Fill a Valid Utah Tc 40 Template

Dos and Don'ts

When filling out the Utah TC-40 form, keep these tips in mind:

- Double-check your Social Security number and your spouse's, if applicable.

- Use the correct codes for your filing status and dependents.

- Ensure all income sources are accurately reported, including any additions or subtractions.

- Sign and date the form before submitting it.

- Keep copies of all documents for your records.

- File on time to avoid penalties and interest.

Avoid these common mistakes:

- Don't leave any sections blank; fill in all required fields.

- Avoid using incorrect or outdated forms.

- Do not forget to attach any necessary schedules or documents.

- Refrain from guessing amounts; use accurate figures from your records.

- Don't ignore the instructions; they provide essential guidance.

- Never submit your form without reviewing it for errors.

More PDF Forms

Utah State Id Number for Taxes - Each corporation must carefully assess its eligibility for credits and report them accurately on the TC-20.

When engaging in the sale of a motorcycle, it is crucial to use the correct documentation to safeguard both parties involved. A vital resource for this purpose is the arizonapdfforms.com/motorcycle-bill-of-sale, which provides the necessary form to formalize the transaction. This ensures that all legal stipulations are met, contributing to a smooth transfer of ownership.

Utah Drivers Handbook - Fill out the testing section for written and road tests taken.

Listed Questions and Answers

-

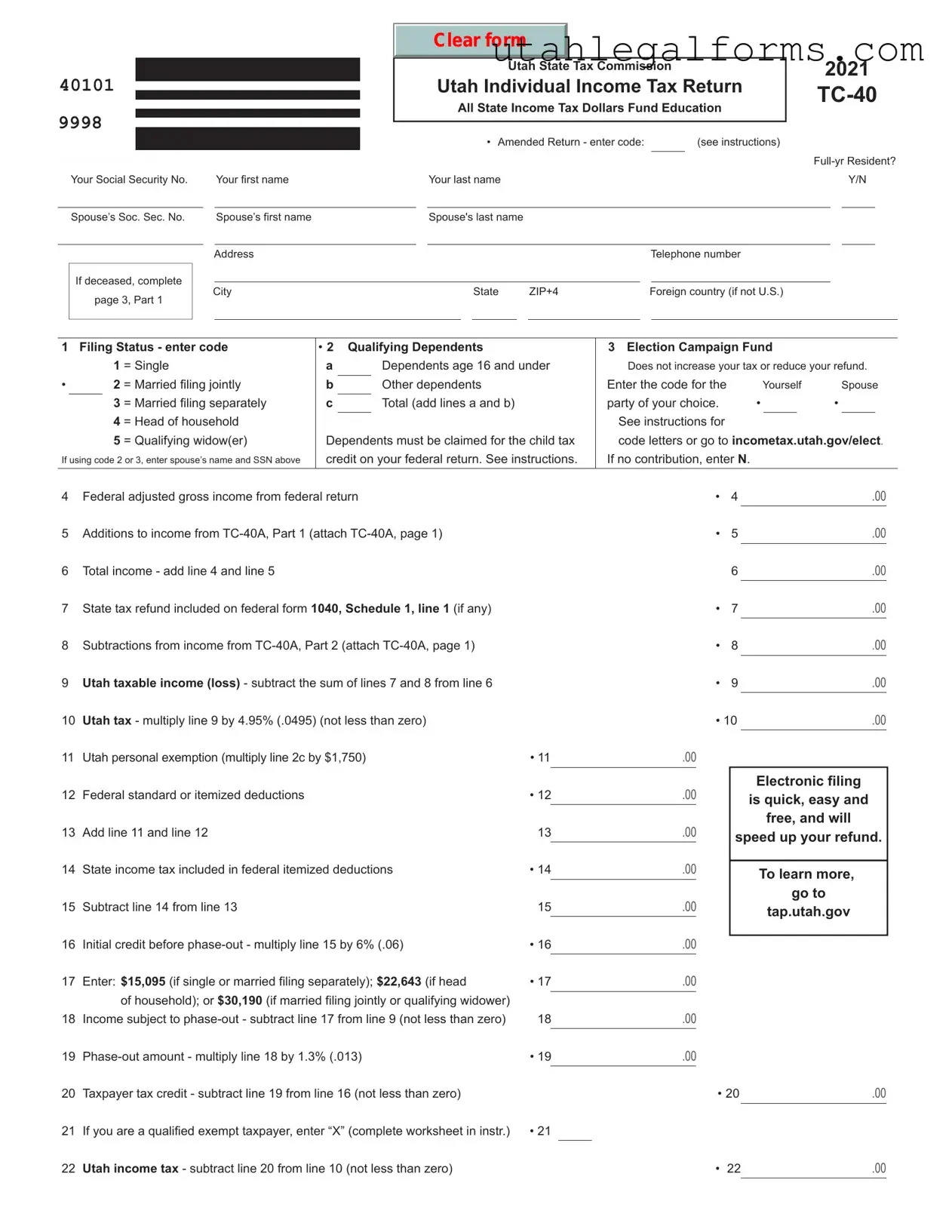

What is the TC-40 form?

The TC-40 form is the Utah Individual Income Tax Return. It is used by residents of Utah to report their income and calculate their state tax liability. This form allows individuals to claim deductions, credits, and exemptions, ultimately determining how much tax is owed or if a refund is due.

-

Who should file the TC-40?

Full-year residents of Utah who earn income must file the TC-40. If you are a part-year resident or a non-resident with income sourced from Utah, you will need to file different forms, such as TC-40B. It’s essential to assess your residency status to ensure you use the correct form.

-

What information do I need to complete the TC-40?

To fill out the TC-40, you will need your Social Security number, your spouse’s Social Security number (if applicable), your filing status, and details about your dependents. Additionally, you will require information about your federal adjusted gross income, deductions, and any applicable credits.

-

What are the filing statuses available on the TC-40?

The TC-40 offers several filing statuses:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

-

What is the deadline for filing the TC-40?

The TC-40 must be filed by April 15th of the year following the tax year. If April 15th falls on a weekend or holiday, the deadline may be extended to the next business day. Extensions for filing can be requested, but any taxes owed must still be paid by the original deadline to avoid penalties.

-

Can I e-file the TC-40?

Yes, electronic filing is available and encouraged for the TC-40. E-filing is quick, easy, and often results in faster refunds. Many tax preparation software options and online services support e-filing for Utah tax returns.

-

What are some common deductions available on the TC-40?

Common deductions include the Utah personal exemption, standard deduction, and itemized deductions. Taxpayers can also claim specific credits for contributions to education funds or other qualifying programs. It's crucial to review the instructions for the TC-40 to identify all possible deductions and credits.

-

What if I need to amend my TC-40?

If you need to amend your TC-40, you should use the same form and indicate that it is an amended return. You will need to enter a specific code, which is provided in the instructions. Be sure to include any new information and documentation to support your amendments.

-

How do I check the status of my refund?

You can check the status of your Utah tax refund online through the Utah State Tax Commission’s website. By entering your personal information, you can see if your return has been processed and when you can expect your refund.

-

What should I do if I owe taxes?

If you owe taxes, you should pay the amount due by the filing deadline to avoid penalties and interest. Payment options include electronic payment through the Utah State Tax Commission’s website, mailing a check, or setting up a payment plan if necessary.

Key takeaways

Key Takeaways for Using the Utah TC-40 Form

- Ensure accurate personal information: The TC-40 form requires your Social Security number, filing status, and details about your dependents. Double-check this information to avoid processing delays.

- Understand income calculations: Total income on the TC-40 includes your federal adjusted gross income and any additions or subtractions as specified in the TC-40A form. Be thorough when calculating these amounts.

- Utilize electronic filing: Filing electronically is a quick and convenient option. It can expedite your refund and reduce the likelihood of errors in your submission.

- Be aware of voluntary contributions: The form allows for voluntary contributions to various funds. If you choose to make a contribution, ensure you follow the instructions for proper reporting on the TC-40.

Documents used along the form

The Utah TC-40 form is a crucial document for individuals filing their state income tax returns. Alongside this form, several other documents are often required to ensure accurate reporting and compliance with state tax laws. Below is a list of forms and documents commonly used in conjunction with the TC-40, along with brief descriptions of each.

- TC-40A - Income Tax Supplemental Schedule: This form is used to report additions to and subtractions from income, as well as to claim various tax credits. It provides detailed information necessary for calculating the taxpayer's overall tax liability.

- TC-40B - Nonresident and Part-Year Resident Income Tax Return: This form is specifically for individuals who do not reside in Utah for the entire tax year. It helps determine the appropriate tax liability based on income earned in Utah during the period of residency.

- Hold Harmless Agreement Form: For those participating in various events, familiarize yourself with the Hold Harmless Agreement essentials to mitigate liability and ensure protection from potential claims.

- TC-546 - Credit for Taxes Paid to Another State: Taxpayers who have paid income tax to another state can use this form to claim a credit against their Utah tax liability, preventing double taxation on the same income.

- TC-40W - Utah Withholding Tax Statement: This document reports the amount of Utah income tax withheld from wages. Taxpayers must attach this form to their TC-40 to accurately account for taxes already paid throughout the year.

- TC-131 - Claim for Refund for a Deceased Taxpayer: If filing for a deceased taxpayer, this form is required to claim any refunds owed. It must be completed and submitted along with the TC-40.

- IRS Form 8886 - Reportable Transaction Disclosure Statement: This federal form must be filed if the taxpayer has engaged in a reportable transaction. It provides the IRS with information about certain tax avoidance strategies.

- Form 1040 - U.S. Individual Income Tax Return: While this is a federal form, it is essential for reporting overall income and tax liability. Information from the federal return is often needed to complete the TC-40 accurately.

- my529 Account Contribution Form: Taxpayers wishing to contribute to a my529 account can use this form to designate a portion of their tax refund for educational savings, promoting investment in future education costs.

Each of these forms plays a vital role in ensuring that taxpayers meet their obligations while maximizing potential credits and deductions. Properly completing and submitting these documents can lead to a smoother tax filing experience and may result in a more favorable tax outcome.

File Specifications

| Fact Name | Details |

|---|---|

| Purpose | The TC-40 form is used for filing individual income tax returns in Utah. |

| Eligibility | This form is for full-year residents of Utah. Part-year residents should use TC-40B. |

| Filing Status Options | Taxpayers can choose from several filing statuses, including single, married filing jointly, and head of household. |

| Governing Law | The TC-40 is governed by Utah Code Title 59, Chapter 10, which outlines income tax regulations. |

| Amended Returns | If you need to amend your return, you must enter a specific code as indicated in the instructions. |