Fill a Valid Tc 738 Utah Template

Dos and Don'ts

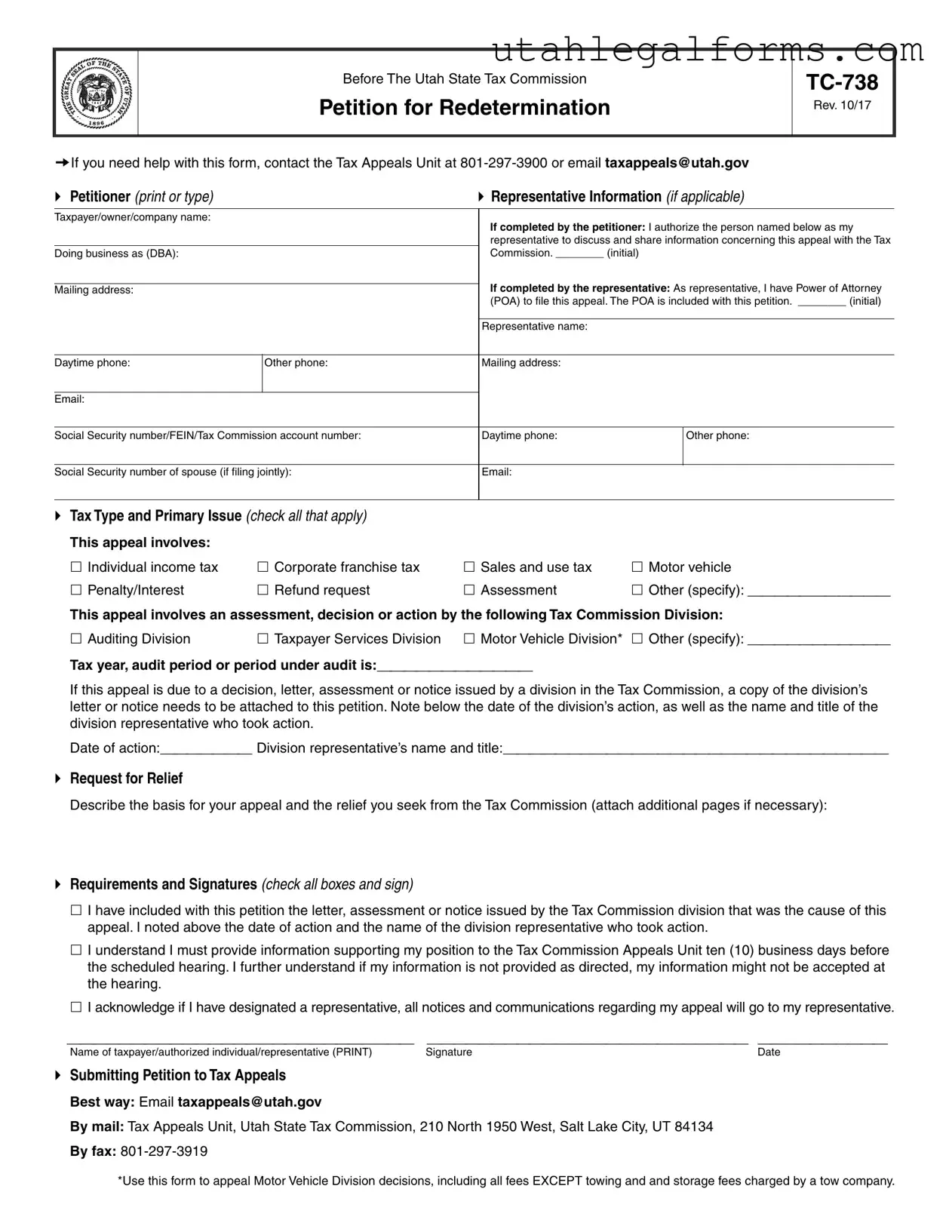

When filling out the TC-738 Utah form, keep the following in mind:

- Ensure all information is printed clearly or typed to avoid any misunderstandings.

- Attach any required documents, such as letters or notices from the Tax Commission.

- Double-check that you have signed the form and included your contact information.

- Provide supporting information to the Tax Commission Appeals Unit at least ten business days before the hearing.

- Keep copies of everything you submit for your records.

Avoid these common mistakes:

- Do not leave any required fields blank; incomplete forms may be rejected.

- Do not forget to include the date of action and the name of the division representative.

- Avoid submitting the form without reviewing it for accuracy and completeness.

- Do not assume your representative will handle all communication; confirm their role.

- Do not submit the form without attaching the necessary supporting documents.

More PDF Forms

Dopl Price - This form acts as a guide for necessary disclosures.

For those navigating legal matters, understanding the importance of a well-prepared Durable Power of Attorney document is fundamental. You can find a useful resource for this in the comprehensive Durable Power of Attorney template, which ensures that your decisions are honored and your affairs are managed in alignment with your wishes.

How to Transfer a Car Title to a Family Member in Utah - Make sure your claim addresses all required sections to avoid delays.

Dopl Price - Future engagements may rely on details provided in the Dopl Ap 116.

Listed Questions and Answers

-

What is the purpose of the TC-738 form?

The TC-738 form is used to petition the Utah State Tax Commission for a redetermination of a tax decision, assessment, or action. Taxpayers may use this form to appeal issues related to various tax types, including individual income tax, corporate franchise tax, sales and use tax, and motor vehicle taxes. It allows individuals or businesses to formally request a review of the Tax Commission's decisions and seek relief.

-

Who can file the TC-738 form?

The form can be filed by the taxpayer or their authorized representative. If a representative is filing the form, they must have Power of Attorney (POA) to act on behalf of the taxpayer. The form requires the taxpayer to provide their name, contact information, and details about the tax issue being appealed. If applicable, the representative's information must also be included.

-

What information is required to complete the TC-738 form?

To complete the TC-738 form, the petitioner must provide several key details. This includes the taxpayer's name, mailing address, and the tax type being appealed. Additionally, the form requires a description of the basis for the appeal and the relief being sought. It is important to attach any relevant documents, such as letters or notices from the Tax Commission, that support the appeal. The form also includes a section for signatures and acknowledgment of requirements.

-

How should the TC-738 form be submitted?

The TC-738 form can be submitted in several ways. The preferred method is via email to taxappeals@utah.gov. Alternatively, it can be mailed to the Tax Appeals Unit at the Utah State Tax Commission, or sent by fax to 801-297-3919. It is essential to ensure that all required documentation is included with the submission to avoid delays in processing the appeal.

Key takeaways

Filling out the TC-738 form for the Utah State Tax Commission can seem daunting, but understanding the key elements can simplify the process. Here are nine essential takeaways to help you navigate this form effectively:

- Contact Information: If you need assistance, reach out to the Tax Appeals Unit at 801-297-3900 or via email at taxappeals@utah.gov.

- Petitioner Details: Clearly print or type your name, mailing address, and any representative information if applicable.

- Power of Attorney: If someone is representing you, ensure they have a Power of Attorney (POA) included with your petition.

- Tax Type Selection: Check all applicable tax types and issues related to your appeal, such as individual income tax or corporate franchise tax.

- Attach Supporting Documents: Include any relevant letters, assessments, or notices from the Tax Commission that prompted your appeal.

- Details of Action: Document the date of the Tax Commission’s action and the name and title of the representative involved.

- Request for Relief: Clearly describe the basis for your appeal and the specific relief you are seeking from the Tax Commission.

- Timely Submission: Remember to provide supporting information to the Appeals Unit at least ten business days before your scheduled hearing.

- Submission Methods: You can submit your petition via email, mail, or fax. Choose the method that works best for you.

By keeping these points in mind, you can approach the TC-738 form with confidence. Taking the time to ensure accuracy and completeness will help facilitate a smoother appeals process.

Documents used along the form

The TC-738 form is essential for petitioning the Utah State Tax Commission for a redetermination. When filing this form, you may need to include additional documents to support your case. Here are some commonly used forms and documents that often accompany the TC-738.

- Power of Attorney (POA): This document allows a designated representative to act on behalf of the taxpayer. It must be included if the appeal is being filed by someone other than the taxpayer themselves.

- Tax Commission Division Letter or Notice: A copy of the letter or notice from the Tax Commission that initiated the appeal is required. This document provides context and details about the specific action being contested.

- California Boat Bill of Sale: Essential for legitimizing the transaction between buyer and seller in boat purchases; see more at legalpdf.org.

- Supporting Documentation: Any additional information or evidence that supports the taxpayer's position should be attached. This could include financial records, tax returns, or any other relevant documents that clarify the appeal.

- Request for Hearing: If the taxpayer wishes to have a hearing regarding their appeal, this document formally requests that a hearing be scheduled. It outlines the reasons for the hearing and any specific issues to be addressed.

Including these documents can strengthen your appeal and ensure that the Tax Commission has all the necessary information to make a fair decision. Always review your submission for completeness before sending it to the Tax Appeals Unit.

File Specifications

| Fact Name | Details |

|---|---|

| Form Purpose | The TC-738 form is used to petition for a redetermination of tax assessments or decisions made by the Utah State Tax Commission. |

| Governing Law | This form is governed by Utah Code Title 59, which covers tax administration and procedures. |

| Filing Methods | You can submit the TC-738 form via email, mail, or fax, providing flexibility in how you choose to file your appeal. |

| Contact Information | If you need assistance, you can contact the Tax Appeals Unit at 801-297-3900 or email taxappeals@utah.gov. |

| Representative Authorization | Petitioners can authorize a representative to discuss their appeal with the Tax Commission, which must be indicated on the form. |

| Required Attachments | When filing, you must attach a copy of any relevant letters or notices from the Tax Commission that prompted the appeal. |

| Tax Types | The TC-738 form can be used for various tax types, including individual income tax, corporate franchise tax, and sales and use tax. |

| Deadline for Evidence | Petitioners must provide supporting information to the Tax Commission Appeals Unit at least ten business days before the scheduled hearing. |

| Signature Requirement | The form must be signed by the taxpayer or an authorized representative, confirming the accuracy of the information provided. |

| Special Note for Motor Vehicle Appeals | This form is specifically designed to appeal decisions from the Motor Vehicle Division, excluding towing and storage fees charged by tow companies. |