Official Tractor Bill of Sale Form for Utah State

Dos and Don'ts

When filling out the Utah Tractor Bill of Sale form, it's important to follow certain guidelines to ensure accuracy and compliance. Here are five things you should and shouldn't do:

- Do provide accurate information about the tractor, including the make, model, year, and VIN.

- Don't leave any fields blank; all sections must be completed to avoid delays.

- Do include the purchase price clearly to reflect the transaction amount.

- Don't forget to sign and date the form; both the seller and buyer must do this.

- Do keep a copy of the completed form for your records after submission.

Consider Some Other Templates for Utah

Utah Prenuptial Contract - A prenuptial agreement can clarify how debts will be handled during marriage.

For those looking to navigate the transaction of horse ownership, the guide on the comprehensive Horse Bill of Sale form template is invaluable. This document will help ensure all necessary details are properly recorded, making the process much smoother. For more information, visit our resource on the Horse Bill of Sale.

Utah State Corporations - Outlines any rights to purchase additional shares in the future.

Listed Questions and Answers

-

What is a Utah Tractor Bill of Sale?

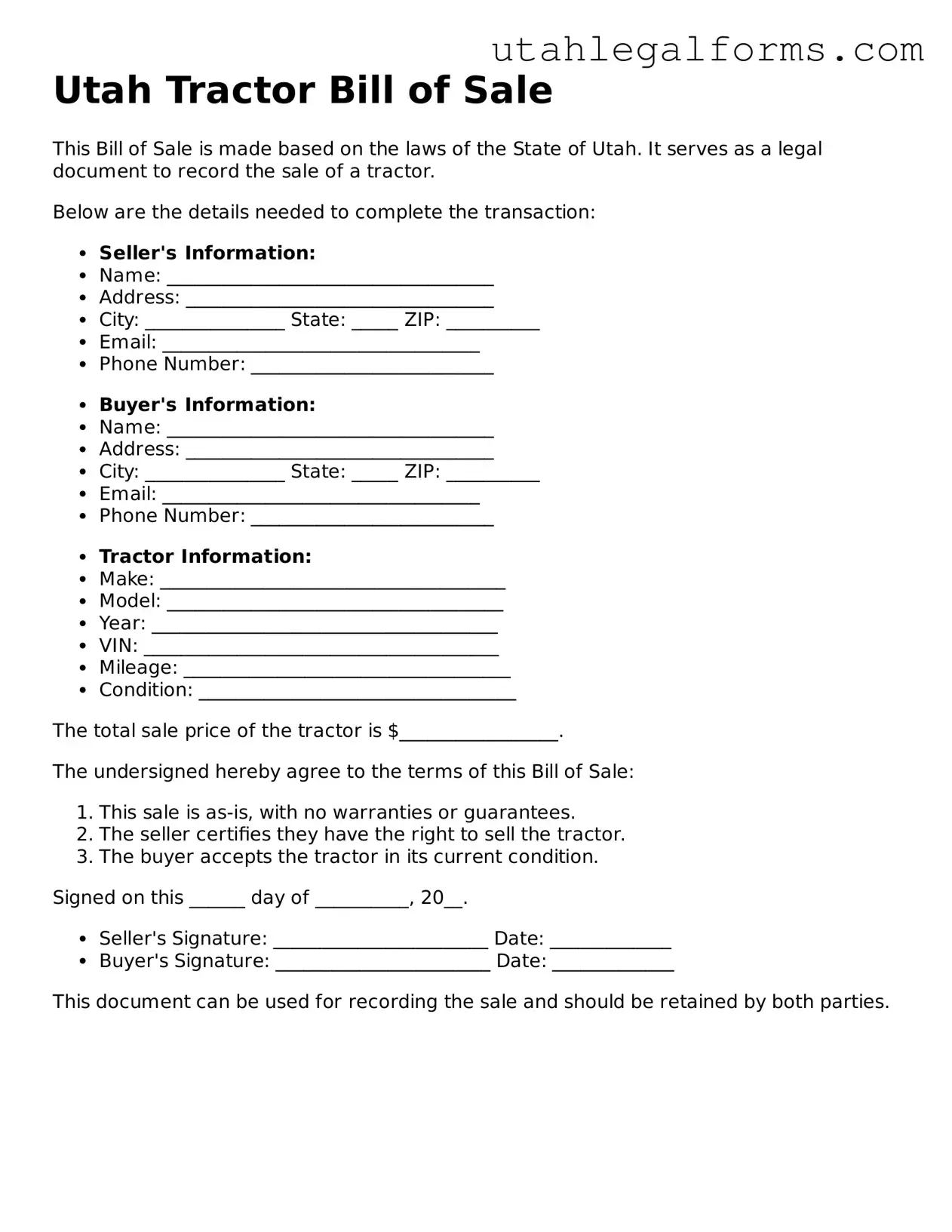

A Utah Tractor Bill of Sale is a legal document that records the sale of a tractor. It includes essential information about the buyer, seller, and the tractor being sold. This document serves as proof of ownership transfer and can be important for future transactions or registrations.

-

Why do I need a Bill of Sale for my tractor?

A Bill of Sale is crucial for several reasons. It protects both the buyer and seller by providing a record of the transaction. It also helps establish legal ownership and can be required for registering the tractor with the state. Without it, you may face challenges if disputes arise later.

-

What information should be included in the Bill of Sale?

The Bill of Sale should include:

- The names and addresses of both the buyer and seller.

- The make, model, year, and Vehicle Identification Number (VIN) of the tractor.

- The sale price.

- The date of the sale.

- Any warranties or conditions of the sale, if applicable.

-

Is the Bill of Sale required to register my tractor in Utah?

Yes, a Bill of Sale is typically required for registering a tractor in Utah. The Department of Motor Vehicles (DMV) may request this document to confirm the transfer of ownership. Always check with the DMV for specific requirements.

-

Do I need to have the Bill of Sale notarized?

In Utah, notarization is not a requirement for a Bill of Sale for a tractor. However, having it notarized can add an extra layer of security and authenticity to the document. It may also be beneficial if there are any disputes in the future.

-

Can I create my own Bill of Sale?

Yes, you can create your own Bill of Sale. Just ensure that it includes all necessary information. There are also templates available online that can help guide you in creating a proper document. Make sure it meets Utah's requirements.

-

What if I lose the Bill of Sale?

If you lose the Bill of Sale, it can be challenging, but not impossible. You may need to contact the seller to obtain a duplicate. If that’s not possible, you might consider filing an affidavit of ownership with the DMV to help establish your claim to the tractor.

-

Can I use a Bill of Sale from another state?

Using a Bill of Sale from another state is possible, but it must meet Utah's requirements. Ensure that it includes all necessary details specific to the transaction. It may be wise to consult with the DMV or a legal advisor to confirm its acceptability.

-

What should I do after completing the Bill of Sale?

After completing the Bill of Sale, both the buyer and seller should keep a copy for their records. The buyer should take the document to the DMV for registration. Ensure that all information is accurate and that both parties sign the document.

Key takeaways

When filling out and using the Utah Tractor Bill of Sale form, several key considerations can enhance the process and ensure compliance with state regulations. Below are essential takeaways to keep in mind:

- The form must include accurate information about both the buyer and seller, including full names and addresses.

- Detail the tractor's specifications, such as make, model, year, and Vehicle Identification Number (VIN).

- Clearly state the purchase price to avoid any misunderstandings between parties.

- Both parties should sign and date the form to validate the transaction.

- Consider including a statement regarding the condition of the tractor, which can help in future disputes.

- Keep a copy of the completed bill of sale for personal records, as it serves as proof of the transaction.

- Check for any local requirements or additional documentation needed for registration after the sale.

- Utilize the form to facilitate a smooth transfer of ownership, which is crucial for legal and financial records.

Documents used along the form

When purchasing or selling a tractor in Utah, several additional forms and documents may be necessary to ensure a smooth transaction. These documents help clarify ownership, provide necessary information for registration, and protect both parties involved in the sale.

- Title Transfer Document: This form is essential for transferring ownership from the seller to the buyer. It includes details such as the vehicle identification number (VIN), make, model, and the names of both parties.

- Odometer Disclosure Statement: Required by federal law, this document certifies the mileage on the tractor at the time of sale. It helps prevent fraud related to odometer tampering.

- Bill of Sale for Personal Property: While specific to tractors, a general bill of sale can also be used. This document outlines the terms of the sale and serves as proof of the transaction.

- Sales Tax Form: Depending on the sale, a sales tax form may be required. This form details the tax collected on the sale and is necessary for proper state reporting.

- Affidavit of Vehicle Identification Number: If the VIN is missing or obscured, this affidavit can be used to verify the tractor's identity and establish ownership.

- Dirt Bike Bill of Sale: Similar to the Tractor Bill of Sale, for those engaging in the sale or purchase of a dirt bike in New York, completing the legalpdf.org form is essential to ensure a smooth and legal transaction.

- Insurance Verification: Buyers may need to provide proof of insurance before registering the tractor. This document confirms that the tractor is insured and complies with state requirements.

- Registration Application: After the sale, the buyer must complete a registration application with the Utah Department of Motor Vehicles. This document includes personal information and details about the tractor.

- Power of Attorney: If one party cannot be present during the transaction, a power of attorney form can authorize another individual to act on their behalf, ensuring the sale can proceed smoothly.

- Inspection Certificate: Some buyers may require an inspection certificate to confirm the tractor's condition before purchase. This document is issued by a certified mechanic or inspector.

Having these documents prepared and organized can facilitate a more efficient transaction. Ensuring all necessary paperwork is completed correctly helps protect both the buyer and the seller, providing peace of mind throughout the process.

Form Information

| Fact Name | Details |

|---|---|

| Purpose | The Utah Tractor Bill of Sale form is used to document the sale and transfer of ownership of a tractor in the state of Utah. |

| Governing Law | This form is governed by Utah Code Title 41, Chapter 3, which outlines the regulations for the transfer of motor vehicles and equipment. |

| Required Information | The form typically requires details such as the names of the buyer and seller, the tractor's identification number, and the sale price. |

| Signatures | Both the buyer and seller must sign the form to validate the transaction and ensure a legal transfer of ownership. |