Fill a Valid Utah Seller Financing Addendum Template

Dos and Don'ts

When filling out the Utah Seller Financing Addendum form, it is crucial to follow specific guidelines to ensure accuracy and compliance. Below are four essential do's and don'ts to consider:

- Do provide accurate and complete information in all sections of the form. This includes the buyer and seller names, property details, and financial terms.

- Do ensure that all credit terms, such as interest rates and payment schedules, are clearly defined and understood by both parties.

- Don't leave any sections blank unless they are not applicable. Incomplete forms can lead to misunderstandings and potential legal issues.

- Don't forget to include any required disclosures, such as tax identification numbers and financial information, as these are essential for compliance with federal laws.

More PDF Forms

Dopl Price - Consider utilizing digital tools to assist with the Dopl Ap 017.

The importance of having a well-drafted Bill of Sale is paramount in ensuring a smooth transaction, as it not only protects the interests of both parties involved but also serves as legal evidence of the agreed terms. To find a template or further information, you can visit legalpdf.org, which offers resources to assist in the process of creating a Bill of Sale tailored to your needs.

Utah Dws Sds 305 - It provides a space for listing skills and qualifications relevant to the desired job.

Utah Drivers Handbook - Provide your Social Security Number or ITIN as required for the application.

Listed Questions and Answers

-

What is the purpose of the Utah Seller Financing Addendum?

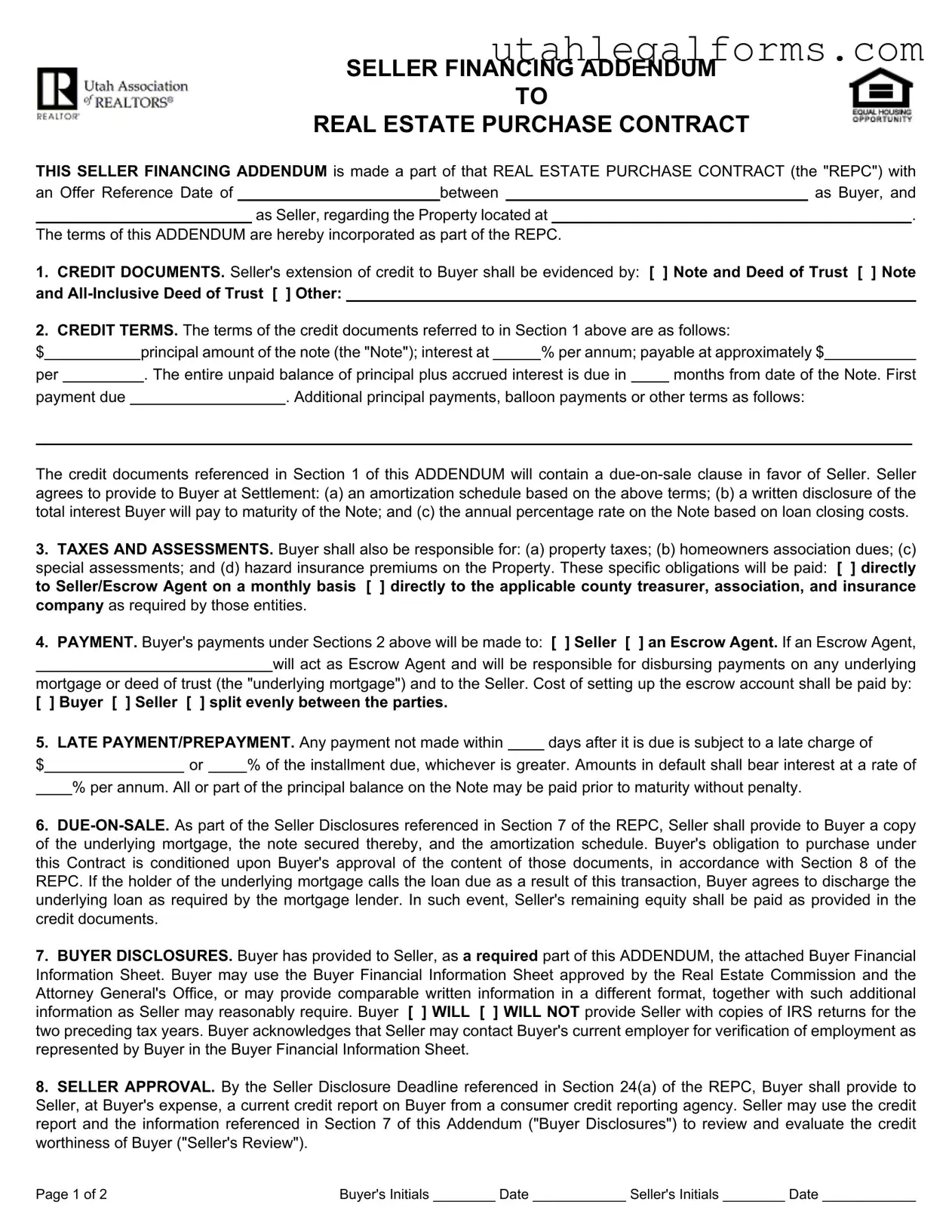

The Utah Seller Financing Addendum is a legal document that outlines the terms of seller financing in a real estate purchase. It becomes part of the Real Estate Purchase Contract (REPC) and details how the seller will provide financing to the buyer, including payment terms, interest rates, and responsibilities for taxes and insurance.

-

What information is included in the credit terms section?

This section specifies the principal amount of the note, the interest rate, and the payment schedule. It also includes details about any balloon payments and the due date for the entire unpaid balance. The seller is required to provide an amortization schedule and disclosures about the total interest the buyer will pay over the life of the loan.

-

Who is responsible for paying property taxes and insurance?

The buyer is responsible for property taxes, homeowners association dues, special assessments, and hazard insurance premiums. These payments can be made directly to the seller or through an escrow agent, depending on the terms agreed upon in the addendum.

-

What happens if a payment is late?

If a payment is not made within the specified number of days after it is due, a late charge will apply. This charge is either a fixed dollar amount or a percentage of the installment due, whichever is greater. Additionally, amounts in default will accrue interest at a specified rate.

-

What is the due-on-sale clause?

The due-on-sale clause allows the seller to call the loan due if the property is sold. This means that if the buyer sells the property, they must pay off the underlying loan as required by the mortgage lender. The seller's remaining equity will be paid according to the terms outlined in the credit documents.

-

What disclosures does the buyer need to provide?

The buyer must provide a Buyer Financial Information Sheet, which includes details about their financial situation. They may also need to submit copies of their IRS returns for the past two years if required by the seller. Additionally, the buyer’s current employer may be contacted for verification of employment.

Key takeaways

When using the Utah Seller Financing Addendum form, it's important to understand the key aspects involved. Here are some essential takeaways:

- Credit Documentation: Ensure that the credit extension is clearly documented. Specify whether it will be a Note and Deed of Trust, an All-Inclusive Deed of Trust, or another form.

- Payment Terms: Clearly outline the payment terms, including interest rates, due dates, and any additional payments. This clarity helps both parties understand their obligations.

- Taxes and Assessments: The buyer is responsible for various costs such as property taxes and insurance. Make sure to indicate how these payments will be handled.

- Seller Approval: The seller has the right to review the buyer’s financial information. This process can lead to acceptance or rejection of the financing terms based on creditworthiness.

Understanding these points can help facilitate a smoother transaction and protect the interests of both the buyer and seller.

Documents used along the form

The Utah Seller Financing Addendum is an important document in real estate transactions where the seller provides financing to the buyer. Alongside this addendum, several other forms and documents are commonly used to ensure clarity and compliance throughout the transaction process. Below is a list of these documents, each serving a specific purpose in the financing arrangement.

- Real Estate Purchase Contract (REPC): This is the primary agreement between the buyer and seller, outlining the terms of the property sale. It includes details such as purchase price, contingencies, and closing dates. The Seller Financing Addendum is incorporated into this contract to specify the financing terms.

- Hold Harmless Agreement: To protect parties from liability risks, refer to our detailed Hold Harmless Agreement template for comprehensive guidance and documentation.

- Note and Deed of Trust: This document serves as evidence of the loan agreement between the seller and buyer. The note outlines the borrower's promise to repay the loan, while the deed of trust secures the loan against the property, giving the seller rights in case of default.

- Buyer Financial Information Sheet: This form collects essential financial data from the buyer, helping the seller assess the buyer's creditworthiness. It may include income details, debts, and assets, enabling the seller to make informed decisions regarding financing.

- Credit Report Authorization: This document allows the seller to obtain the buyer's credit report from a credit reporting agency. The report provides insights into the buyer's credit history, which is crucial for evaluating their ability to repay the loan.

These documents work together to create a comprehensive framework for seller financing in Utah real estate transactions. Understanding each component helps both buyers and sellers navigate the complexities of financing agreements effectively.

File Specifications

| Fact Name | Fact Detail |

|---|---|

| Form Purpose | The Utah Seller Financing Addendum is designed to outline the terms under which a seller provides financing to a buyer in a real estate transaction. |

| Governing Law | This addendum is governed by the laws of the State of Utah, specifically related to real estate transactions. |

| Credit Terms | It specifies credit terms such as the principal amount, interest rate, and payment schedule, ensuring both parties understand their financial obligations. |

| Tax Responsibilities | The buyer is responsible for property taxes, homeowners association dues, and hazard insurance premiums, among other obligations. |

| Disclosure Requirements | Buyers must provide financial information, including a credit report, to facilitate the seller's evaluation of their creditworthiness. |