Fill a Valid Utah Tc 116 Template

Dos and Don'ts

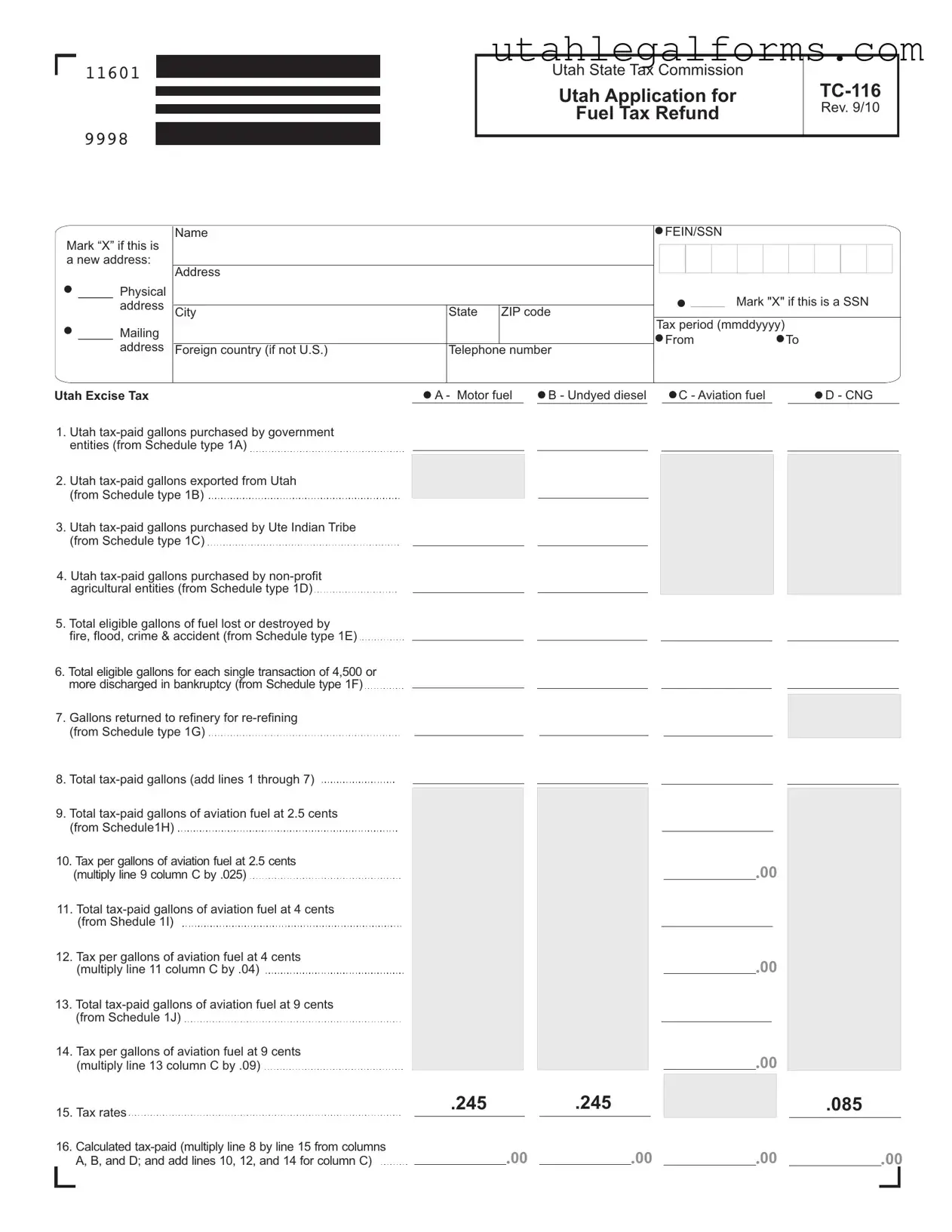

When completing the Utah TC-116 form, it is crucial to follow specific guidelines to ensure accuracy and compliance. Here are nine essential do's and don'ts:

- Do ensure all personal information is accurate, including your name and address.

- Do mark the appropriate boxes, such as indicating if the address is new.

- Do double-check all calculations, especially the total gallons and tax amounts.

- Do use the correct tax period format (mmddyyyy) when entering dates.

- Do sign and date the application to certify its accuracy.

- Don't leave any required fields blank; all information must be filled out.

- Don't forget to attach any necessary schedules or supporting documents.

- Don't submit the form without reviewing it for errors or omissions.

- Don't use outdated versions of the form; always check for the latest revision.

More PDF Forms

Utah Licensing Division - Updates to business contact information should be communicated promptly to the Division.

Utah Board of Accountancy - This submission process supports the integrity of CPAs and the overall profession.

To ensure a seamless transition of ownership when selling or buying a vehicle in Arizona, it is essential to complete the Arizona Motor Vehicle Bill of Sale form correctly. This document not only captures important details about the transaction but also serves to protect both parties involved. For more information on how to obtain and fill out this vital form, you can visit https://arizonapdfforms.com/motor-vehicle-bill-of-sale.

How to Transfer a Car Title to a Family Member in Utah - Inspection must be done by a DMV employee, peace officer, or licensed dealer.

Listed Questions and Answers

-

What is the purpose of the Utah TC-116 form?

The Utah TC-116 form is used to apply for a refund of fuel taxes paid on various types of fuel, including motor fuel, undyed diesel, aviation fuel, and compressed natural gas (CNG). Government entities, non-profit agricultural organizations, and other eligible applicants can use this form to recover taxes paid on fuel that meets specific criteria.

-

Who is eligible to file the TC-116 form?

Eligibility for filing the TC-116 form includes government entities, non-profit agricultural entities, and the Ute Indian Tribe. Additionally, applicants who have experienced losses of fuel due to fire, flood, crime, or accidents may also qualify. Each category has specific requirements outlined in the accompanying schedules.

-

What information is required on the TC-116 form?

The form requires several pieces of information, including the applicant's name, address, telephone number, and Federal Employer Identification Number (FEIN) or Social Security Number (SSN). It also asks for details about the tax-paid gallons of fuel purchased, exported, or lost, as well as calculations for the total tax refund being claimed.

-

How do I calculate the total tax refund on the TC-116 form?

To calculate the total tax refund, add the total tax-paid gallons from all applicable categories, and then apply the respective tax rates. The form provides specific lines for calculating tax amounts for different fuel types, including aviation fuel at varying rates. Finally, sum these amounts to determine the total refund.

-

What are the deadlines for submitting the TC-116 form?

While specific deadlines may vary, it is important to submit the TC-116 form within the timeframe set by the Utah State Tax Commission. Generally, claims for refunds should be filed for the tax period in which the fuel was purchased or used. It is advisable to check the latest guidelines from the Tax Commission for any updates.

-

Can I submit the TC-116 form electronically?

Yes, the Utah State Tax Commission allows for electronic submission of the TC-116 form. Applicants can complete the form online and submit it through the Tax Commission's website. This method can expedite processing times and reduce the likelihood of errors.

-

What supporting documents do I need to include with the TC-116 form?

Applicants must include supporting documentation that substantiates their claim for a refund. This may include invoices, manifests, and schedules that detail the fuel purchases and any losses incurred. Each schedule type corresponds to specific lines on the TC-116 form and must be completed accurately.

-

What happens after I submit the TC-116 form?

After submission, the Utah State Tax Commission will review the application and supporting documents. If everything is in order, the refund will be processed, and the applicant will receive notification regarding the status of their claim. Processing times may vary, so applicants should monitor their submission status.

-

How can I check the status of my TC-116 refund application?

Applicants can check the status of their TC-116 refund application by contacting the Utah State Tax Commission directly. They may provide a tracking number or other identifying information to facilitate the inquiry. Additionally, some online tools may be available for tracking the status of submissions.

-

What should I do if my TC-116 application is denied?

If the TC-116 application is denied, the applicant will receive a notice explaining the reasons for the denial. It is important to review the notice carefully. If the applicant believes the denial was in error, they can appeal the decision or provide additional documentation to support their claim.

Key takeaways

When filling out and using the Utah TC 116 form, there are several key points to keep in mind to ensure accuracy and compliance. Here are the main takeaways:

- Identify Your Eligibility: Ensure you qualify for a fuel tax refund by confirming that your purchases fall under the categories listed in the form, such as government entities, non-profit agricultural entities, or losses due to accidents.

- Accurate Information: Provide complete and accurate information, including your name, address, and tax identification number. Any discrepancies can delay the processing of your refund.

- Document Your Purchases: Maintain records of all fuel purchases and the corresponding schedules (1A, 1B, etc.) to substantiate your claims. This documentation is essential for verification.

- Calculate Tax Correctly: Carefully calculate the total tax paid by adding the eligible gallons from various categories. Ensure you apply the correct tax rates to avoid errors.

- Submit on Time: Be mindful of the tax period and submit your form within the designated timeframe. Late submissions may result in the denial of your refund request.

- Certification Requirement: Remember to sign the form and certify that all information is true and complete. This certification is a legal affirmation of your claims.

By keeping these points in mind, you can navigate the process of filling out and using the Utah TC 116 form more effectively.

Documents used along the form

The Utah TC-116 form is a crucial document for entities seeking a fuel tax refund in Utah. However, it is often accompanied by several other forms and documents that provide additional information or support the claims made in the TC-116. Understanding these related documents can help ensure a smoother application process and a better chance of receiving the refund.

- TC-116A - General Schedule: This schedule details the various types of fuel purchases eligible for refunds. It categorizes gallons purchased by government entities, Ute Indian Tribe, and non-profit agricultural entities, among others.

- TC-116B - Schedule of Tax-Paid Gallons: This form captures the specific tax-paid gallons for different fuel types, including motor fuel and undyed diesel. It helps to verify the amounts claimed on the TC-116.

- Durable Power of Attorney Form: To ensure that your wishes are followed during times when you may be unable to communicate, consider utilizing our comprehensive Durable Power of Attorney documentation resources for effective representation.

- TC-116C - Environmental Assurance Fee Schedule: This document outlines the gallons subject to the Utah Environmental Assurance Fee. It includes details on gallons exported and those placed in nonparticipating tanks.

- TC-116D - Navajo Nation Refund Schedule: This schedule is specifically for reporting gallons delivered to the Navajo Nation. It helps to calculate any applicable refunds related to fuel tax for these transactions.

- TC-116E - Certification of Eligibility: This form serves as a certification that the applicant meets all conditions for the refund. It is a declaration of truthfulness and completeness regarding the information provided.

- Invoices and Purchase Receipts: These documents serve as proof of purchase for the fuel. They are essential for substantiating the claims made in the TC-116 and related schedules.

- Manifest or Delivery Tickets: These records detail the delivery of fuel, including quantities and destinations. They support the claims made regarding fuel usage and tax payments.

- Tax Identification Number Documentation: This includes any relevant tax identification numbers, such as the Federal Employer Identification Number (FEIN) or Social Security Number (SSN), necessary for processing the refund application.

Each of these forms and documents plays a significant role in the fuel tax refund process in Utah. By ensuring that all necessary paperwork is completed and submitted, applicants can enhance their chances of receiving the refunds they are entitled to. Understanding the interconnected nature of these documents is key to navigating the complexities of tax refund applications effectively.

File Specifications

| Fact Name | Details |

|---|---|

| Form Purpose | The TC-116 form is used to apply for a fuel tax refund in Utah. |

| Governing Law | This form is governed by Utah Code Title 59, Chapter 14, which pertains to fuel taxes. |

| Eligibility Criteria | Eligible applicants include government entities, non-profit agricultural entities, and the Ute Indian Tribe. |

| Tax Period | Applicants must specify the tax period for which they are seeking a refund, using the format mmddyyyy. |

| Types of Fuel | The form covers various fuel types, including motor fuel, undyed diesel, aviation fuel, and compressed natural gas (CNG). |

| Refund Calculation | Refunds are calculated based on eligible gallons and applicable tax rates, as outlined in the form. |

| Signature Requirement | Applicants must certify the accuracy of the information provided by signing the form. |