Fill a Valid Seller Utah Template

Dos and Don'ts

When filling out the Seller Utah form, it's essential to approach the process with care and attention to detail. Here’s a list of what to do and what to avoid:

- Do: Read the entire form thoroughly before filling it out. Understanding every section will help prevent mistakes.

- Do: Provide accurate and complete information, especially regarding financial details and obligations. Inaccuracies can lead to complications later.

- Do: Ensure all parties involved sign the form where indicated. Signatures are crucial for the validity of the agreement.

- Do: Keep a copy of the completed form for your records. This can be invaluable for future reference.

- Do: Double-check the deadlines for acceptance and disclosures to avoid missing critical dates.

- Don't: Rush through the form. Taking your time can help you avoid errors that might cause issues down the line.

- Don't: Leave any sections blank unless instructed. Incomplete forms can lead to delays or rejection.

- Don't: Ignore the importance of the due-on-sale clause. Understanding its implications is vital for both parties.

- Don't: Forget to provide the necessary financial documentation, as this can affect the approval process.

- Don't: Assume that verbal agreements will suffice. Everything must be documented in the form to ensure enforceability.

More PDF Forms

Utah Licensing Division - Annual notice of exemption submissions are processed by the Utah Division of Consumer Protection.

Tc 738 Utah - The form includes a section for detailing the basis of the appeal and the relief desired.

Obtaining a New York Boat Bill of Sale is essential for ensuring a smooth transaction when buying or selling a boat in New York. This form not only safeguards both parties by documenting the sale but also provides the necessary details required by the state. To help facilitate this process, you can find the appropriate resources at legalpdf.org, where you can access templates and helpful guidelines.

Utah Dmv Forms - Be proactive in contacting the MVED with any questions or concerns during the application process.

Listed Questions and Answers

-

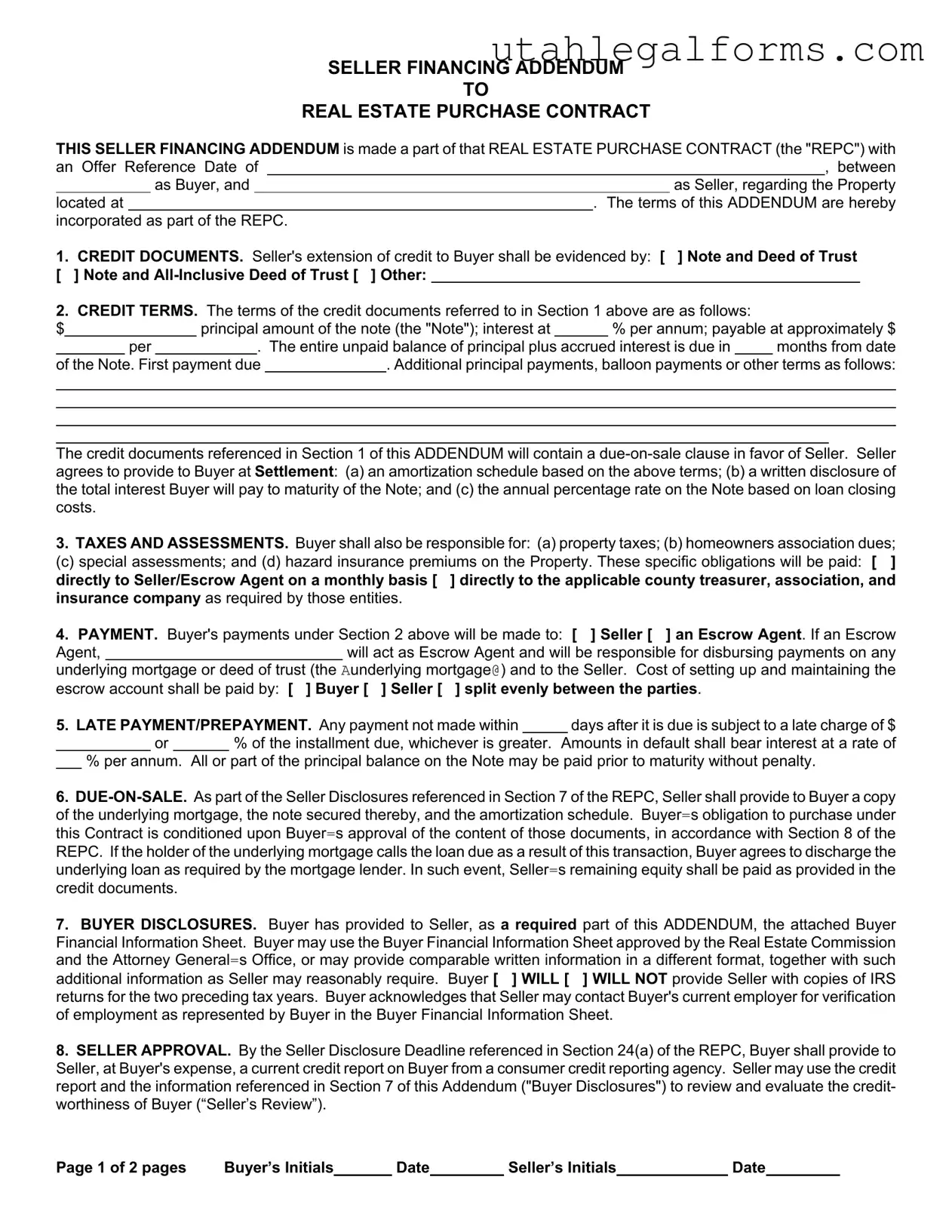

What is the Seller Utah form?

The Seller Utah form, officially known as the Seller Financing Addendum to Real Estate Purchase Contract, is a legal document that outlines the terms of seller financing in a real estate transaction. It becomes part of the main Real Estate Purchase Contract (REPC) and includes important details such as credit terms, payment schedules, and responsibilities of both the buyer and seller.

-

What are the key components included in this form?

This form covers several essential aspects:

- Credit Documents: Specifies whether the financing will be through a note and deed of trust or other means.

- Credit Terms: Details the principal amount, interest rate, payment schedule, and any balloon payments.

- Taxes and Assessments: Outlines the buyer's responsibilities for property taxes, HOA dues, and insurance premiums.

- Payment Structure: Clarifies where payments will be made and who will manage the escrow account.

- Late Payment and Prepayment Terms: Indicates penalties for late payments and conditions for prepayment without penalty.

-

How does the due-on-sale clause work?

The due-on-sale clause allows the seller to require the buyer to pay off the underlying mortgage if the property is sold. This clause is included in the credit documents and provides protection for the seller. If the lender calls the loan due, the buyer must comply and pay off the existing mortgage, ensuring the seller's equity is preserved.

-

What is the importance of the Buyer Financial Information Sheet?

The Buyer Financial Information Sheet is crucial for the seller's review process. It provides the seller with insight into the buyer's financial status and creditworthiness. The buyer is required to submit this sheet, which may include information such as income verification and tax returns. This helps the seller make informed decisions regarding financing and the overall transaction.

-

What happens if the seller finds the buyer's credit report unacceptable?

If the seller determines that the buyer's credit report is unsatisfactory, they have the option to cancel the REPC or address any objections in writing. This must be done by the due diligence deadline specified in the contract. If the seller does not act by this deadline, they are considered to have waived their right to object based on the credit review.

Key takeaways

Here are some key takeaways about filling out and using the Seller Utah form:

- Seller Financing Addendum: This form is an addendum to the Real Estate Purchase Contract (REPC) that outlines the terms of seller financing.

- Credit Documents: Sellers must specify the type of credit documents being used, such as a Note and Deed of Trust or other options.

- Credit Terms: Important details like the principal amount, interest rate, and payment schedule must be clearly outlined in this section.

- Tax Responsibilities: Buyers are responsible for property taxes, homeowners association dues, and hazard insurance premiums.

- Payment Instructions: Buyers should indicate whether payments will be made directly to the Seller or through an Escrow Agent.

- Late Payment Penalties: The form specifies penalties for late payments, which can include a late charge or interest on the overdue amount.

- Due-on-Sale Clause: This clause allows the seller to call the loan due if the property is sold, which protects the seller’s interests.

- Buyer Disclosures: Buyers must provide financial information and may need to submit IRS returns to the seller.

- Seller Review: Sellers have the right to review the buyer's credit report and can cancel the contract if the buyer's credit is deemed unacceptable.

- Disclosure of Tax IDs: Both parties must disclose their Social Security Numbers or tax IDs by the time of settlement for tax reporting purposes.

Documents used along the form

When engaging in real estate transactions in Utah, several forms and documents accompany the Seller Utah form. Each document plays a crucial role in ensuring clarity and compliance throughout the process. Below is a list of commonly used documents that complement the Seller Utah form.

- Real Estate Purchase Contract (REPC): This is the primary agreement between the buyer and seller detailing the terms of the sale, including purchase price, property description, and contingencies.

- Buyer Financial Information Sheet: This document provides the seller with essential financial details about the buyer, including income and credit history, to assess creditworthiness.

- Title Insurance Policy: A policy that protects the buyer and lender against potential losses due to defects in the title, ensuring that the property is free from liens or claims.

- Motorcycle Bill of Sale: Essential for recording the sale and transfer of ownership of a motorcycle in Arizona, this legal document ensures both the buyer and seller have a clear understanding of the terms of the sale, and is vital for registration and title transfer. More information can be found at https://arizonapdfforms.com/motorcycle-bill-of-sale/.

- Amortization Schedule: This schedule outlines the payment plan for the loan, showing how much of each payment goes toward principal and interest over time.

- Credit Report: A detailed report of the buyer's credit history, which helps the seller evaluate the buyer's financial stability and ability to fulfill the loan obligations.

- Disclosure of Tax Identification Numbers: This document ensures both parties provide their Social Security Numbers or tax IDs for compliance with federal reporting requirements related to mortgage interest.

Understanding these documents enhances the transaction process, fostering transparency and trust between buyers and sellers. Each form has its specific purpose, contributing to a smoother real estate experience in Utah.

File Specifications

| Fact Name | Description |

|---|---|

| Form Title | This document is officially titled "Seller Financing Addendum to Real Estate Purchase Contract." |

| Governing Law | The form is governed by the laws of the State of Utah. |

| Credit Documents | Seller's extension of credit to the Buyer can be evidenced by various documents, including a Note and Deed of Trust. |

| Payment Terms | The Buyer must adhere to specific payment terms, including principal amount, interest rate, and payment schedule. |

| Taxes and Assessments | The Buyer is responsible for property taxes, homeowners association dues, special assessments, and hazard insurance premiums. |

| Late Payment | A late payment may incur a charge, which can be a fixed dollar amount or a percentage of the installment due. |

| Due-on-Sale Clause | This clause allows the Seller to call the loan due if the property is sold, protecting the Seller's interests. |

| Title Insurance | The Buyer may be required to provide a lender’s policy of title insurance, which must be paid at Settlement. |