Fill a Valid Utah Tax Exemption Template

Dos and Don'ts

When filling out the Utah Tax Exemption form, it is essential to adhere to specific guidelines to ensure accuracy and compliance. Below is a list of recommended practices and common pitfalls to avoid.

- Do ensure that the name of the business or institution is clearly printed and matches official records.

- Do provide a valid sales tax license number if required for the exemption claimed.

- Do check the appropriate box indicating the basis for the exemption being claimed.

- Do keep the completed form with your records instead of sending it to the tax commission.

- Don't leave any required fields blank, as this can lead to processing delays.

- Don't attempt to claim exemptions that do not apply to your specific situation.

- Don't forget to notify the seller of any changes to the exemption status after submission.

- Don't use the form for purchases that do not meet the minimum requirements for exemption.

More PDF Forms

Utah Licensing Division - The form is essential for protecting consumers from misleading practices in business opportunities.

When preparing for the ownership transfer of a trailer, it is essential to utilize the Bill of Sale for Trailers to ensure all necessary information is accurately recorded, safeguarding both the buyer's and seller's interests throughout the process.

How to Make a Job Application Form - Repeat the above steps for your second employer.

Utah Dws Sds 305 - Job seekers can make multiple submissions with varied job titles on the form.

Listed Questions and Answers

-

What is the Utah Tax Exemption Form?

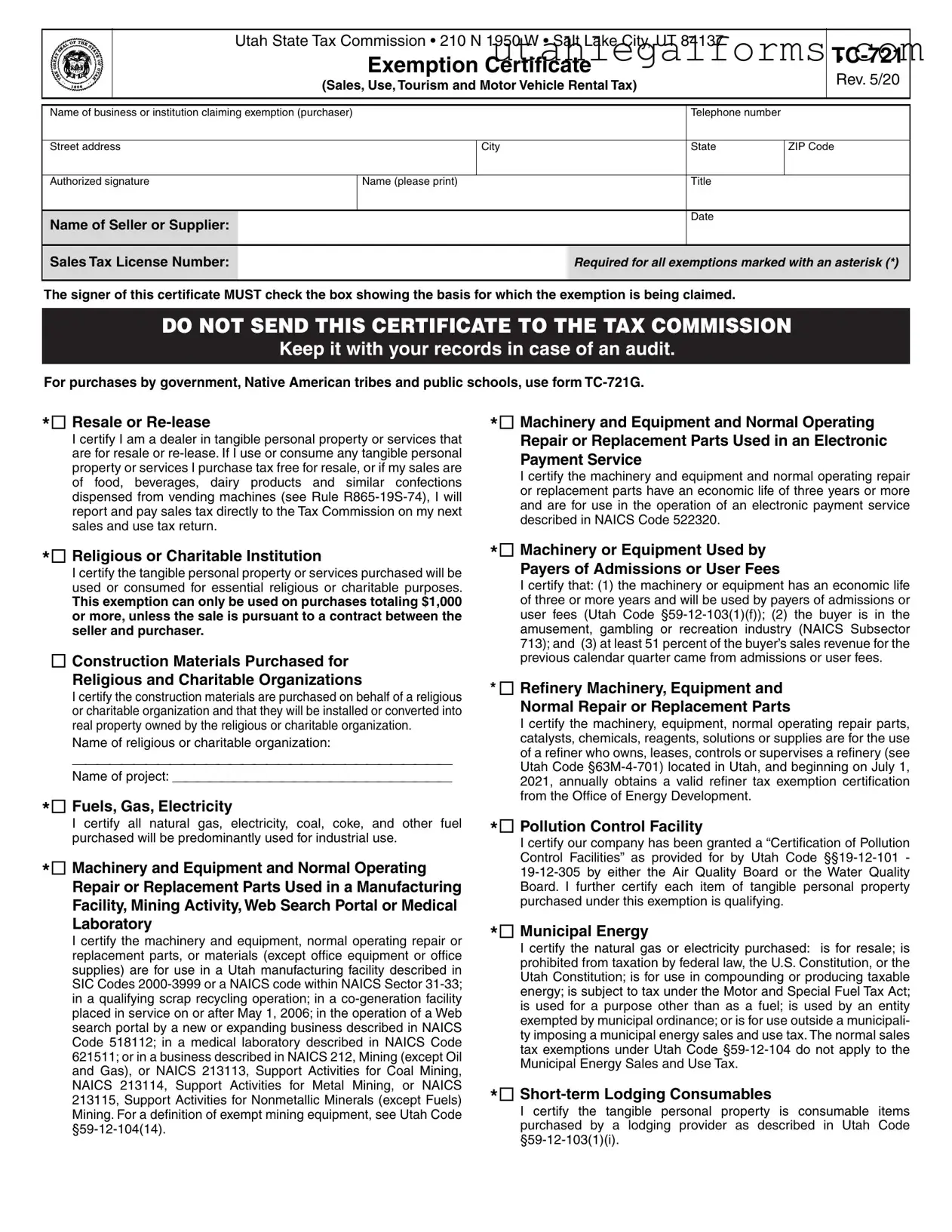

The Utah Tax Exemption Form, officially known as the Exemption Certificate (Sales, Use, Tourism and Motor Vehicle Rental Tax), allows eligible businesses and organizations to claim exemptions from sales and use taxes on specific purchases. This form is essential for entities that qualify for tax exemptions under various categories outlined by Utah state law.

-

Who can use the Utah Tax Exemption Form?

This form can be used by businesses, government entities, Native American tribes, and public schools that meet specific criteria for tax exemptions. Each category on the form has its requirements, so it’s important to ensure that your organization fits one of these classifications before applying.

-

What types of purchases are eligible for exemption?

Eligible purchases include items for resale, construction materials for religious or charitable organizations, machinery and equipment for manufacturing, fuels for industrial use, and many others. Each category has specific conditions that must be met, so reviewing these carefully is crucial.

-

How do I complete the form?

To complete the form, you will need to provide your business or institution's name, address, and telephone number. Then, check the appropriate box that corresponds to the exemption you are claiming. It’s also important to include your sales tax license number if required for the exemption category you select.

-

Do I need to submit the form to the Utah State Tax Commission?

No, you do not send this form to the Utah State Tax Commission. Instead, keep it with your records. This is important in case of an audit, as you may need to provide proof of the exemption claimed.

-

What should I do if my exemption status changes?

If there are any changes to your exemption status, such as cancellation or modification, you must notify the seller. This ensures that your tax records remain accurate and compliant with state regulations.

-

What if I have questions about the form?

If you have questions or need assistance regarding the Utah Tax Exemption Form, you can reach out via email at taxmaster@utah.gov or call the Utah State Tax Commission at 801-297-2200 or toll-free at 1-800-662-4335.

-

Are there any penalties for misuse of the exemption?

Yes, there are penalties for misusing the exemption. If you claim an exemption incorrectly or for ineligible purchases, you may be subject to back taxes, interest, and penalties. It is crucial to ensure that you meet the requirements for the exemption you are claiming.

Key takeaways

When filling out and using the Utah Tax Exemption form, it’s important to understand the following key points:

- Keep it for your records: Do not send the exemption certificate to the Tax Commission. Instead, retain it for your records in case of an audit.

- Identify the seller: Clearly list the name of the seller or supplier to ensure proper documentation of the transaction.

- Check the appropriate box: The signer must check the box that corresponds to the reason for claiming the exemption. This is a critical step in the process.

- Sales tax license number: For exemptions marked with an asterisk (*), include the sales tax license number in the header of the form.

- Understand the limits: Some exemptions, such as those for religious or charitable institutions, apply only to purchases totaling $1,000 or more unless specified otherwise.

- Notify the seller: If there is any change to the exemption claimed, such as cancellation or modification, it is essential to notify the seller.

- Different forms for specific entities: Government entities, Native American tribes, and public schools must use form TC-721G instead of the standard exemption form.

- Consult for questions: If you have questions or need assistance, reach out via email at taxmaster@utah.gov or call the provided numbers for support.

Documents used along the form

When completing the Utah Tax Exemption form, there are several other forms and documents that may be relevant to your situation. These documents help clarify the nature of the exemption and ensure compliance with state regulations. Below is a list of commonly used forms and documents.

- TC-721G: This form is used specifically for purchases made by government entities, Native American tribes, and public schools. It provides a streamlined process for these organizations to claim tax exemptions.

- Sales Tax License: This document is essential for businesses claiming exemptions. It verifies that the business is registered to collect sales tax and is necessary for many exemption claims.

- Exemption Certificates: Various exemption certificates exist for specific industries or types of purchases. These certificates provide proof that a particular purchase qualifies for tax exemption under Utah law.

- California Bill of Sale: For a comprehensive understanding of property transfers, you can refer to legalpdf.org for necessary documents and guidelines.

- Purchase Orders: These documents are used to detail the items being purchased and the terms of the sale. They can help substantiate the reason for claiming an exemption.

- Invoices: Invoices serve as proof of purchase and should reflect the details of the transaction, including the items purchased and the total amount paid.

- Contracts: Contracts between buyers and sellers can outline the terms of the sale, including any agreed-upon exemptions. They may be necessary for specific claims.

- Tax Returns: Past tax returns may be required to show compliance with tax laws and to support the exemption claim during audits.

- Documentation of Use: Records showing how the purchased items will be used can be important. This documentation supports the claim for exemption based on intended use.

- Letters of Intent: In some cases, a letter explaining the purpose of the purchase and the reason for seeking exemption may be helpful in clarifying the intent behind the exemption claim.

It is crucial to keep all documentation organized and readily available in case of an audit. Understanding these forms and their purposes can facilitate a smoother exemption process and ensure compliance with Utah tax regulations.

File Specifications

| Fact Name | Details |

|---|---|

| Form Purpose | The Utah Tax Exemption form, TC-721, is used to claim exemptions from sales, use, tourism, and motor vehicle rental taxes. |

| Governing Laws | This form is governed by Utah Code §59-12-104 and various other related statutes. |

| Record Keeping | Do not send the completed form to the Tax Commission. Keep it with your records for potential audits. |

| Eligibility Criteria | Exemptions can be claimed for various purposes, including resale, charitable use, and specific industrial applications. |

| Sales Tax License Requirement | A sales tax license number is required for all exemptions marked with an asterisk (*) on the form. |

| Specific Exemption Types | Exemptions include purchases by government entities, Native American tribes, and public schools, as well as specific categories like machinery and agricultural products. |

| Higher Education Exemption | Textbooks required for higher education courses are exempt, provided they are purchased from recognized institutions. |

| Contact Information | For questions, contact the Utah State Tax Commission via email at taxmaster@utah.gov or call 801-297-2200. |