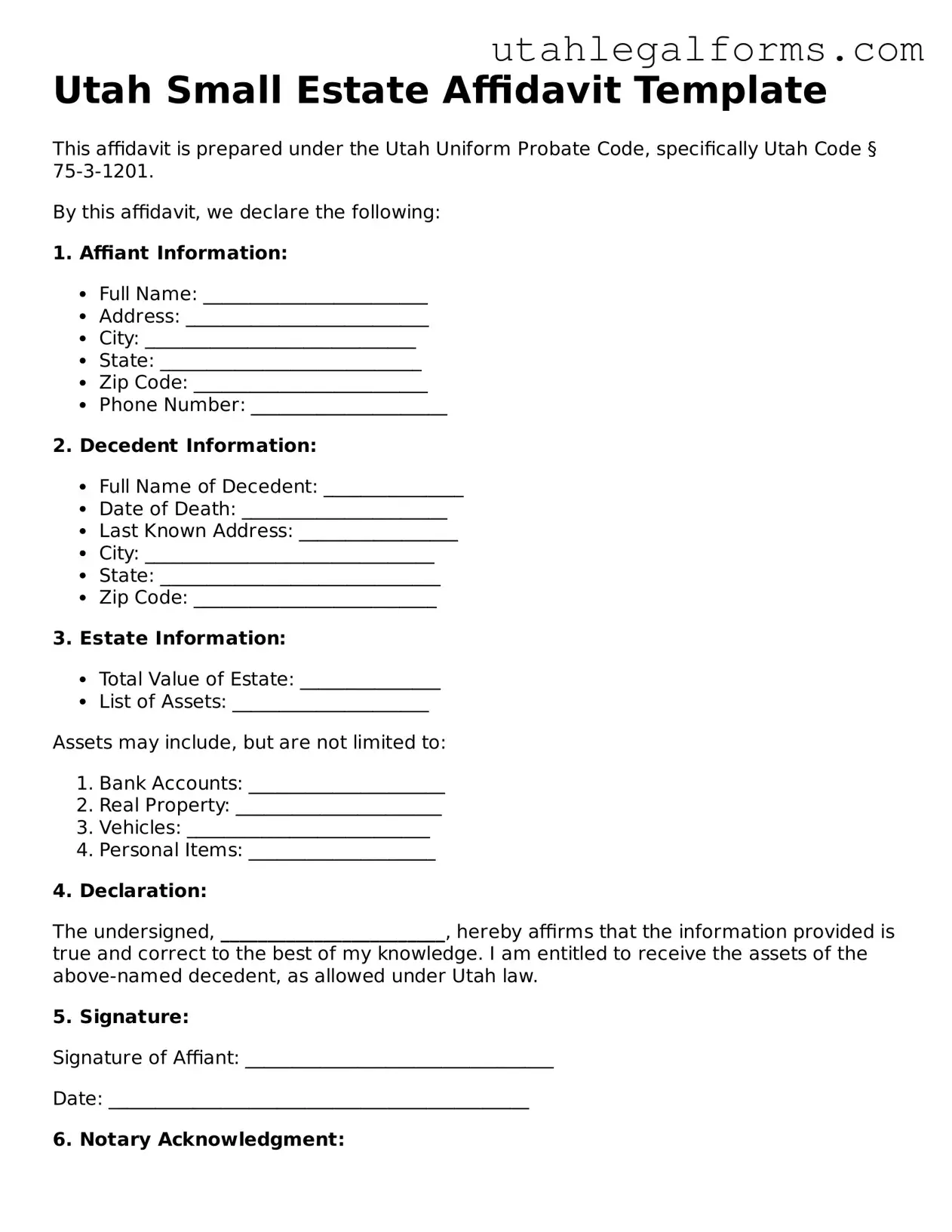

Official Small Estate Affidavit Form for Utah State

Dos and Don'ts

When filling out the Utah Small Estate Affidavit form, it's essential to be thorough and accurate. Here are some important dos and don’ts to keep in mind:

- Do ensure you meet the eligibility requirements for using the Small Estate Affidavit.

- Do gather all necessary documents, including the decedent's death certificate and any relevant financial statements.

- Do fill out the form completely and clearly, avoiding any ambiguous language.

- Do sign the affidavit in front of a notary public to ensure its validity.

- Do keep a copy of the completed affidavit for your records.

- Don't leave any sections of the form blank; provide all required information.

- Don't submit the affidavit without reviewing it for errors or omissions.

- Don't forget to check the specific requirements for your county, as they may vary.

- Don't assume that verbal agreements or informal arrangements will suffice; documentation is crucial.

Following these guidelines will help ensure that the process goes smoothly and efficiently. Be diligent and proactive in your approach.

Consider Some Other Templates for Utah

Utah Dmv Report Sold Vehicle - Can assist in future title transfers and registrations.

For those looking to navigate the complexities of event planning, understanding the essential components of a Hold Harmless Agreement is crucial. This important document outlines the responsibilities assumed by the involved parties, thereby minimizing the risk of future legal disputes. Learn more about how to effectively utilize this agreement by accessing the necessary Hold Harmless Agreement for your needs.

Utah Title Application - It can prevent cases of fraud or unauthorized sales of a vehicle when properly utilized.

Listed Questions and Answers

-

What is a Small Estate Affidavit in Utah?

A Small Estate Affidavit is a legal document that allows individuals to claim assets of a deceased person without going through the full probate process. In Utah, this is applicable when the total value of the estate is below a certain threshold, which makes it easier and faster to settle the estate.

-

What is the threshold for a small estate in Utah?

The threshold for a small estate in Utah is currently set at $100,000 for personal property. This means that if the total value of the deceased person's assets is $100,000 or less, you may be eligible to use the Small Estate Affidavit.

-

Who can use the Small Estate Affidavit?

Generally, any person who is entitled to inherit under Utah law can use the Small Estate Affidavit. This often includes family members like spouses, children, or other heirs. However, it's important to ensure that you meet the legal requirements to use this affidavit.

-

What assets can be claimed using the Small Estate Affidavit?

You can claim various types of assets, such as bank accounts, personal property, and vehicles. However, real estate cannot be transferred using this affidavit. If the estate includes real property, a different process must be followed.

-

How do I complete the Small Estate Affidavit?

To complete the Small Estate Affidavit, you will need to provide details about the deceased, the assets involved, and your relationship to the deceased. The form must be signed in front of a notary public. Make sure to double-check all information for accuracy before submitting.

-

Do I need to file the Small Estate Affidavit with the court?

No, you do not need to file the Small Estate Affidavit with the court. Instead, you will present it to the institutions or entities holding the deceased's assets, such as banks or vehicle departments, to claim the assets directly.

-

Is there a waiting period to use the Small Estate Affidavit?

There is no mandatory waiting period to use the Small Estate Affidavit in Utah. However, it is advisable to wait at least 30 days after the death of the individual before submitting the affidavit. This allows time for any debts or claims against the estate to be addressed.

-

What if there are debts owed by the deceased?

If the deceased had debts, the Small Estate Affidavit can still be used, but the debts must be settled before distributing the assets. It's important to ensure that all creditors are paid before you claim any assets to avoid personal liability.

-

Can I get help with the Small Estate Affidavit?

Yes, you can seek assistance from legal professionals or organizations that specialize in estate planning. They can guide you through the process and help ensure that all requirements are met for a smooth transfer of assets.

Key takeaways

When dealing with the Utah Small Estate Affidavit form, it’s essential to understand its purpose and requirements. Here are some key takeaways:

- The Small Estate Affidavit allows individuals to claim a deceased person's assets without going through the lengthy probate process.

- To qualify, the total value of the estate must not exceed $100,000, excluding certain types of property.

- All heirs must agree to the use of the affidavit, ensuring that everyone involved is on the same page.

- Filing the affidavit with the appropriate court is necessary to legally transfer the assets to the rightful heirs.

Documents used along the form

When dealing with the Utah Small Estate Affidavit, several other forms and documents may be needed to ensure a smooth process in settling an estate. These documents help clarify ownership, facilitate asset transfer, and provide necessary legal backing. Below is a list of commonly used forms and documents that often accompany the Small Estate Affidavit.

- Death Certificate: This official document verifies the death of the individual whose estate is being settled. It is typically required to initiate the probate process.

- Will: If the deceased left a will, it should be included as it outlines their wishes regarding asset distribution. Even in small estate cases, a will can provide clarity on the decedent's intentions.

- List of Assets: A detailed inventory of the decedent's assets is essential. This list helps in determining whether the estate qualifies as a small estate under Utah law.

- Boat Bill of Sale: A necessary document when transferring ownership of a boat in New York, this form, which can be found at legalpdf.org, ensures all transaction details are properly recorded.

- Affidavit of Heirship: This document can be used to establish who the legal heirs are if there is no will. It provides evidence of relationships and rights to inherit.

- Bank Forms: Many financial institutions require specific forms to transfer accounts or assets. These forms often need to be submitted along with the Small Estate Affidavit.

- Property Deeds: If real estate is part of the estate, the property deeds must be updated to reflect the new ownership after the estate is settled.

- Tax Forms: Depending on the estate's value, tax forms may be necessary to report any estate taxes owed or to claim exemptions.

- Notice to Creditors: This form is often filed to inform creditors of the estate's administration. It allows them to make claims against the estate within a specified time frame.

Having these documents ready can simplify the process of settling an estate in Utah. Each plays a vital role in ensuring that the deceased's wishes are honored and that the legal requirements are met efficiently.

Form Information

| Fact Name | Details |

|---|---|

| Purpose | The Utah Small Estate Affidavit allows heirs to claim assets of a deceased person without going through formal probate, simplifying the process for small estates. |

| Eligibility | The estate must not exceed $100,000 in value, excluding certain assets like real estate, to qualify for the use of this affidavit. |

| Governing Law | The use of the Small Estate Affidavit in Utah is governed by Utah Code § 75-3-1201 to § 75-3-1203. |

| Filing Requirements | The affidavit must be signed by all heirs and submitted to the appropriate financial institutions or entities holding the deceased's assets. |