Fill a Valid Utah Tc 142 Template

Dos and Don'ts

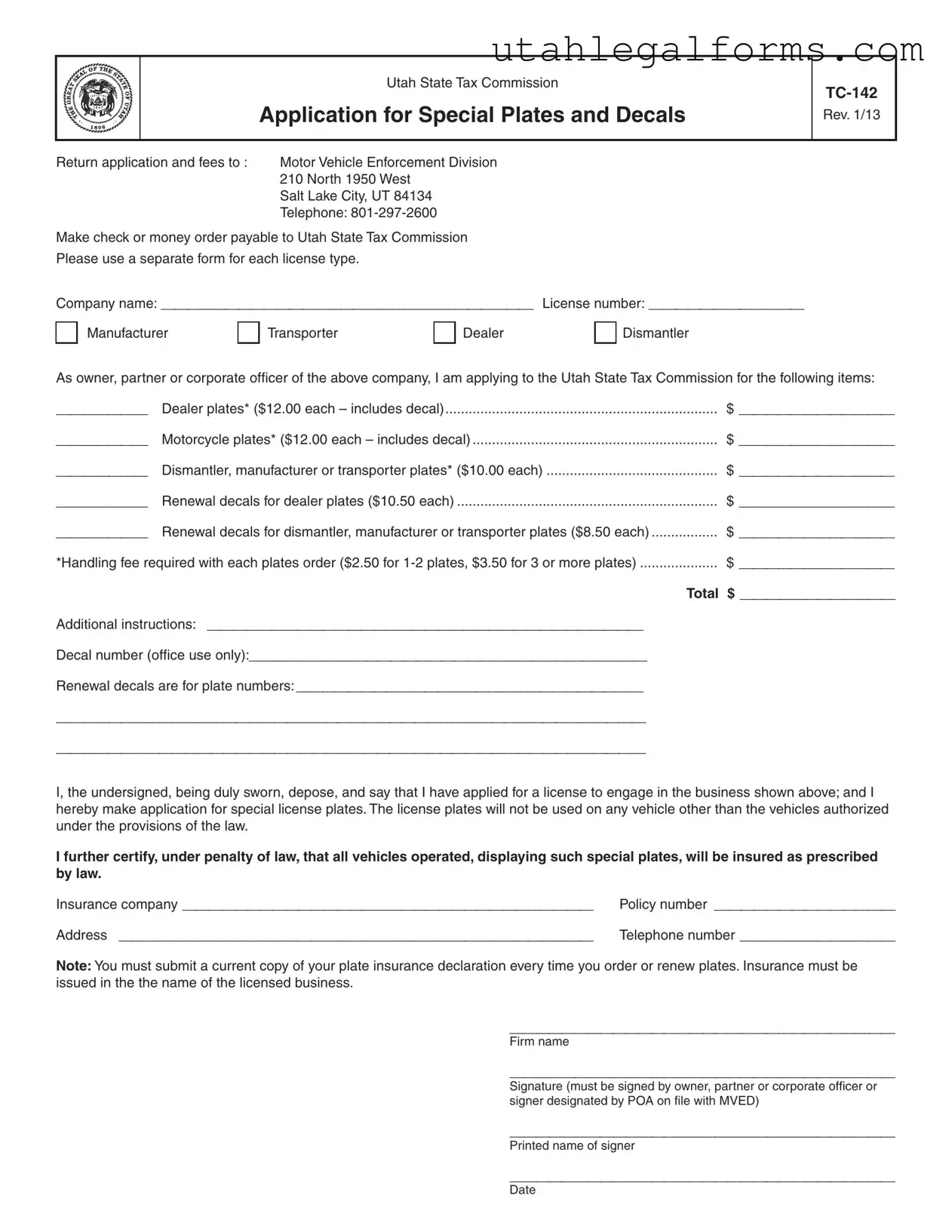

When filling out the Utah TC-142 form, it is essential to follow specific guidelines to ensure your application is processed smoothly. Below is a list of things you should and shouldn't do.

- Do provide accurate information for your company name and license number.

- Do use a separate form for each type of license you are applying for.

- Do include the correct fees for each type of plate or decal requested.

- Do ensure that the signature is from the owner, partner, or corporate officer.

- Don't forget to attach a current copy of your plate insurance declaration.

- Don't submit an incomplete form; check for missing information before sending.

- Don't use the special plates on vehicles not authorized by law.

Following these guidelines will help avoid delays in processing your application. If you have any questions, consider reaching out to the Motor Vehicle Enforcement Division for assistance.

More PDF Forms

Utah Department of Workforce Services - The form allows for the listing of preferred job titles.

The Ohio Hold Harmless Agreement serves as a crucial legal tool for those looking to mitigate risks associated with events or activities, protecting against potential claims. To access a detailed template of this form, you can refer to a comprehensive Hold Harmless Agreement resource that offers guidance and clarity on the matter.

Utah Real Estate Purchase Contract - Clearly stated timelines boost efficiency in processing the financing agreement between parties.

Dopl Price - It often serves as an initial point of contact with regulatory bodies.

Listed Questions and Answers

-

What is the purpose of the Utah TC-142 form?

The Utah TC-142 form serves as an application for special license plates and decals. This form is utilized by businesses such as dealers, dismantlers, manufacturers, and transporters to request specific types of license plates that are essential for their operations. Each type of plate has associated fees and requirements that must be adhered to for successful processing.

-

Who is eligible to apply for special plates using the TC-142 form?

Eligibility to apply for special plates using the TC-142 form is primarily limited to businesses engaged in specific activities. This includes dealers, dismantlers, manufacturers, and transporters. Individuals must be owners, partners, or corporate officers of the respective businesses to submit the application.

-

What types of plates can be requested through the TC-142 form?

The TC-142 form allows applicants to request several types of plates, including:

- Dealer plates ($12.00 each)

- Motorcycle plates ($12.00 each)

- Dismantler, manufacturer, or transporter plates ($10.00 each)

- Renewal decals for dealer plates ($10.50 each)

- Renewal decals for dismantler, manufacturer, or transporter plates ($8.50 each)

Each order may also incur a handling fee, depending on the number of plates requested.

-

How should payment be made when submitting the TC-142 form?

Payment must be made via check or money order, payable to the Utah State Tax Commission. It is important to note that each application should be accompanied by the appropriate fees for the requested plates or decals. Applicants should ensure that their payment is included with the form to avoid processing delays.

-

What documentation is required to accompany the TC-142 form?

When submitting the TC-142 form, applicants must provide a current copy of their plate insurance declaration. This documentation is crucial, as it verifies that all vehicles displaying the special plates will be insured as required by law. The insurance must be issued in the name of the licensed business.

-

Where should the completed TC-142 form be sent?

The completed TC-142 form, along with payment and any required documentation, should be mailed to the Motor Vehicle Enforcement Division at the following address:

Motor Vehicle Enforcement Division

210 North 1950 West

Salt Lake City, UT 84134 -

What happens if the TC-142 form is not filled out correctly?

If the TC-142 form is not filled out correctly, it may lead to delays in processing or even rejection of the application. It is essential for applicants to carefully review the form, ensuring that all required fields are completed accurately. Any discrepancies or missing information could result in the need to resubmit the application.

Key takeaways

When filling out the Utah TC-142 form, keep these key takeaways in mind:

- Separate Forms Required: Use a different TC-142 form for each type of license plate you are applying for.

- Payment Details: Make your check or money order payable to the Utah State Tax Commission. Ensure you include any applicable handling fees.

- Insurance Documentation: A current copy of your plate insurance declaration is necessary for each order or renewal. The insurance must be in the name of your licensed business.

- Signature Requirement: The form must be signed by the owner, partner, corporate officer, or a designated signer with a Power of Attorney on file.

- Fees and Costs: Familiarize yourself with the costs associated with each type of plate and any additional handling fees to avoid surprises.

Documents used along the form

The Utah TC-142 form is essential for those applying for special plates and decals in Utah. When submitting this application, several other forms and documents may also be required to ensure compliance with state regulations. Below is a list of commonly used documents that accompany the TC-142.

- TC-123: Application for Dealer License - This form is necessary for businesses seeking to obtain a dealer license. It provides the Utah State Tax Commission with essential information about the dealership, including ownership details and business operations.

- TC-721: Vehicle Registration Application - This application is used to register vehicles under the business name. It includes details about the vehicle, such as make, model, and VIN, ensuring proper registration with the state.

- TC-656: Power of Attorney Form - If someone other than the business owner is submitting the TC-142, a Power of Attorney form is required. This document grants authority to the designated individual to act on behalf of the business in matters related to vehicle registration and licensing.

- California Bill of Sale: Essential for documenting the transfer of ownership of personal property in California, the form ensures both parties understand the terms of the transaction. For further details, visit legalpdf.org.

- Proof of Insurance - A current copy of the vehicle insurance declaration must be submitted. This document verifies that the vehicles displaying the special plates are insured as required by law.

- Business License - A copy of the business license may be required to confirm that the business is legally registered and authorized to operate in Utah.

- Sales Tax License - For dealers, a sales tax license proves that the business is registered to collect sales tax on vehicle sales, ensuring compliance with state tax laws.

These documents play a crucial role in the application process for special plates and decals. Ensuring that all required forms are completed and submitted can help streamline the approval process and avoid potential delays.

File Specifications

| Fact Name | Description |

|---|---|

| Form Purpose | The TC-142 form is used to apply for special license plates and decals in Utah. |

| Governing Law | This form is governed by the Utah Code Title 41, Chapter 1a, which pertains to motor vehicles. |

| Application Fee | Fees vary based on the type of plates requested. For example, dealer and motorcycle plates cost $12 each. |

| Handling Fee | A handling fee is applied based on the number of plates ordered: $2.50 for 1-2 plates and $3.50 for 3 or more. |

| Insurance Requirement | Applicants must provide proof of insurance for vehicles displaying the special plates, as required by law. |

| Submission Location | Completed forms and fees should be sent to the Motor Vehicle Enforcement Division in Salt Lake City. |

| Signature Requirement | The form must be signed by an owner, partner, or corporate officer of the applying company. |

| Renewal Process | Renewal decals can be ordered for existing plates, with specific fees depending on the type of decal. |