Official Transfer-on-Death Deed Form for Utah State

Dos and Don'ts

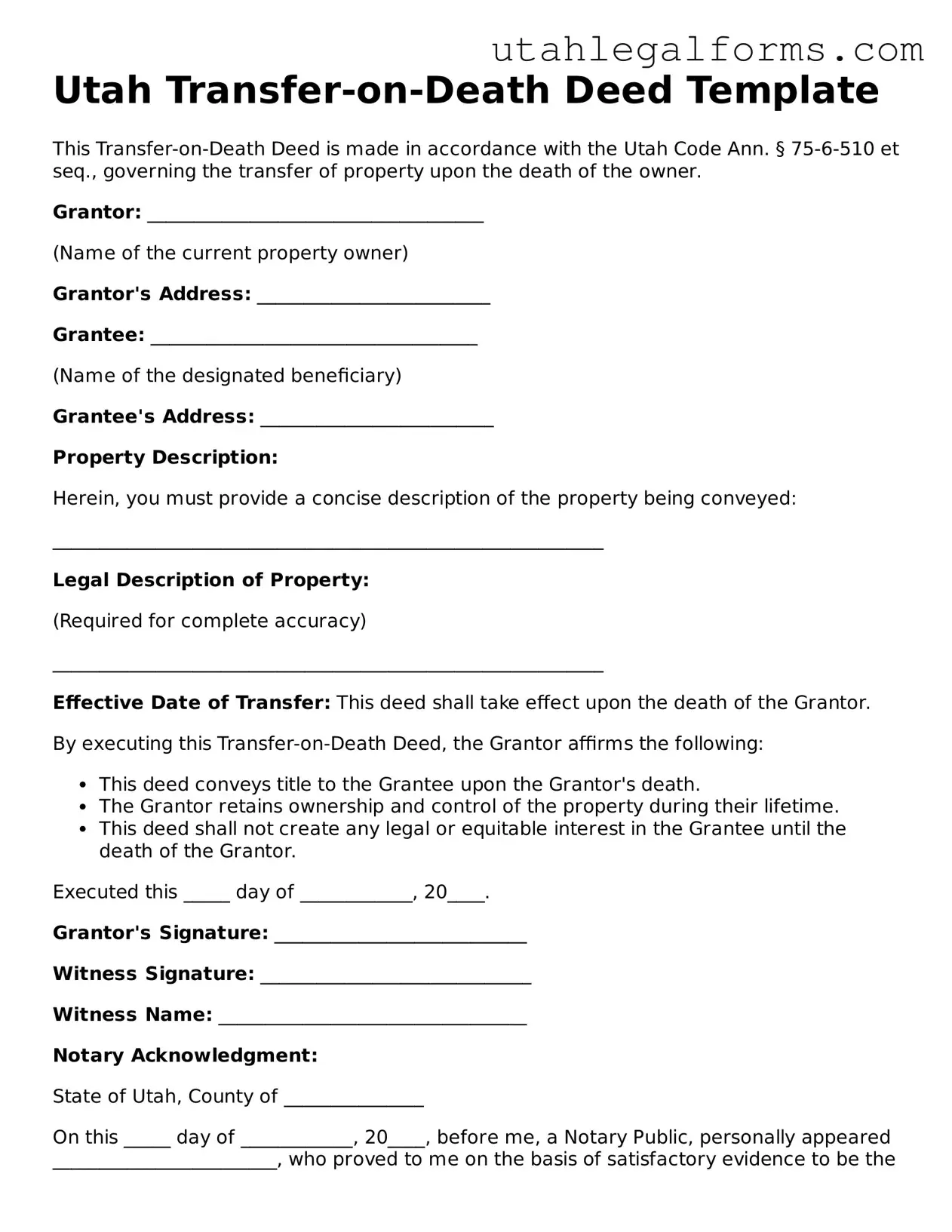

When filling out the Utah Transfer-on-Death Deed form, it is important to follow specific guidelines to ensure accuracy and compliance. Here are six things you should and shouldn't do:

- Do: Clearly identify the property being transferred. Include the full legal description.

- Do: Provide accurate information about the grantor and the beneficiary.

- Do: Sign the deed in the presence of a notary public.

- Do: Record the deed with the county recorder's office to make it effective.

- Don't: Leave any sections of the form blank. Fill in all required fields.

- Don't: Use vague language when describing the property or the beneficiary.

Consider Some Other Templates for Utah

Is Utah a 50 50 Divorce State - The marital separation agreement can be executed without court intervention.

Completing the ATV Bill of Sale form is crucial for a smooth transaction, as it not only protects the interests of both parties but also helps in avoiding any potential disputes in the future. To ensure you have all necessary documentation, you can download the document in pdf for your convenience.

In Consideration of Bill of Sale Example - Promotes transparency in the sale, reassuring both buyer and seller.

Listed Questions and Answers

-

What is a Transfer-on-Death Deed in Utah?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows property owners in Utah to designate a beneficiary who will receive their property upon the owner's death. This form enables the transfer of real estate without the need for probate, simplifying the process for heirs.

-

Who can use a Transfer-on-Death Deed?

Any individual who owns real property in Utah can utilize a Transfer-on-Death Deed. This includes homeowners, individuals holding property in their name, and even joint owners, provided that the deed is executed correctly.

-

How do I complete a Transfer-on-Death Deed?

To complete a TOD Deed, you must fill out the form with the required information, including your name, the property description, and the name of the beneficiary. It must be signed in front of a notary public and then recorded with the county recorder's office where the property is located.

-

Is there a cost associated with filing a Transfer-on-Death Deed?

Yes, there may be fees associated with recording the deed at the county recorder's office. These fees can vary by county, so it is advisable to check with your local office for the exact amount.

-

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a TOD Deed at any time during your lifetime. To do this, you must create a new deed that explicitly states the changes or a revocation document that cancels the previous deed. It is essential to record this new document to ensure it is legally recognized.

-

What happens if the beneficiary predeceases me?

If the designated beneficiary dies before you, the property will not transfer to them. Instead, the property will become part of your estate and will be distributed according to your will or, if there is no will, according to Utah's intestacy laws.

-

Are there any tax implications associated with a Transfer-on-Death Deed?

Generally, the transfer of property via a TOD Deed does not trigger immediate tax consequences. However, beneficiaries may be responsible for taxes on any income generated from the property after the owner's death. Consulting with a tax professional can provide clarity on specific situations.

-

Is a Transfer-on-Death Deed the right choice for everyone?

While a TOD Deed can simplify the transfer of property, it may not be suitable for everyone. Individuals with complex estates or specific wishes regarding property distribution may want to consider other estate planning tools, such as a trust or a will. It is advisable to evaluate your individual circumstances and consult with a legal professional.

Key takeaways

- Purpose: The Utah Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate.

- Eligibility: Any property owner in Utah can use this deed for their real estate, including homes and land.

- Form Completion: Fill out the form with accurate property details and the names of the beneficiaries you wish to designate.

- Signature Requirement: The property owner must sign the deed in front of a notary public to ensure its validity.

- Filing: Once completed, the deed must be filed with the county recorder’s office where the property is located.

- Revocation: The Transfer-on-Death Deed can be revoked at any time by filing a revocation form or executing a new deed.

- Beneficiary Rights: Beneficiaries do not have any rights to the property until the owner passes away.

- Tax Implications: Consult with a tax advisor to understand any potential tax consequences for the beneficiaries.

- Legal Advice: While the form is straightforward, seeking legal advice can help ensure that all aspects are properly addressed.

Documents used along the form

When dealing with property transfer in Utah, the Transfer-on-Death Deed is a useful tool. However, it often works in conjunction with other important documents that ensure a smooth transition of ownership. Below is a list of forms and documents that are commonly used alongside the Transfer-on-Death Deed, each serving a specific purpose in the process.

- Will: A legal document that outlines how a person's assets should be distributed after their death. It can complement a Transfer-on-Death Deed by addressing other properties or assets not covered by the deed.

- Revocable Living Trust: This document allows individuals to place their assets into a trust during their lifetime. Upon death, the assets can be distributed according to the trust's terms, often avoiding probate.

- Affidavit of Death: A sworn statement used to verify the death of an individual. This document can be required to execute the Transfer-on-Death Deed and transfer property to beneficiaries.

- Deed of Distribution: A document used to formally transfer property from an estate to beneficiaries. It may be necessary if the property was not transferred during the decedent's lifetime.

- Motor Vehicle Bill of Sale: This document is crucial for the transfer of ownership of a vehicle, providing necessary details that ensure legality in the transaction. For templates and more information, visit fastpdftemplates.com/.

- Power of Attorney: A legal document that grants someone the authority to act on another's behalf. This can be useful if the property owner becomes incapacitated and needs someone to manage their affairs.

- Notice of Death: A formal notification that informs interested parties of the death of an individual. This can help in updating property records and ensuring all stakeholders are aware of the change in ownership.

- Property Tax Records: These documents provide information on property ownership and tax obligations. Keeping them updated is essential for the new owner after a transfer occurs.

Understanding these documents can simplify the process of property transfer in Utah. Each plays a vital role in ensuring that the intentions of the property owner are honored and that beneficiaries receive their rightful inheritance without unnecessary complications.

Form Information

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death Deed allows an individual to transfer real property to a beneficiary upon their death without going through probate. |

| Governing Law | The Transfer-on-Death Deed in Utah is governed by Utah Code Title 75, Chapter 6, Section 1201. |

| Eligibility | Any individual who owns real property in Utah can create a Transfer-on-Death Deed. |

| Beneficiary Designation | The deed allows the owner to designate one or more beneficiaries who will receive the property upon the owner’s death. |

| Revocation | A Transfer-on-Death Deed can be revoked at any time by the property owner through a written document. |

| Recording Requirement | The deed must be recorded with the county recorder's office in the county where the property is located. |

| Effectiveness | The Transfer-on-Death Deed becomes effective only upon the death of the property owner. |

| Tax Implications | There are no immediate tax implications for the beneficiary until they sell the property after the owner's death. |

| Limitations | This deed cannot be used for transferring property that is part of a trust or for properties subject to liens. |

| Legal Assistance | While not required, consulting with a legal professional is advisable to ensure the deed is properly executed and recorded. |