Fill a Valid Tc 8453 Utah Template

Dos and Don'ts

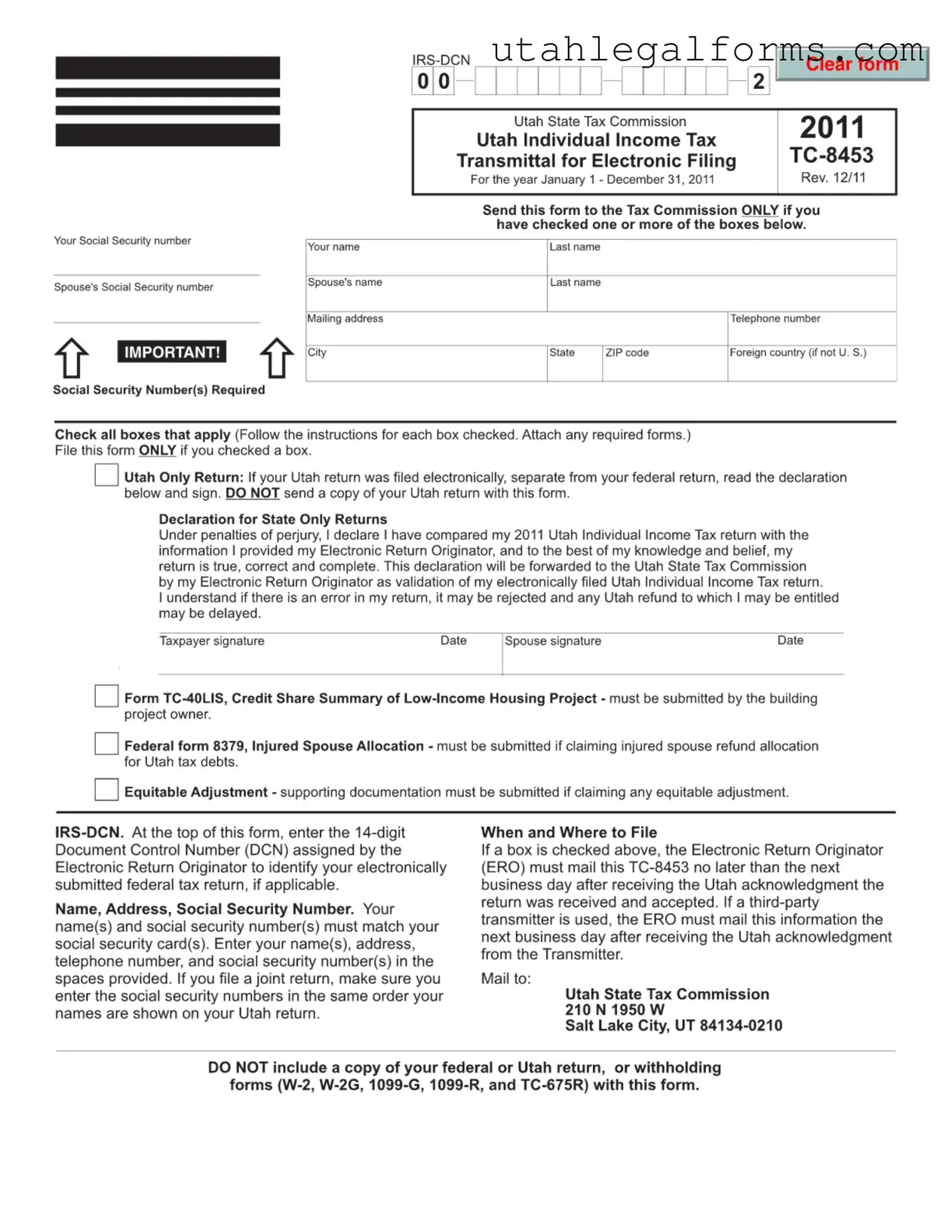

When filling out the TC-8453 Utah form, it is essential to follow specific guidelines to ensure accuracy and compliance. Below is a list of things to do and avoid during this process.

- Do check all applicable boxes before submitting the form.

- Do ensure that your name and Social Security number match the information on your Social Security card.

- Do enter your address and telephone number in the designated spaces clearly.

- Do sign and date the form in the appropriate sections.

- Do mail the form to the Utah State Tax Commission promptly after receiving acknowledgment of your return.

- Don’t send a copy of your federal or Utah return with the TC-8453 form.

- Don’t include any withholding forms such as W-2s or 1099s.

- Don’t forget to attach any required forms if you checked a box that mandates it.

- Don’t delay mailing the form; it must be sent no later than the next business day after acknowledgment.

By adhering to these guidelines, you can help ensure that your TC-8453 form is processed smoothly and without unnecessary delays.

More PDF Forms

Workmen's Compensation Claims - Employers must designate their workers' compensation insurance carrier on the form.

To ensure a smooth transaction when buying or selling a boat, it's essential to utilize the New York Boat Bill of Sale form, as this document encapsulates important details regarding the sale and ownership transfer. For those interested in accessing the necessary form, you can find it at legalpdf.org, where you can accurately complete the required information to formalize the agreement.

Utah State Income Tax Form - Each fiduciary must accurately report income and deductions on the TC-41.

How to Transfer a Car Title to a Family Member in Utah - The document is governed by the Utah State Tax Commission’s regulations.

Listed Questions and Answers

-

What is the TC-8453 form?

The TC-8453 form is the Utah Individual Income Tax Transmittal for Electronic Filing. It is used to validate your electronically filed Utah tax return when certain conditions are met. This form must be submitted to the Utah State Tax Commission if you check specific boxes indicating that additional documentation is required.

-

When should I file the TC-8453 form?

You should file the TC-8453 form only if you have checked one or more boxes on the form that indicate additional documentation is needed. It is essential to ensure that your Utah return was filed electronically, separate from your federal return, before submitting this form.

-

What information do I need to provide on the TC-8453 form?

You must provide your name, your spouse's name (if applicable), mailing address, telephone number, and Social Security numbers. Ensure that the names and Social Security numbers match what is on your Social Security card. If filing jointly, list the Social Security numbers in the same order as they appear on your Utah return.

-

How do I submit the TC-8453 form?

The Electronic Return Originator (ERO) must mail the TC-8453 form to the Utah State Tax Commission no later than the next business day after receiving acknowledgment that your return was accepted. If a third-party transmitter is used, the ERO must also send it the next business day after receiving acknowledgment from the transmitter.

-

Where should I send the TC-8453 form?

Mail the TC-8453 form to the following address:

Utah State Tax Commission

210 N 1950 W

Salt Lake City, UT 84134-0210 -

What should I not include with the TC-8453 form?

Do not include a copy of your federal or Utah return, or any withholding forms such as W-2, W-2G, 1099-G, 1099-R, and TC-675R with this submission. Only send the TC-8453 form if required.

-

What happens if I make an error on my TC-8453 form?

If there is an error in your return, it may be rejected, which could delay any refund you may be entitled to receive. It is crucial to review all information carefully before submission to avoid any issues.

-

What if I need to claim additional credits or adjustments?

If you are claiming credits such as the Low-Income Housing Project or an injured spouse refund allocation, you must submit the appropriate forms along with the TC-8453. Ensure you check all applicable boxes and provide any required supporting documentation.

Key takeaways

Here are key takeaways regarding the TC-8453 Utah form:

- Filing Requirement: Submit the TC-8453 only if you have checked one or more boxes on the form. This indicates specific circumstances that require this transmittal.

- Accurate Information: Ensure that names and Social Security numbers match those on your Social Security cards. If filing jointly, enter the numbers in the order they appear on your Utah return.

- Submission Timeline: The Electronic Return Originator (ERO) must mail the TC-8453 within one business day after receiving acknowledgment that the return was accepted.

- No Additional Documents: Do not attach copies of your federal or Utah returns, or any withholding forms, when submitting the TC-8453.

Documents used along the form

The TC-8453 form is an essential document for Utah residents filing their individual income tax returns electronically. However, there are several other forms and documents that often accompany the TC-8453 to ensure a complete and accurate tax filing. Below is a list of these forms, each serving a unique purpose in the tax filing process.

- Form TC-40LIS: This form is the Credit Share Summary of Low-Income Housing Project. It must be submitted by the owner of a building project that qualifies for low-income housing credits. This form provides necessary details about the allocation of credits.

- Arizona Motorcycle Bill of Sale: Essential for documenting the sale and transfer of motorcycle ownership in Arizona, this form serves as proof of the transaction. More details can be found at arizonapdfforms.com/motorcycle-bill-of-sale/.

- Federal Form 8379: Known as the Injured Spouse Allocation, this form is required when a taxpayer is claiming a refund allocation for Utah tax debts. It helps to protect the refund of the spouse who is not responsible for the debt.

- Equitable Adjustment: This is not a specific form but rather a request that requires supporting documentation. Taxpayers may submit this when claiming any equitable adjustment to their tax liability, often related to special circumstances.

- W-2 Forms: These forms report an employee's annual wages and the taxes withheld from their paycheck. They are crucial for verifying income and tax withholdings when filing returns.

- 1099 Forms: Various types of 1099 forms report different types of income received throughout the year, such as freelance work or interest income. They are important for ensuring all income is accurately reported.

- Form TC-675R: This form is used to report Utah withholding tax for certain payments. It is necessary to include if the taxpayer has had Utah state taxes withheld from their income.

- IRS-DCN: This is the Document Control Number assigned by the Electronic Return Originator. It helps identify the electronically submitted federal tax return and is required on the TC-8453 for proper processing.

By understanding the purpose of each of these forms, taxpayers can ensure they are adequately prepared when filing their Utah income tax returns. Having the right documents ready can help streamline the process and minimize any potential delays in receiving refunds or resolving issues with the tax authorities.

File Specifications

| Fact Name | Description |

|---|---|

| Form Purpose | The TC-8453 is used to transmit Utah Individual Income Tax returns electronically. |

| Filing Period | This form is applicable for the tax year from January 1 to December 31, 2011. |

| Submission Requirement | It must be submitted only if one or more boxes are checked on the form. |

| Signature Requirement | Taxpayer and spouse must sign the declaration to validate the electronic filing. |

| Mailing Address | The completed form should be mailed to the Utah State Tax Commission at 210 N1950W, Salt Lake City, UT 84134-0210. |

| Document Control Number | A 14-digit Document Control Number (DCN) must be entered at the top of the form. |

| Social Security Numbers | Names and Social Security numbers must match those on the Social Security cards. |

| Filing Deadline | The form must be mailed no later than the next business day after receiving Utah acknowledgment of the return. |

| Governing Law | This form is governed by Utah state tax laws, specifically under Title 59, Chapter 10 of the Utah Code. |