Fill a Valid Utah B10 Template

Dos and Don'ts

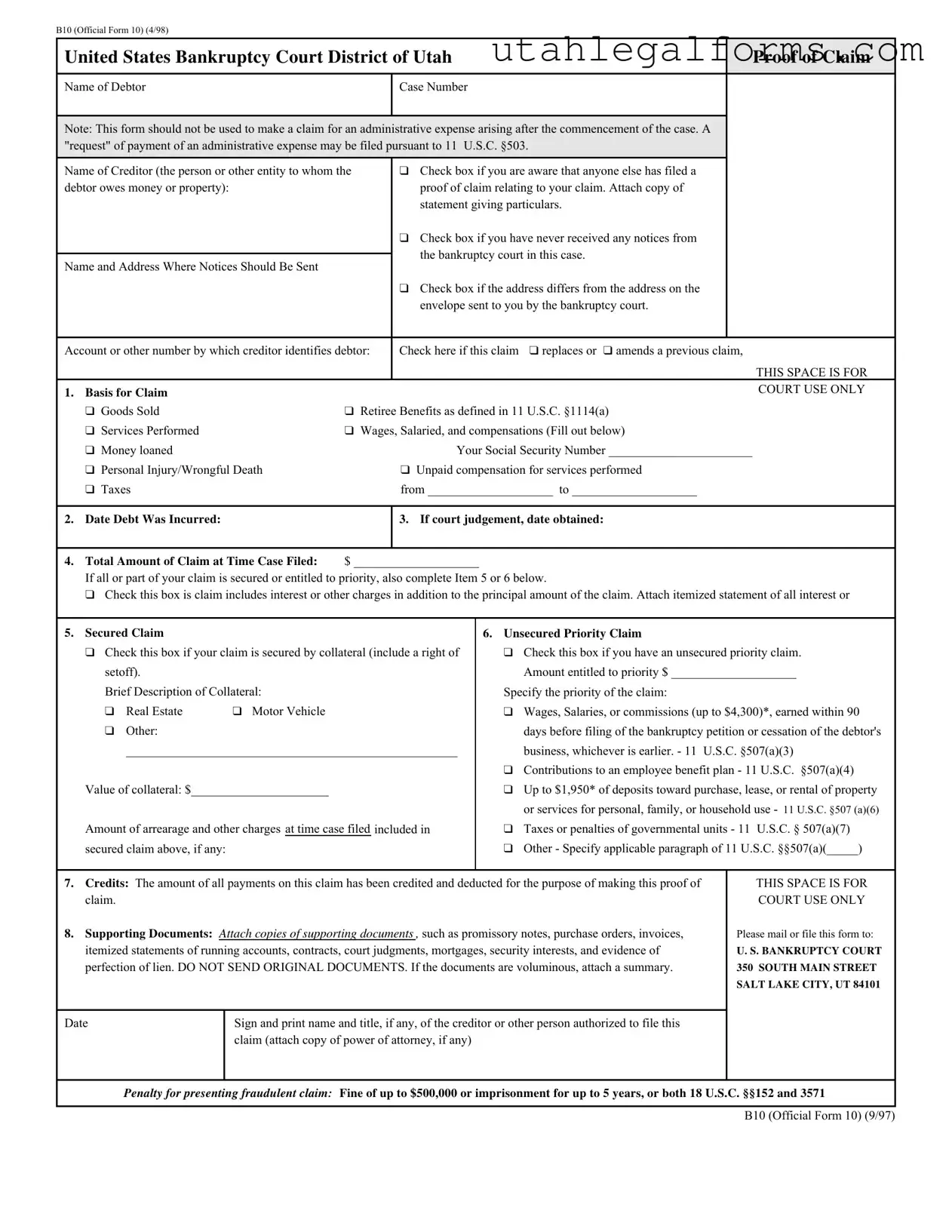

When filling out the Utah B10 form, it is essential to approach the process with care and attention to detail. Here are eight important dos and don'ts to consider:

- Do ensure that all information is accurate and complete. Double-check names, case numbers, and amounts.

- Do attach all necessary supporting documents, such as invoices or contracts, to substantiate your claim.

- Do indicate whether your claim is secured or unsecured, as this affects the priority of your claim.

- Do sign and print your name clearly on the form, including your title if applicable.

- Don't submit original documents. Always provide copies of supporting materials instead.

- Don't forget to check the appropriate boxes that apply to your claim, such as whether you have received notices from the court.

- Don't leave any sections blank. If a section does not apply, indicate that clearly.

- Don't delay in filing your claim. Ensure you submit the form before the deadline set by the court.

More PDF Forms

Utah Income Tax Forms - Timely reporting through this form demonstrates commitment to service quality.

Understanding the importance of a Bill of Sale can greatly enhance the security of your transaction, as it serves as a vital record of ownership transfer. For more details and a streamlined process, you can visit legalpdf.org, which provides essential resources for completing a California Bill of Sale form accurately.

Utah Dopl Ap - A government-issued ID is required for fingerprinting at DOPL’s office.

Listed Questions and Answers

-

What is the purpose of the Utah B10 form?

The Utah B10 form, also known as the Proof of Claim, is used by creditors to assert their claims against a debtor who has filed for bankruptcy. This form allows creditors to formally declare the amount owed to them and provides necessary details about the nature of the debt. It is crucial for creditors to file this form to ensure they are recognized in the bankruptcy proceedings and can potentially recover some of the owed amounts.

-

Who should file the B10 form?

The B10 form should be filed by any individual or entity that believes they are owed money or property by the debtor in a bankruptcy case. This includes businesses, individuals, and government entities. If you are a creditor, it is important to file this form to protect your rights and interests in the bankruptcy process.

-

What information is required on the B10 form?

The B10 form requires several pieces of information, including:

- The name and address of the creditor.

- The name of the debtor and the case number.

- The basis for the claim, such as goods sold or services performed.

- The total amount of the claim at the time the case was filed.

- Details about whether the claim is secured or unsecured, and if it is entitled to priority.

Completing the form accurately is essential to ensure your claim is properly processed.

-

What should I do if I have never received any notices from the bankruptcy court?

If you have not received any notices from the bankruptcy court regarding the case, you should check the appropriate box on the B10 form. This indicates to the court that you may not have been properly informed of the proceedings. It is advisable to seek additional information from the court or consult with a legal professional to ensure you understand your rights and obligations.

-

What happens if my claim is secured or entitled to priority?

If your claim is secured, it means you have a legal right to specific collateral that can be used to satisfy the debt. You will need to provide details about the collateral on the form. If your claim is entitled to priority, it will be paid before general unsecured claims in the bankruptcy process. It is important to specify the nature of your claim and provide any necessary documentation to support your position.

-

What supporting documents should I attach to the B10 form?

When filing the B10 form, you should attach copies of any relevant supporting documents. This may include promissory notes, invoices, contracts, or any other evidence that substantiates your claim. It is crucial to provide this documentation to validate your claim. However, do not send original documents, as they will not be returned. If the documents are extensive, a summary can be attached instead.

Key takeaways

Here are some key takeaways regarding the Utah B10 form:

- Purpose: The B10 form is used to file a proof of claim in bankruptcy cases. It is essential for creditors seeking payment from the debtor's estate.

- Eligibility: This form should not be used for claims related to administrative expenses incurred after the bankruptcy case has started. Instead, those claims require a different filing under 11 U.S.C. §503.

- Accurate Information: Ensure all details, such as the debtor's name, case number, and creditor's information, are correct. Mistakes can delay the processing of your claim.

- Supporting Documents: Attach necessary documents that support your claim, like invoices or contracts. Do not send original documents; copies are sufficient.

- Filing Location: Submit the completed form to the U.S. Bankruptcy Court in Salt Lake City. The address is 350 South Main Street, Salt Lake City, UT 84101.

Documents used along the form

The Utah B10 form is essential for filing a proof of claim in bankruptcy proceedings. However, it often accompanies several other documents that help clarify and support the claim. Below is a list of common forms and documents used alongside the B10 form, each serving a specific purpose in the bankruptcy process.

- Proof of Service: This document verifies that all parties involved have been properly notified about the bankruptcy filing and the proof of claim. It ensures compliance with court rules regarding notification.

- Notice of Bankruptcy Filing: This is a formal notification sent to creditors and interested parties, informing them of the bankruptcy case and relevant deadlines, including the deadline for filing claims.

- Claim Objection: If a creditor disputes a claim, they may file this document to formally object. It outlines the reasons for the objection and is submitted to the court for consideration.

- Statement of Financial Affairs: This form provides a comprehensive overview of the debtor's financial situation, including income, expenses, and assets. It helps creditors assess the validity of the claim.

- Schedule of Assets and Liabilities: This document details the debtor's assets and liabilities, offering a clearer picture of their financial standing. Creditors can use this information to evaluate their claims.

- Hold Harmless Agreement: When participating in activities with potential risks, it's crucial to utilize a thorough Hold Harmless Agreement template to protect one party from liability for damages that may arise.

- Bankruptcy Petition: The initial document filed to commence bankruptcy proceedings. It outlines the debtor's intention to seek relief under bankruptcy laws and includes basic information about the debtor.

- Master Mailing List: A comprehensive list of all creditors and parties involved in the bankruptcy case. This list ensures that all relevant parties receive necessary notices and updates throughout the process.

- Supporting Documentation: This includes any additional documents that support the claim, such as invoices, contracts, or promissory notes. These documents provide evidence of the debt owed to the creditor.

Understanding these documents can significantly streamline the bankruptcy process and improve the chances of a successful claim. Each form serves a unique purpose, contributing to a clearer picture of the financial situation at hand.

File Specifications

| Fact Name | Details |

|---|---|

| Form Purpose | The Utah B10 form is used to file a proof of claim in bankruptcy cases, allowing creditors to assert their rights to payment from the debtor's estate. |

| Governing Law | This form is governed by the U.S. Bankruptcy Code, specifically under 11 U.S.C. §501. |

| Eligibility | Creditors can use this form to make claims for debts incurred before the bankruptcy filing, but not for administrative expenses arising after the case commencement. |

| Amendments | Check the designated box if the claim being filed replaces or amends a previous claim, ensuring clarity in the claims process. |

| Supporting Documents | Creditors must attach supporting documents such as invoices or contracts, but should not send original documents. |

| Priority Claims | The form allows creditors to specify if their claim is secured or qualifies as a priority claim under 11 U.S.C. §507. |

| Penalties | Presenting a fraudulent claim can lead to severe penalties, including fines up to $500,000 or imprisonment for up to 5 years, according to 18 U.S.C. §§152 and 3571. |