Fill a Valid Utah Dmv Tc 656 Template

Dos and Don'ts

When filling out the Utah DMV TC 656 form, there are important things to keep in mind. Here’s a list of dos and don’ts:

- Do double-check all personal information for accuracy.

- Do ensure that the Vehicle Identification Number (VIN) is correct.

- Do provide a valid email address for communication.

- Do sign and date the form before submission.

- Do keep a copy of the completed form for your records.

- Don't leave any sections blank; fill out all required fields.

- Don't use white-out or erasers on the form.

- Don't forget to include any necessary fees.

- Don't submit the form without checking for errors.

- Don't forget to provide additional documentation if required.

More PDF Forms

Utah Board of Accountancy - A minimum of two times the shortfall in hours may be needed if the 80-hour requirement is not met.

For additional resources and templates related to the New York Dirt Bike Bill of Sale, you can visit legalpdf.org, which provides helpful information to ensure the process is smooth and compliant with state regulations.

Utah 3045 - The Utah 3045 form is a deed of trust used in real estate transactions.

Utah Dws Sds 305 - It can be used by a variety of employers across different industries.

Listed Questions and Answers

-

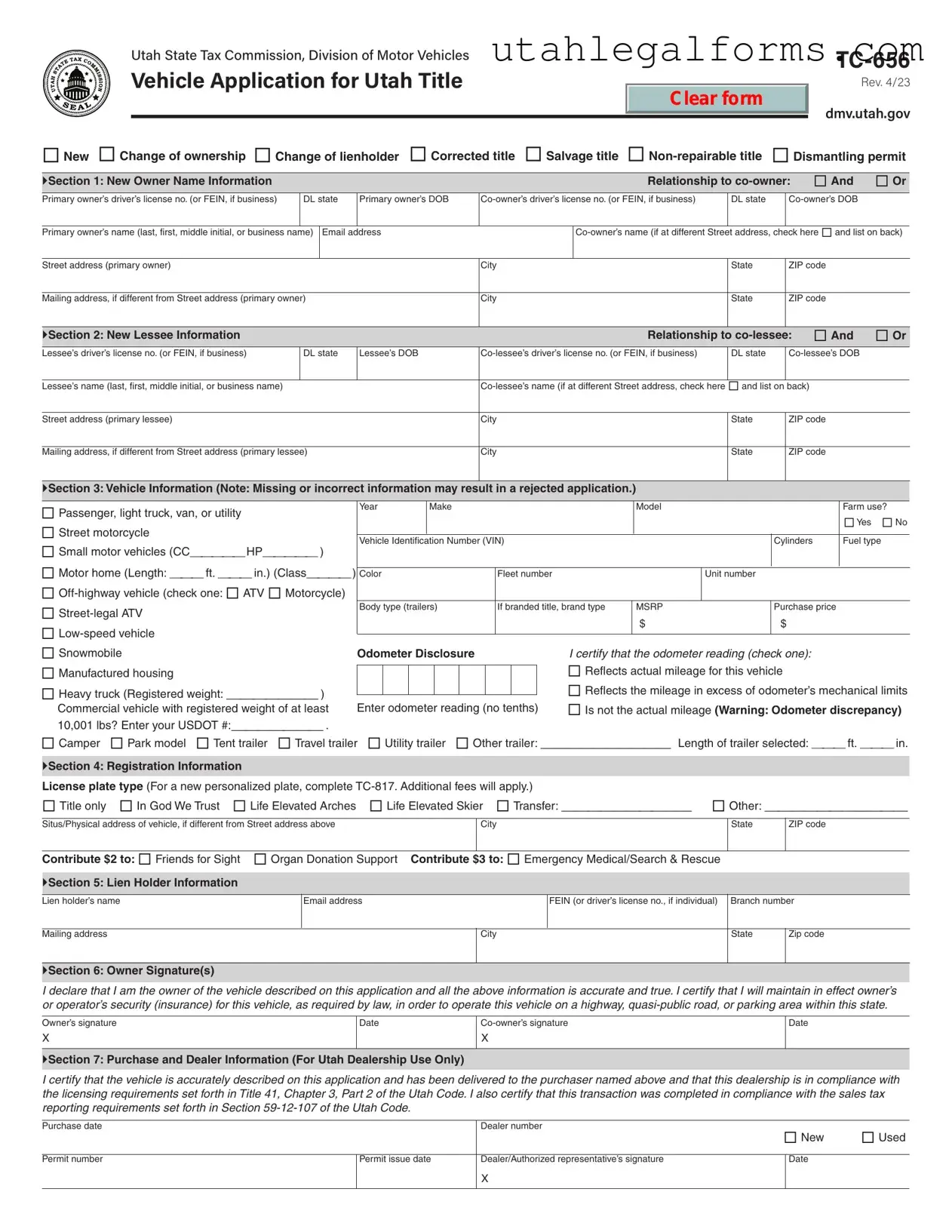

What is the purpose of the TC-656 form?

The TC-656 form is used to report changes related to vehicle ownership in Utah. This includes new ownership, changes in lienholders, corrected titles, and applications for salvage or non-repairable titles. It is essential for ensuring that the vehicle's registration information is accurate and up-to-date.

-

Who needs to fill out the TC-656 form?

The form must be completed by the new owner or co-owner of a vehicle. This applies to individuals or businesses. If there are co-owners, both parties must provide their information. Additionally, lienholders may need to provide details if there is a change in financing.

-

What information is required on the TC-656 form?

Several sections must be filled out, including:

- Owner and co-owner names, addresses, and driver’s license numbers or FEINs.

- Lessee and co-lessee information, if applicable.

- Details about the vehicle, such as make, model, VIN, and odometer reading.

- Registration information, including license plate type and any contributions to state programs.

- Information about the lienholder, if applicable.

Providing accurate and complete information is crucial to avoid delays or rejections.

-

How do I submit the TC-656 form?

Once completed, the TC-656 form can be submitted to your local DMV office. It is advisable to check the office's specific submission guidelines, as some may accept forms electronically while others require in-person submission. Make sure to keep a copy for your records.

Key takeaways

Here are key takeaways for filling out and using the Utah DMV TC 656 form:

- Accurate Information is Crucial: Ensure that all details, especially vehicle information and owner names, are correct to avoid application rejection.

- Multiple Ownership Options: Indicate the relationship between co-owners or co-lessees clearly using the provided options: "And" or "Or."

- Odometer Disclosure: Be prepared to disclose the vehicle's odometer reading accurately. Misreporting can lead to serious penalties.

- Registration Choices: Select the appropriate license plate type. Additional fees may apply for personalized plates.

- Signature Requirement: Both owners or co-owners must sign the form, confirming the accuracy of the information provided.

- Mailing Address: If the mailing address differs from the street address, be sure to fill it out in the designated section.

- Contributions: Consider contributing to the listed causes, such as organ donation support, as part of the registration process.

Documents used along the form

The Utah DMV TC 656 form is essential for various vehicle transactions, including ownership changes and title corrections. However, several other forms and documents often accompany it to ensure compliance with state regulations and facilitate a smooth process. Below is a list of additional forms frequently used in conjunction with the TC 656.

- TC-817 - Personalized License Plate Application: This form is required for individuals who wish to obtain a personalized license plate. It includes options for different plate designs and requires an additional fee.

- TC-661 - Application for Duplicate Title: If a vehicle title is lost or damaged, this form allows the owner to request a duplicate title. Proper identification and proof of ownership must be provided.

- TC-656A - Affidavit of Vehicle Ownership: This affidavit serves as a declaration of ownership when the original title is not available. It is often used in cases of inherited vehicles or when purchasing from a private seller.

- Affidavit of Support: This document, also known as the USCIS I-864 form, is used to demonstrate that a sponsor can financially support an immigrant, ensuring they will not rely on public assistance.

- TC-673 - Vehicle Registration Renewal: This document is used to renew the registration of a vehicle. It requires information about the vehicle and proof of insurance, ensuring that the vehicle remains legally registered.

- TC-550 - Odometer Disclosure Statement: This form is necessary when transferring ownership of a vehicle to disclose the odometer reading. It helps prevent fraud related to mileage misrepresentation.

These documents play a crucial role in the vehicle registration and ownership process in Utah. Ensuring that all necessary forms are completed accurately can help avoid delays and complications during transactions.

File Specifications

| Fact Name | Description |

|---|---|

| Form Purpose | The TC-656 form is used for various vehicle ownership changes in Utah, including new ownership, lienholder changes, and title corrections. |

| Governing Law | This form is governed by Title 41, Chapter 3, Part 2 of the Utah Code, which outlines vehicle registration and titling processes. |

| Owner Information | Section 1 requires detailed information about the new owner, including names, addresses, and driver’s license numbers. |

| Lessee Information | Section 2 collects similar information for lessees, ensuring that both primary and co-lessee details are documented. |

| Vehicle Details | Section 3 gathers essential information about the vehicle, such as make, model, VIN, and odometer readings. |

| Registration Types | In Section 4, applicants can select different types of vehicle registrations, including personalized plates and special designs. |

| Lien Holder Information | Section 5 requires information about any lien holders, ensuring that all financial interests in the vehicle are recorded. |

| Signature Requirement | Section 6 mandates signatures from the owner and co-owner, affirming the accuracy of the provided information. |

| Dealer Certification | Section 7 is for dealership use, certifying that the vehicle transaction complies with state regulations and tax requirements. |