Fill a Valid Utah Tc 40V Template

Dos and Don'ts

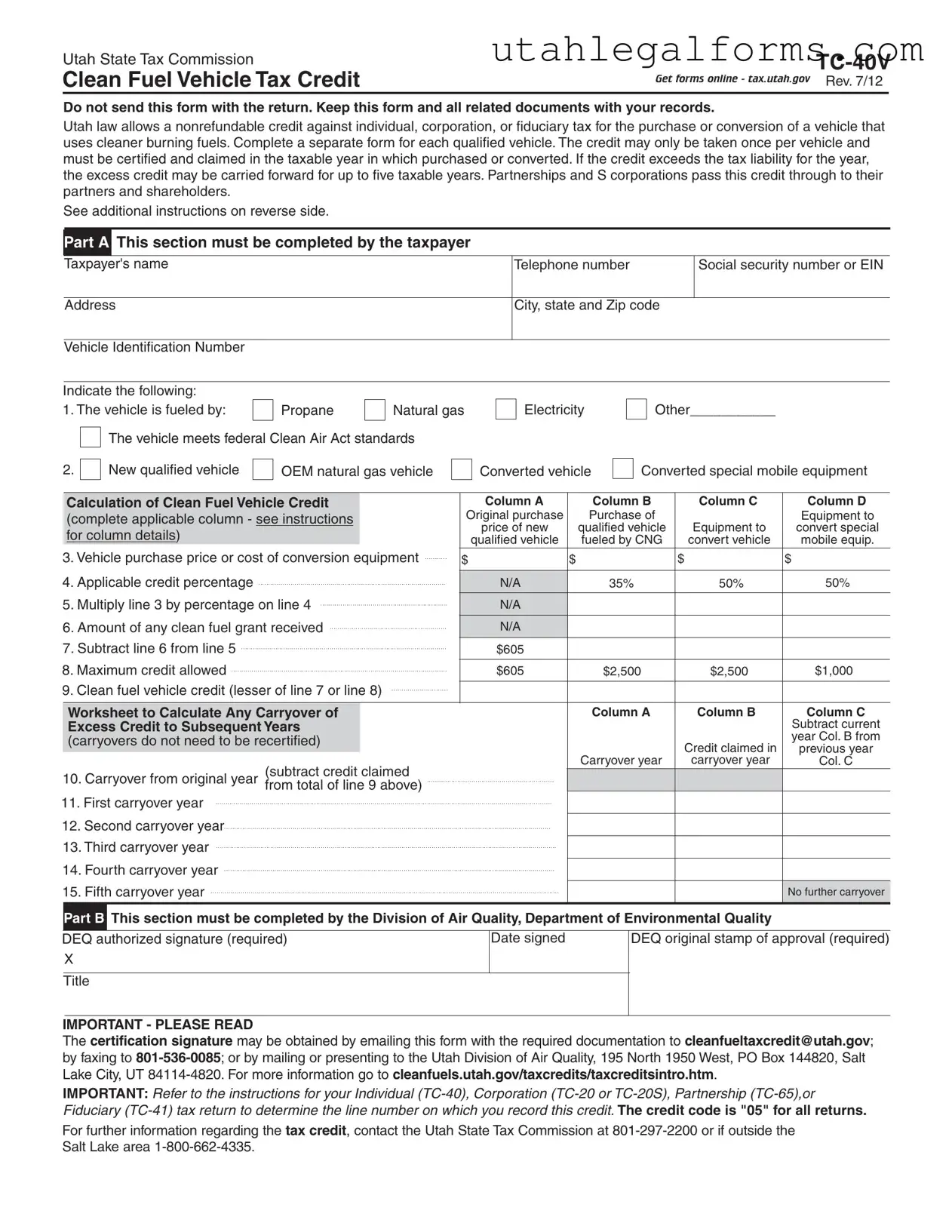

When filling out the Utah TC-40V form, it is essential to follow certain guidelines to ensure a smooth process. Below is a list of things you should and shouldn't do:

- Do complete a separate form for each qualified vehicle.

- Do keep the TC-40V form and all related documents for your records.

- Do ensure that the vehicle meets federal Clean Air Act standards before submitting the form.

- Do provide accurate information, including your name, Social Security number, and Vehicle Identification Number (VIN).

- Don't send the TC-40V form with your tax return; it should be kept separately.

- Don't forget to obtain the required certification from the Utah Division of Air Quality, as it is necessary for the credit to be valid.

More PDF Forms

Utah State Tax Form - Completing the TC 8453 helps validate your electronically filed tax return.

To ensure a smooth transaction when buying or selling a boat in New York, utilizing a New York Boat Bill of Sale is essential, as it details the necessary terms and conditions of the sale while protecting both parties involved. For more guidance on how to prepare this document correctly, you can visit legalpdf.org, which offers helpful resources on the boat bill of sale process.

Utah State Tax Form for Employees - The TC-116 requires detailed information on fuel consumption and taxes paid.

Listed Questions and Answers

-

What is the purpose of the Utah TC-40V form?

The Utah TC-40V form is used to claim a nonrefundable tax credit for individuals, corporations, or fiduciaries who purchase or convert vehicles that utilize cleaner burning fuels. This initiative encourages the use of clean fuel vehicles by offering a financial incentive for those who make environmentally friendly choices.

-

Who qualifies for the Clean Fuel Vehicle Tax Credit?

To qualify for the credit, you must purchase or convert a vehicle that meets specific criteria. The vehicle must be fueled by propane, natural gas, electricity, or another approved fuel. Additionally, it must meet federal Clean Air Act standards. Each vehicle qualifies for the credit only once, and it must be claimed in the taxable year it is purchased or converted.

-

How is the credit amount calculated?

The credit amount varies based on the type of vehicle and its fuel source. For example:

- New qualified vehicles that meet air quality standards can receive a credit of $605.

- OEM vehicles fueled by compressed natural gas can receive up to $2,500 or 35% of the purchase price, whichever is less.

- Conversion equipment for vehicles can receive a credit of up to $2,500 or 50% of the conversion cost, again whichever is less.

- Special mobile equipment can receive a credit of up to $1,000 or 50% of the conversion cost, whichever is less.

-

What should I do if my credit exceeds my tax liability?

If your Clean Fuel Vehicle Tax Credit exceeds your tax liability for the year, you can carry forward the excess credit for up to five subsequent taxable years. This allows you to utilize the full benefit of your credit over time, rather than losing it.

-

How do I submit the TC-40V form?

You should not send the TC-40V form with your tax return. Instead, keep it along with all related documents for your records. To obtain certification for your vehicle, submit the completed TC-40V form along with the required documentation to the Utah Division of Air Quality. You can also obtain certification via email, fax, or mail.

Key takeaways

Filling out the Utah TC-40V form can seem daunting, but understanding its key aspects can simplify the process. Here are some important takeaways to keep in mind:

- Separate Forms for Each Vehicle: You must complete a separate TC-40V form for each vehicle that qualifies for the Clean Fuel Vehicle Tax Credit.

- Certification Required: The form must be certified by the Utah Division of Air Quality. This certification is crucial for the credit to be valid.

- Nonrefundable Credit: The credit is nonrefundable, meaning it can only reduce your tax liability to zero. Any excess credit can be carried forward for up to five years.

- Documentation: Keep the TC-40V form and all related documents with your records. Do not send this form with your tax return.

- Credit Amounts Vary: The credit amount differs based on the type of vehicle or conversion. Familiarize yourself with the specific limits for new vehicles, OEM natural gas vehicles, and conversions.

- Follow Instructions Carefully: Each section of the form has specific instructions. Make sure to complete all applicable sections accurately to avoid delays or issues with your credit claim.

By keeping these key points in mind, you can navigate the TC-40V form more effectively and ensure you maximize your tax benefits.

Documents used along the form

When applying for the Clean Fuel Vehicle Tax Credit using the Utah TC-40V form, several other documents may be necessary to support your application. Here’s a list of commonly used forms and documents that can assist in the process.

- TC-40 Individual Income Tax Return: This is the main tax return form for individuals in Utah. It is essential for reporting your overall income and claiming various credits, including the clean fuel vehicle credit.

- TC-20 Corporation Tax Return: Corporations in Utah must file this form to report income and claim applicable tax credits. It’s relevant for businesses claiming the clean fuel vehicle tax credit.

- TC-20S S Corporation Tax Return: This form is used by S corporations to report income and pass through tax credits to shareholders. It’s important for S corporations claiming the clean fuel vehicle credit.

- TC-65 Partnership Tax Return: Partnerships use this form to report income and distribute tax credits among partners. It is necessary for partnerships claiming the clean fuel vehicle tax credit.

- TC-41 Fiduciary Tax Return: This form is for estates and trusts in Utah. It allows fiduciaries to report income and claim applicable credits, including the clean fuel vehicle credit.

- Vehicle Purchase Agreement: A document that outlines the terms of the vehicle purchase, including price and specifications. This is crucial for verifying the vehicle’s eligibility for the tax credit.

- Hold Harmless Agreement Form: For those entering into agreements that require liability protection, the comprehensive Hold Harmless Agreement guidelines provide essential information on safeguarding parties from potential risks.

- Proof of Vehicle Registration: This document shows that the vehicle is registered in Utah. It is necessary to confirm that the vehicle qualifies for the clean fuel vehicle tax credit.

- Certification from the Division of Air Quality: This certification verifies that the vehicle meets the necessary clean fuel standards. It is mandatory for claiming the tax credit.

- Documentation of Clean Fuel Grants: If you received any grants for the clean fuel vehicle, this documentation is needed to calculate the credit accurately.

- Tax Credit Calculation Worksheet: A worksheet to help calculate the clean fuel vehicle tax credit. This assists in ensuring that all figures are accurate before submission.

Having these documents ready can streamline the process of claiming your clean fuel vehicle tax credit. Ensure that you keep copies of everything for your records, as you may need to refer back to them in the future.

File Specifications

| Fact Name | Description |

|---|---|

| Form Purpose | The TC-40V form is used to claim a tax credit for purchasing or converting vehicles to cleaner burning fuels in Utah. |

| Governing Law | This form is governed by Utah Code sections 59-7-605 and 59-10-1009. |

| Nonrefundable Credit | The credit is nonrefundable, meaning it can only reduce tax liability to zero, not result in a refund. |

| One Credit Per Vehicle | Taxpayers can claim the credit only once for each qualified vehicle. |

| Certification Requirement | The credit must be certified by the Utah Division of Air Quality and claimed in the year of purchase or conversion. |

| Credit Carryover | If the credit exceeds tax liability, the excess can be carried forward for up to five years. |

| Partnerships and S Corporations | These entities can pass the credit through to their partners and shareholders. |

| Documentation Retention | Taxpayers must keep the TC-40V form and related documents for their records, but do not send it with their tax return. |

| Contact Information | For questions, taxpayers can contact the Utah State Tax Commission at 801-297-2200 or 1-800-662-4335. |