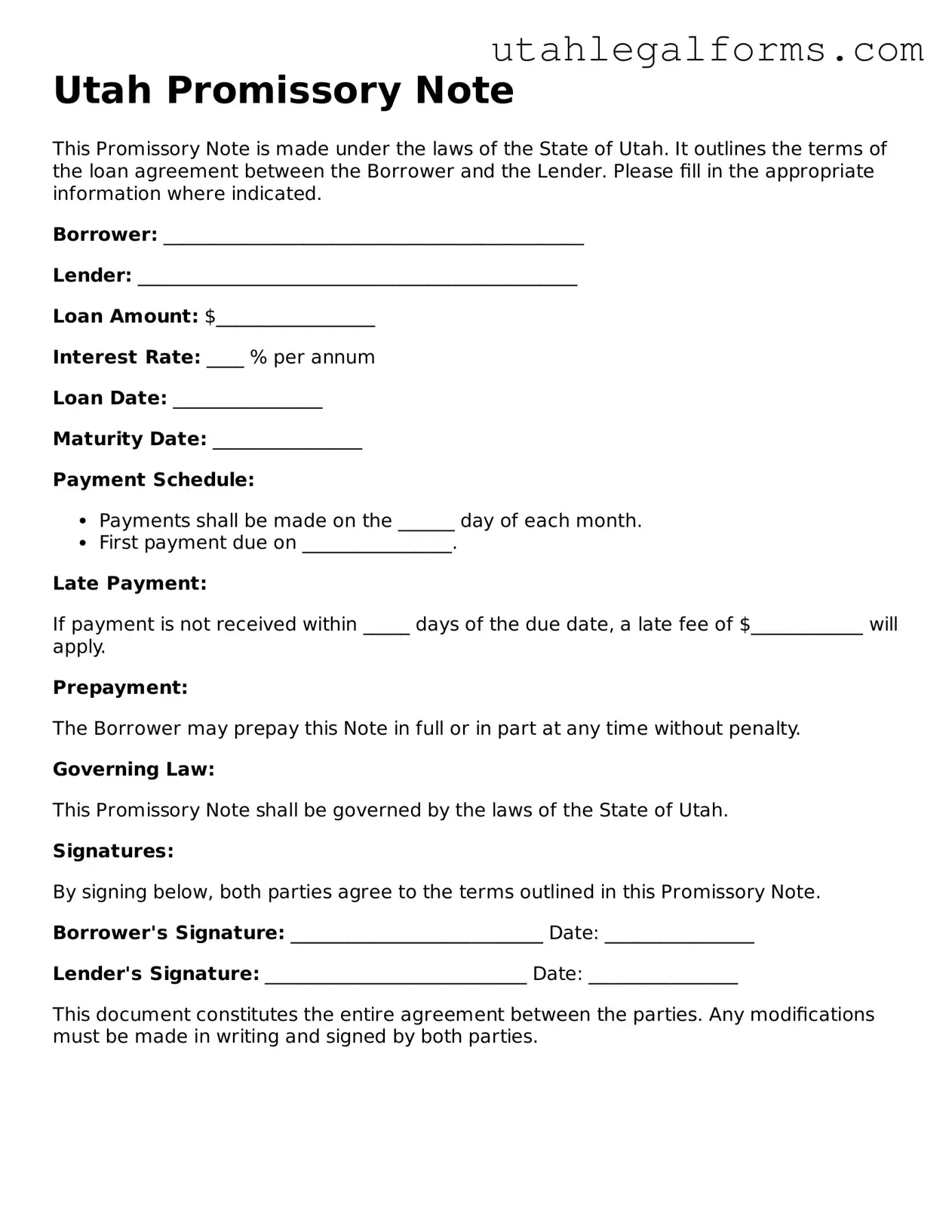

What is a Utah Promissory Note?

A Utah Promissory Note is a legal document that outlines a borrower's promise to repay a loan to a lender under specific terms. It typically includes details such as the loan amount, interest rate, repayment schedule, and any penalties for late payments. This document serves as evidence of the debt and protects the rights of both parties involved.

-

Who can use a Promissory Note in Utah?

Any individual or business can use a Promissory Note in Utah. Whether you are lending money to a friend, family member, or a business, this document is useful for formalizing the loan agreement. It is important for both lenders and borrowers to understand their rights and obligations as specified in the note.

-

What are the essential components of a Utah Promissory Note?

A comprehensive Promissory Note should include:

- The names and addresses of the borrower and lender

- The principal amount of the loan

- The interest rate, if applicable

- The repayment schedule, including due dates

- Any late fees or penalties for missed payments

- Details about collateral, if the loan is secured

- Signatures of both parties

Including these components ensures clarity and reduces the risk of misunderstandings.

-

Is a Promissory Note legally binding in Utah?

Yes, a Promissory Note is legally binding in Utah as long as it meets the necessary legal requirements. Both parties must agree to the terms, and the document should be signed by both the borrower and the lender. If the terms are not fulfilled, the lender can take legal action to recover the owed amount.

-

Can a Promissory Note be modified after it has been signed?

Yes, a Promissory Note can be modified, but both parties must agree to the changes. It is advisable to document any modifications in writing and have both parties sign the revised note. This helps maintain clarity and prevents future disputes regarding the terms of the loan.

-

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, meaning they fail to make the required payments, the lender has several options. They may pursue legal action to recover the owed amount, which could include filing a lawsuit. If the loan is secured by collateral, the lender may also have the right to seize the collateral to satisfy the debt.

-

Do I need a lawyer to create a Promissory Note in Utah?

While it is not legally required to have a lawyer draft a Promissory Note, it is often advisable. Legal professionals can ensure that the document complies with state laws and adequately protects your interests. For simple loans, however, many individuals choose to use templates or online resources to create their own notes.

-

Where can I find a Utah Promissory Note template?

Utah Promissory Note templates are widely available online. Many legal websites offer free or paid templates that can be customized to fit your specific needs. It is important to choose a template that complies with Utah laws and includes all necessary components to ensure its effectiveness.

Key takeaways

Filling out and using the Utah Promissory Note form is an important task that requires attention to detail. Here are some key takeaways to keep in mind:

- Ensure all parties involved are clearly identified, including names and addresses.

- Specify the loan amount in both numerical and written form to avoid confusion.

- Include a detailed repayment schedule, outlining due dates and payment amounts.

- Clearly state the interest rate, if applicable, to avoid misunderstandings later.

- Consider adding terms for late payments or default to protect your interests.

- Both parties should sign and date the document to make it legally binding.

Taking these steps will help ensure that the promissory note serves its purpose effectively. It is essential to keep a copy for your records after it is signed.

Documents used along the form

When dealing with financial transactions, especially loans, several documents complement the Utah Promissory Note. Each of these forms plays a crucial role in ensuring clarity and legal protection for both the lender and borrower. Below is a list of commonly used documents that often accompany a Promissory Note.

- Loan Agreement: This detailed document outlines the terms of the loan, including the amount, interest rate, repayment schedule, and any collateral involved. It serves as a comprehensive guide for both parties.

- Security Agreement: If the loan is secured by collateral, this document specifies the assets being used to secure the loan. It details the rights of the lender in case of default.

- Personal Guarantee: This form is signed by an individual who agrees to take personal responsibility for the loan if the borrower defaults. It adds an extra layer of security for the lender.

- Hold Harmless Agreement: To adequately protect against potential liabilities, refer to the detailed Hold Harmless Agreement insights that outline responsibilities and key elements of this essential document.

- Disclosure Statement: This document provides important information about the loan, including fees, terms, and potential risks. It ensures that borrowers are fully informed before signing.

- Amortization Schedule: This schedule breaks down each payment over the life of the loan, showing how much goes toward interest and principal. It helps borrowers understand their repayment obligations.

- Release of Liability: Once the loan is fully paid, this document formally releases the borrower from any further obligations. It provides peace of mind that the debt is settled.

These documents work together with the Utah Promissory Note to create a clear and enforceable agreement. Understanding each form can help both lenders and borrowers navigate their financial commitments with confidence.

Form Information

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person at a specific time. |

| Governing Law | The Utah Promissory Note is governed by the Utah Uniform Commercial Code (UCC), specifically Title 70A of the Utah Code. |

| Parties Involved | Typically, there are two parties: the borrower (maker) who promises to pay and the lender (payee) who will receive the payment. |

| Interest Rate | The note can specify an interest rate, which is the cost of borrowing money, and must comply with Utah's usury laws. |

| Payment Terms | Payment terms outline when and how payments should be made, including due dates and acceptable payment methods. |

| Default Clause | A default clause details what happens if the borrower fails to make payments as agreed, including potential penalties. |

| Signatures | Both parties must sign the note for it to be legally binding. Signatures indicate agreement to the terms outlined in the document. |

| Notarization | While notarization is not required in Utah, having the document notarized can add an extra layer of authenticity and protection. |

| Record Keeping | It’s important for both parties to keep a copy of the signed promissory note for their records and future reference. |