Fill a Valid Utah 3045 Template

Dos and Don'ts

When filling out the Utah 3045 form, it is essential to follow certain guidelines to ensure accuracy and compliance. Here are seven things to do and avoid:

- Do ensure all required fields are completed accurately.

- Do double-check the spelling of names and addresses.

- Do use clear and legible handwriting or type the information.

- Do review the definitions provided in the form to understand the terms used.

- Don't leave any sections blank unless specified as optional.

- Don't use white-out or other correction methods on the form.

- Don't forget to sign and date the form where required.

More PDF Forms

Utah Tax Forms - Access to records is strictly regulated, and misuse can lead to serious penalties.

For individuals looking to understand their legal options, a vital resource is a guide to the Durable Power of Attorney document that outlines its importance and utility. You can find more information about this essential form at an informative Durable Power of Attorney overview.

Tc 738 Utah - Failure to meet information submission deadlines could jeopardize the appeal.

Listed Questions and Answers

-

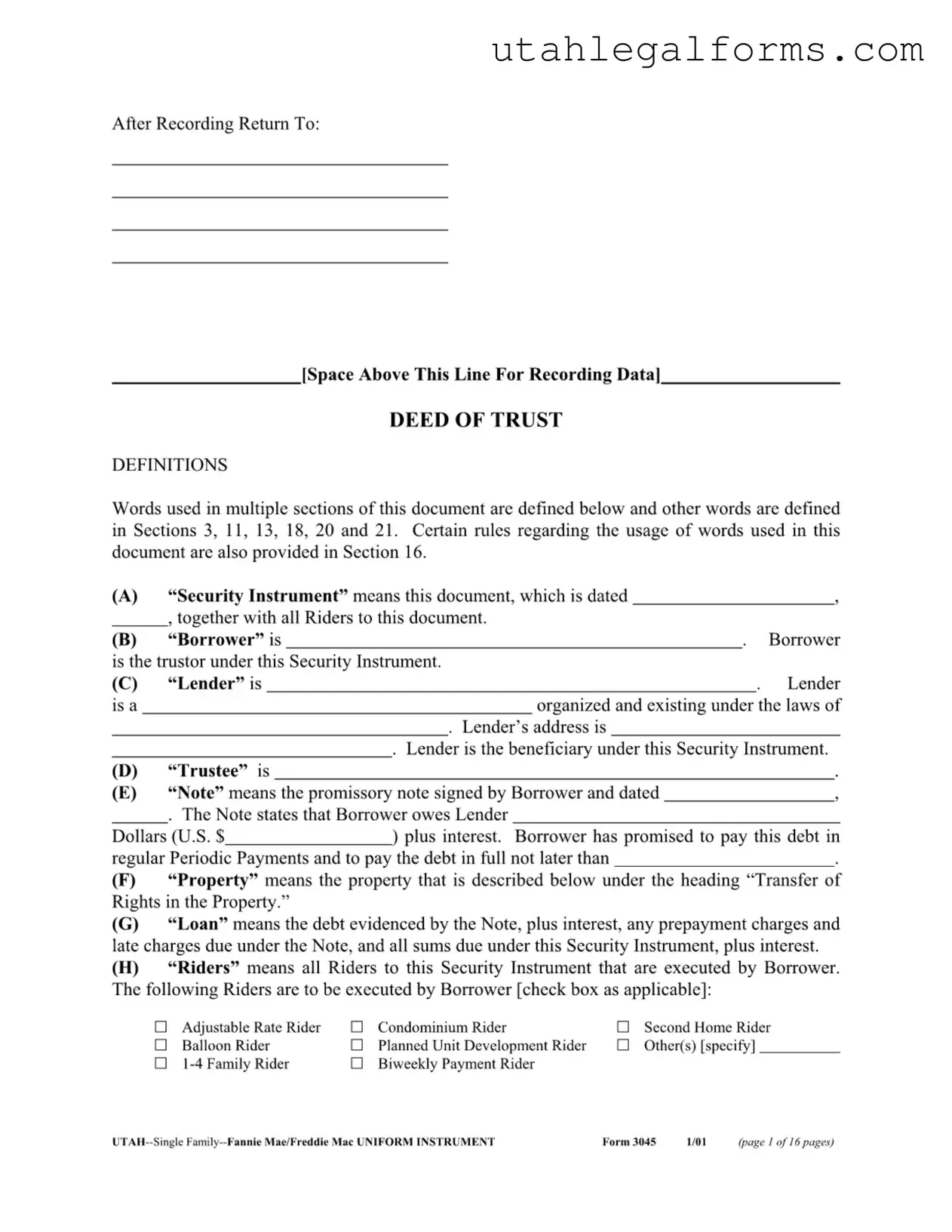

What is the Utah 3045 form?

The Utah 3045 form is a legal document known as a Deed of Trust. It serves as a security instrument in real estate transactions, allowing a lender to secure a loan with the property being purchased. This document outlines the rights and responsibilities of the borrower, lender, and trustee involved in the transaction.

-

Who are the parties involved in the Utah 3045 form?

There are three main parties involved in the Utah 3045 form: the Borrower, the Lender, and the Trustee. The Borrower is the individual or entity taking out the loan, while the Lender provides the funds. The Trustee is a neutral third party who holds the legal title to the property until the loan is repaid.

-

What does the term "Property" refer to in the context of the Utah 3045 form?

The term "Property" refers to the real estate that is being financed through the loan. This includes not only the land itself but also any improvements, fixtures, and easements associated with the property. Essentially, it is the physical asset that secures the loan.

-

What is a "Note" in the Utah 3045 form?

The "Note" is a promissory note that the Borrower signs, which states the amount of money borrowed and the terms of repayment. It includes details like interest rates and payment schedules. The Note is a critical component of the Deed of Trust, as it outlines the Borrower's obligation to repay the loan.

-

What are "Riders" in the context of the Utah 3045 form?

Riders are additional provisions that can be attached to the Deed of Trust to address specific circumstances or requirements. These might include adjustable rate riders, balloon riders, or other types of riders depending on the specifics of the loan or property type. They help customize the agreement to fit the needs of the Borrower and Lender.

-

What happens if the Borrower defaults on the loan?

If the Borrower defaults, the Lender can initiate foreclosure proceedings. This means the Trustee can sell the Property to recover the loan amount. The Deed of Trust gives the Lender the right to take this action if the Borrower fails to meet their obligations as outlined in the Note and the Deed of Trust.

-

What are "Escrow Items" mentioned in the Utah 3045 form?

Escrow Items are costs associated with the property that the Borrower agrees to pay in addition to the principal and interest on the loan. These can include property taxes, homeowners insurance, and any other fees that may be required. The Lender often collects these funds in advance and holds them in escrow until they are due.

-

How does the Utah 3045 form protect the Lender?

The Utah 3045 form protects the Lender by creating a legal claim against the Property. If the Borrower fails to repay the loan, the Lender can foreclose on the Property. This means that the Lender can sell the Property to recover the money owed, making it a secure way for lenders to finance real estate transactions.

-

Can the terms of the Utah 3045 form be modified?

Yes, the terms of the Utah 3045 form can be modified, but such changes typically require the agreement of all parties involved. Any modifications should be documented in writing and may require additional signatures to ensure that they are legally binding. It's essential to consult with a legal expert when making any changes to ensure compliance with applicable laws.

Key takeaways

- Understand the Purpose: The Utah 3045 form serves as a Deed of Trust, establishing a security interest in real property to secure a loan.

- Identify Key Parties: The form requires the identification of the Borrower, Lender, and Trustee, all of whom play crucial roles in the transaction.

- Complete Definitions: Familiarize yourself with the definitions provided in the form, such as "Security Instrument," "Property," and "Loan," as they clarify the terms used throughout the document.

- Include Accurate Information: Ensure that all sections, including the names, addresses, and specific details about the loan and property, are filled out accurately to avoid potential issues.

- Understand Riders: Check the applicable boxes for any Riders that may accompany the Deed of Trust, as they can modify the terms of the agreement.

- Review Escrow Items: Be aware of the escrow items mentioned in Section 3, as these represent additional costs that may be required during the loan period.

- Follow Applicable Laws: The form is governed by federal, state, and local laws, so it is important to ensure compliance with all relevant regulations.

- Maintain Copies: After completing the form, keep copies for your records. This will be essential for future reference or in case of disputes.

- Consult Professionals: If any uncertainties arise while filling out the form, consider consulting with a legal professional to ensure all requirements are met correctly.

Documents used along the form

The Utah 3045 form, also known as the Deed of Trust, is a crucial document in real estate transactions, particularly for securing a loan. When using this form, several other documents may accompany it to ensure all aspects of the transaction are covered. Here’s a brief overview of some commonly used forms and documents that work in conjunction with the Utah 3045 form.

- Promissory Note: This document outlines the borrower's promise to repay the loan. It specifies the amount borrowed, interest rate, repayment schedule, and consequences of default.

- Loan Application: This form collects personal and financial information from the borrower. Lenders use it to assess creditworthiness and determine loan eligibility.

- Title Insurance Policy: This insurance protects the lender and borrower from potential disputes over property ownership. It covers legal fees and losses due to title defects.

- Appraisal Report: Conducted by a licensed appraiser, this report assesses the property's market value. Lenders require it to ensure the loan amount aligns with the property’s worth.

- Disclosure Statements: These documents inform borrowers about the terms of the loan, including fees, interest rates, and other important details. They ensure transparency in the lending process.

- Closing Statement: Also known as a HUD-1, this document outlines all financial transactions related to the closing of the loan. It details costs, fees, and disbursements.

- Escrow Agreement: This agreement involves a third party holding funds or documents until certain conditions are met. It helps facilitate a smooth transaction between the buyer and seller.

- Boat Bill of Sale: This document is essential when buying or selling a boat in California, providing a formal record of the transaction between buyer and seller. For more information and to obtain the form, visit legalpdf.org.

- Riders: These are additional documents that modify the terms of the Deed of Trust. Common riders include Adjustable Rate Rider and Balloon Rider, which specify unique loan conditions.

- Homeowners Association (HOA) Documents: If the property is part of an HOA, these documents outline the rules, regulations, and fees associated with the community.

- Property Survey: This document provides a detailed map of the property boundaries and any easements. It helps clarify property lines and any potential encroachments.

Understanding these documents can greatly enhance the real estate transaction experience. Each plays a vital role in ensuring that both the borrower and lender are protected throughout the loan process. Familiarity with these forms helps streamline communication and promotes a smoother transaction.

File Specifications

| Fact Name | Description |

|---|---|

| Governing Law | The Utah 3045 form is governed by Utah state law, particularly the Uniform Commercial Code and applicable real estate statutes. |

| Security Instrument | The form serves as a Security Instrument, which includes the terms and conditions under which a borrower secures a loan against a property. |

| Borrower and Lender Definitions | In this document, the "Borrower" refers to the trustor, while the "Lender" is the entity providing the loan, acting as the beneficiary. |

| Periodic Payments | Borrowers are required to make regular payments, which include principal and interest, as specified in the promissory note. |