Fill a Valid Utah Tc 20 Template

Dos and Don'ts

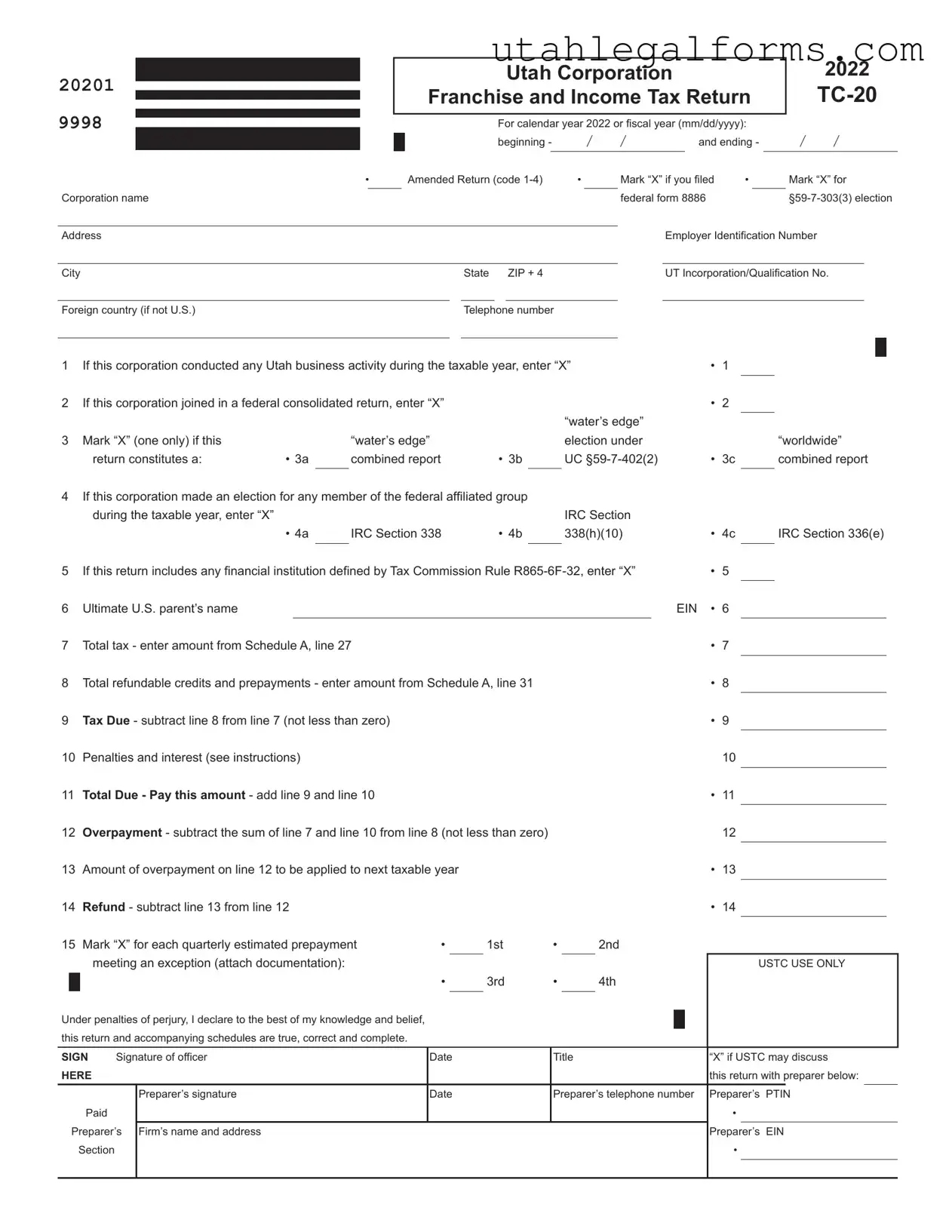

When filling out the Utah TC-20 form, it is important to follow specific guidelines to ensure accuracy and compliance. Here are six recommendations on what to do and what to avoid:

- Do ensure all required fields are completed accurately, including the corporation name, address, and Employer Identification Number (EIN).

- Do double-check the tax year and the dates for the beginning and ending of the fiscal year to prevent errors.

- Do mark all applicable boxes clearly, such as those indicating if the corporation conducted any Utah business activity.

- Do keep copies of all supporting documents, including schedules and adjustments related to federal tax liabilities.

- Don't leave any fields blank if they apply to your corporation; incomplete forms may lead to delays or penalties.

- Don't forget to sign the form and provide the date of signing; an unsigned form is not valid.

More PDF Forms

Utah Tax Forms - Compliance with the Federal Driver's Privacy Protection Act is a critical aspect of the TC-895 process.

To ensure a smooth and legally compliant transfer when buying or selling a boat, utilizing the California Boat Bill of Sale form is vital, as it not only confirms the transaction but also facilitates the necessary registration and titling process. For further guidance on this important document, you can visit legalpdf.org.

Utah Real Estate Purchase Contract - The addendum protects both buyer and seller by delineating clear financial expectations.

Bankruptcy Proof of Claim Form - Completing the B10 accurately is essential to ensure the claim is considered.

Listed Questions and Answers

-

What is the Utah TC-20 form?

The Utah TC-20 form is the state’s franchise and income tax return for corporations. It is used by corporations operating in Utah to report their income, calculate their tax liability, and claim any credits or deductions. This form must be filed annually, either for a calendar year or a fiscal year.

-

Who needs to file the TC-20 form?

Any corporation that conducts business in Utah or has income sourced from Utah is required to file the TC-20 form. This includes both domestic and foreign corporations that meet these criteria. If a corporation is part of a federal consolidated return, it may also need to file the TC-20.

-

What information is required to complete the TC-20 form?

To fill out the TC-20 form, corporations must provide their name, address, Employer Identification Number (EIN), and details about their business activities. Financial information such as total income, deductions, tax credits, and tax due must also be included. If applicable, information about any federal tax elections or consolidated returns should be reported as well.

-

What are the key sections of the TC-20 form?

The TC-20 form includes several key sections:

- Basic corporation information

- Income and deductions

- Tax calculation

- Credits and prepayments

- Signature and declaration

Each section must be completed accurately to ensure compliance with state tax laws.

-

What is the due date for filing the TC-20 form?

The TC-20 form is generally due on the 15th day of the fourth month following the end of the corporation's tax year. For corporations that operate on a calendar year, this means the form is due by April 15. Extensions may be available, but they must be requested in advance.

-

Can the TC-20 form be amended?

Yes, if a corporation discovers an error after filing the TC-20 form, it can submit an amended return. This is done by marking the appropriate box on the form and providing the corrected information. It is important to file the amendment as soon as possible to avoid penalties.

-

What happens if a corporation fails to file the TC-20 form?

If a corporation fails to file the TC-20 form by the due date, it may face penalties and interest on any unpaid taxes. Additionally, the Utah State Tax Commission may take enforcement actions to collect the owed taxes. Therefore, timely filing is crucial.

-

How can a corporation pay its tax due on the TC-20 form?

Corporations can pay their tax due electronically through the Utah State Tax Commission’s website or by mailing a check along with the TC-20 form. It is advisable to keep proof of payment for future reference.

-

Where can I find additional help with the TC-20 form?

For further assistance, corporations can consult the instructions provided with the TC-20 form, visit the Utah State Tax Commission's website, or seek help from a tax professional. These resources can provide valuable guidance in completing the form correctly.

Key takeaways

When filling out and using the Utah TC-20 form, there are several important points to keep in mind. This form is essential for corporations operating in Utah to report their franchise and income tax obligations. Here are some key takeaways:

- Understand the Purpose: The TC-20 form is used by corporations to report their income and calculate their tax liability for the state of Utah. It is crucial to ensure accuracy to avoid penalties.

- Eligibility Criteria: Only corporations that conducted business activities in Utah during the taxable year need to file this form. If your corporation was part of a federal consolidated return, this must be indicated on the form.

- Accurate Reporting: Ensure that all financial data, including income, deductions, and credits, is accurately reported. Mistakes can lead to delays in processing or additional scrutiny from the tax authorities.

- Amended Returns: If you need to correct any information after submission, you can file an amended return. Be sure to follow the specific codes and instructions provided for amendments.

- Deadlines Matter: Pay attention to filing deadlines. Late submissions can incur penalties and interest, so it’s best to file on time or request an extension if needed.

By keeping these points in mind, you can navigate the TC-20 form process more effectively and ensure compliance with Utah tax regulations.

Documents used along the form

The Utah TC-20 form is a crucial document for corporations filing their franchise and income tax returns in Utah. However, it often works in conjunction with several other forms and documents that provide additional information or support for the tax filing process. Below is a list of common forms that you may encounter alongside the TC-20.

- Schedule A - Utah Net Taxable Income and Tax Calculation: This schedule helps corporations calculate their taxable income and the corresponding tax amount. It requires detailed income information and adjustments.

- Schedule B - Additions to Unadjusted Income: This form lists various items that may need to be added to the corporation's unadjusted income. It includes items like interest from state obligations and taxes paid to other states.

- Schedule C - Subtractions from Unadjusted Income: In contrast to Schedule B, this document details deductions that can be subtracted from the corporation's unadjusted income, such as certain expenses and losses.

- Schedule D - Utah Contributions Deduction: This schedule allows corporations to report contributions made to qualifying organizations, which can be deducted from taxable income.

- Schedule E - Prepayments: Corporations use this form to report any estimated tax payments made throughout the year, which can be credited against the total tax due.

- Federal Form 1120: This is the U.S. Corporation Income Tax Return. It provides essential information about the corporation's income, deductions, and tax liability at the federal level, which is necessary for state filings.

- Durable Power of Attorney Form: For essential decision-making support, utilize our comprehensive Durable Power of Attorney resources to ensure your wishes are effectively documented and respected.

- Federal Form 8886: This is a report for disclosure of a potentially abusive tax shelter. If applicable, corporations must indicate its filing alongside the TC-20 to comply with federal regulations.

Understanding these forms and how they relate to the TC-20 can help streamline the filing process and ensure compliance with tax regulations. Each document serves a specific purpose, and together, they provide a comprehensive view of the corporation's financial activities for the tax year.

File Specifications

| Fact Name | Fact Description |

|---|---|

| Form Purpose | The TC-20 form is used by corporations to file their franchise and income tax return in Utah. |

| Tax Year | This form is applicable for the calendar year 2020 or a specified fiscal year. |

| Governing Law | The TC-20 is governed by Utah Code §59-7-401 et seq. |

| Filing Requirements | Corporations conducting any business activity in Utah during the taxable year must file this form. |

| Amended Returns | Corporations can mark the form to indicate if it is an amended return. |

| Penalties and Interest | Penalties and interest may apply if the tax due is not paid by the deadline. |

| Estimated Payments | Corporations must indicate if they made quarterly estimated prepayments. |

| Preparer Information | Preparer's signature and contact information must be included for tax return discussions. |

| Overpayment Handling | Any overpayment can be applied to the next taxable year or refunded. |