Fill a Valid Tc 194 Utah Template

Dos and Don'ts

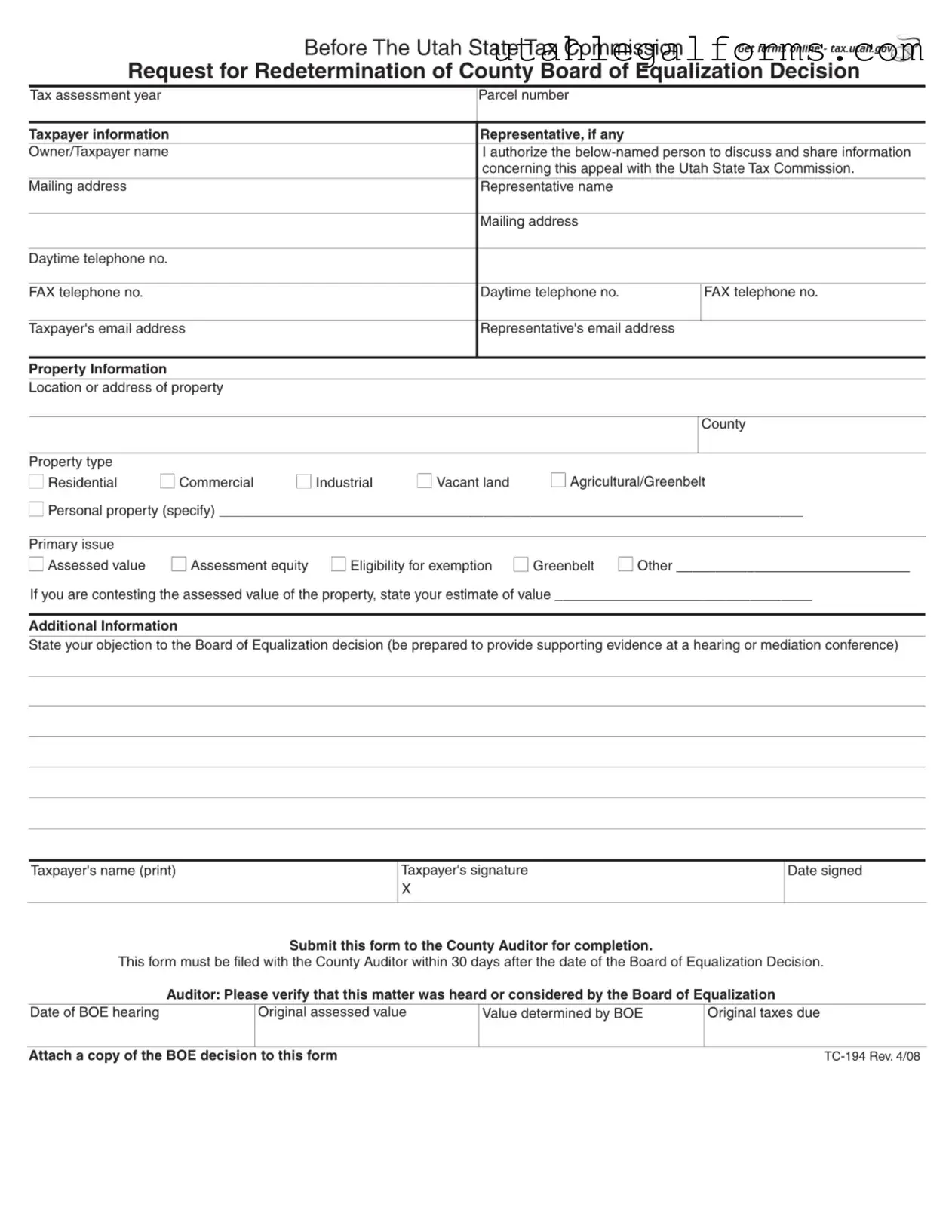

When filling out the TC 194 form for the Utah State Tax Commission, it is crucial to follow specific guidelines to ensure your submission is accurate and effective. Below is a list of things you should and shouldn't do.

- Do provide complete and accurate taxpayer information.

- Do clearly state your objection to the Board of Equalization decision.

- Do include your estimate of the property's value if contesting the assessed value.

- Do sign and date the form before submission.

- Do submit the form to the County Auditor within 30 days of the Board of Equalization decision.

- Don't leave any sections of the form blank; fill in all required fields.

- Don't forget to attach a copy of the Board of Equalization decision.

- Don't use vague language when stating your objections; be specific.

- Don't submit the form without reviewing it for errors or omissions.

- Don't ignore the requirement to provide supporting evidence at a hearing or mediation conference.

More PDF Forms

Dopl Ap 059 - The Dopl Ap 059 plays a role in project management and oversight environments.

When engaging in a boat sale in California, having a properly completed California Boat Bill of Sale form is essential to ensure a smooth transaction. This document not only legitimatizes the exchange but also may be required for the subsequent registration and titling of the boat. For additional resources and guidance on how to create this important document, you can visit legalpdf.org.

Utah 15C - Questions regarding modifications to equipment since a specific date should be answered honestly.

Listed Questions and Answers

-

What is the TC-194 form?

The TC-194 form is a request for redetermination of a decision made by the County Board of Equalization regarding property tax assessments in Utah. It allows taxpayers to formally contest the assessed value of their property or other related issues.

-

Who should use the TC-194 form?

This form is intended for property owners or taxpayers who disagree with the assessment made by the County Board of Equalization. If you believe your property has been overvalued or that there are errors in your assessment, this form is for you.

-

What information is required on the TC-194 form?

The form requires several key pieces of information, including:

- Your name and contact details.

- The property’s location and parcel number.

- Your representative’s information, if applicable.

- The specific issue you are contesting, such as assessed value or eligibility for exemption.

- Your estimate of the property's value, if contesting the assessed value.

- A statement of your objection to the Board of Equalization’s decision.

-

How long do I have to file the TC-194 form?

You must submit the TC-194 form to the County Auditor within 30 days of the date of the Board of Equalization’s decision. Timeliness is crucial, as late submissions may not be considered.

-

What happens after I submit the TC-194 form?

Once submitted, the County Auditor will verify that your matter was heard by the Board of Equalization. They will then process your request for redetermination. Be prepared to provide supporting evidence during a hearing or mediation conference if required.

-

Do I need to provide supporting evidence?

Yes, you should be ready to present supporting evidence for your claims at a hearing or mediation. This evidence can include appraisals, comparable property assessments, or any relevant documentation that supports your case.

-

Can I have a representative file the TC-194 form on my behalf?

Yes, you can authorize a representative to file the form for you. You must provide their name and contact information on the form, allowing them to discuss and share information regarding your appeal with the Utah State Tax Commission.

Key takeaways

Here are some key takeaways regarding the TC 194 form for Utah:

- The TC 194 form is used to request a redetermination of a County Board of Equalization decision.

- It is essential to complete the form accurately, providing all required information such as taxpayer details and property information.

- Make sure to include the parcel number and the property’s location or address to avoid processing delays.

- If you have a representative, their information must be clearly stated on the form, along with your authorization for them to discuss your case.

- Identify the primary issue you are contesting, such as assessed value or eligibility for exemption.

- State your estimate of the property’s value if you are contesting the assessed value.

- Be prepared to provide supporting evidence for your objections during a hearing or mediation conference.

- The completed form must be submitted to the County Auditor within 30 days following the Board of Equalization decision.

By following these guidelines, you can ensure that your request is handled efficiently and effectively.

Documents used along the form

The TC-194 form is a crucial document for taxpayers in Utah who wish to contest a decision made by the County Board of Equalization regarding property assessments. When navigating this process, several other forms and documents may be necessary to support the appeal. Below is a list of commonly used forms that can accompany the TC-194.

- TC-200: Property Tax Exemption Application - This form is used to apply for property tax exemptions, such as those for charitable organizations or non-profit entities. It outlines the eligibility requirements and necessary documentation for exemption consideration.

- TC-721: Property Tax Abatement Application - This application allows property owners to request a temporary reduction in property taxes due to financial hardship or significant property damage. Detailed financial information must be provided.

- TC-703: Notice of Property Tax Assessment - This document is sent to property owners to inform them of their property’s assessed value. It serves as a basis for the appeal process and should be reviewed carefully for accuracy.

- BOE Decision Letter - After a hearing, the Board of Equalization issues a decision letter outlining their ruling on the property assessment. This letter is essential for the TC-194 form as it must be attached to the appeal.

- Supporting Evidence Documentation - This may include recent appraisals, photographs, or comparables that support the taxpayer's claim regarding the assessed value or other contested issues. Proper documentation strengthens the appeal.

- Taxpayer Authorization Form - If a representative is handling the appeal on behalf of the taxpayer, this form grants them permission to discuss the case with the Utah State Tax Commission. It ensures compliance with privacy regulations.

- TC-60: Request for Taxpayer Information - This form allows taxpayers to request specific information from the county regarding their property assessment and tax status. It can provide valuable insights during the appeal process.

- Durable Power of Attorney Form: For individuals in need of appointing a trusted agent, the comprehensive Durable Power of Attorney resource outlines essential details for effective decision-making during times of incapacity.

- Tax Payment History - A record of past tax payments can be useful in demonstrating the taxpayer's compliance history and may support arguments for reduced assessments or exemptions.

Utilizing these forms and documents effectively can enhance the chances of a successful appeal. Each plays a role in providing necessary information and supporting evidence for the TC-194 process, ensuring that taxpayers can present their case clearly and comprehensively.

File Specifications

| Fact Name | Details |

|---|---|

| Purpose | The TC 194 form is used to request a redetermination of a decision made by the County Board of Equalization regarding property tax assessments in Utah. |

| Filing Deadline | This form must be submitted to the County Auditor within 30 days after the Board of Equalization's decision date. |

| Required Information | Taxpayer information, property details, and the primary issue for contesting the assessment must be provided on the form. |

| Governing Law | The TC 194 form is governed by Utah Code Title 59, Chapter 2, which outlines property tax assessment and appeal procedures. |