Fill a Valid Utah Tc 41 Template

Dos and Don'ts

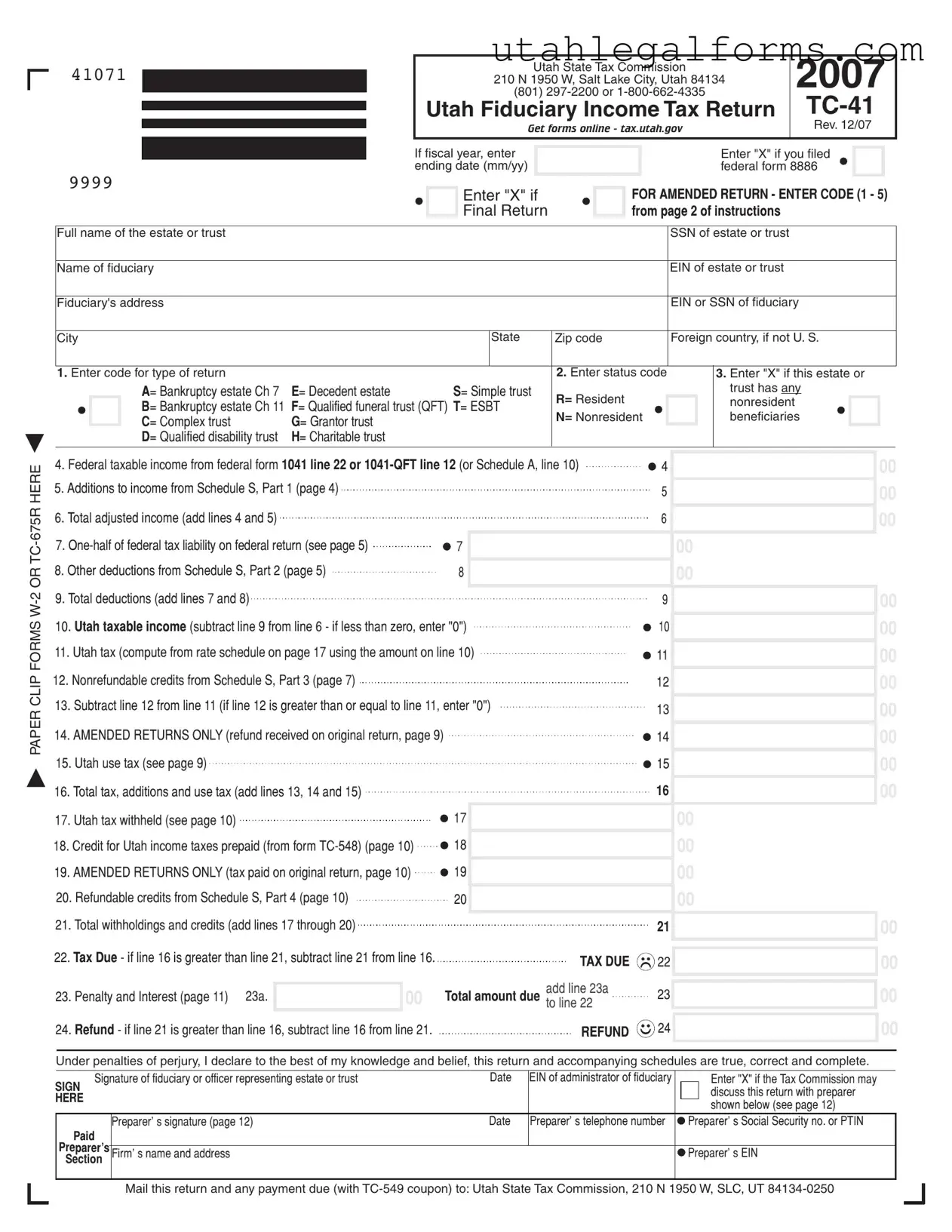

When filling out the Utah TC-41 form, it is essential to follow specific guidelines to ensure accuracy and compliance. Here are eight things you should and shouldn't do:

- Do double-check all entries for accuracy before submitting.

- Do ensure that you have included all necessary schedules and supporting documents.

- Do use black or blue ink to fill out the form clearly.

- Do sign and date the form where required.

- Don't leave any required fields blank; provide information as needed.

- Don't submit the form without reviewing the instructions carefully.

- Don't forget to include the appropriate payment if taxes are due.

- Don't use correction fluid or tape on the form; it may cause issues with processing.

By adhering to these guidelines, you can help ensure that your submission is processed smoothly and without unnecessary delays.

More PDF Forms

Statement of Facts Utah - A government-issued picture ID is necessary for specific requestors to verify their identity.

The California Bill of Sale form plays a crucial role in the ownership transfer process, eliminating any potential misunderstandings between the parties involved. This official documentation not only signifies the agreement on the sale terms but also provides legal protection for both the buyer and seller. For those seeking to navigate this process with clarity and precision, further resources can be found at legalpdf.org, ensuring a smooth transaction.

Utah Tax Form - Taxpayers have the option to contribute to election campaign funds on this form.

Listed Questions and Answers

-

What is the Utah TC-41 form?

The Utah TC-41 form is the Fiduciary Income Tax Return used by estates and trusts to report income earned in Utah. This form helps determine the tax liability for the estate or trust based on its income and deductions.

-

Who needs to file the TC-41 form?

Any estate or trust that generates income in Utah must file the TC-41 form. This includes decedent estates, simple trusts, complex trusts, and charitable trusts, among others. If the estate or trust has beneficiaries residing in Utah, it is also required to file.

-

How do I know if I need to file an amended return?

If you discover an error in your original TC-41 filing or if you need to report additional income or deductions, you should file an amended return. Indicate that it is an amended return by checking the appropriate box and entering the required code.

-

What information do I need to complete the TC-41 form?

You will need the following information:

- Full name of the estate or trust

- Social Security Number (SSN) or Employer Identification Number (EIN) of the estate or trust

- Name and address of the fiduciary

- Federal taxable income

- Any additions or deductions to income

- Credits and taxes withheld

-

What are the key sections of the TC-41 form?

The TC-41 form includes several important sections such as:

- Income Reporting: Where you report federal taxable income and any adjustments.

- Deductions: This section allows for various deductions that can reduce taxable income.

- Credits: Nonrefundable and refundable credits that can offset tax liability.

- Tax Calculation: The final section where you compute the total tax due or refund owed.

-

Where do I send the completed TC-41 form?

Mail the completed TC-41 form and any payment due to the Utah State Tax Commission at:

210 N 1950 W, Salt Lake City, Utah 84134-0250.

-

What if I need assistance with the TC-41 form?

If you need help, you can contact the Utah State Tax Commission at (801) 297-2200 or 1-800-662-4335. They can provide guidance on filling out the form and answer any specific questions you may have.

-

Are there penalties for late filing of the TC-41 form?

Yes, there are penalties for late filing. If you do not file your TC-41 by the due date, you may incur penalties and interest on any taxes owed. It’s best to file on time to avoid these additional costs.

-

Can I e-file the TC-41 form?

As of now, the TC-41 form must be filed by mail. However, check the Utah State Tax Commission website for any updates regarding e-filing options in the future.

-

What should I do if I receive a notice from the Tax Commission after filing?

If you receive a notice, review it carefully. The notice may require additional information or indicate an issue with your filing. Follow the instructions provided in the notice and respond promptly to avoid further complications.

Key takeaways

Filling out the Utah TC-41 form requires attention to detail and accuracy. Here are key takeaways to help you navigate the process:

- Understand the Purpose: The TC-41 form is used for filing the Utah Fiduciary Income Tax Return for estates and trusts.

- Identify the Correct Codes: Familiarize yourself with the various codes for return types and statuses. These codes determine how your return is processed.

- Provide Accurate Information: Ensure that the names, Social Security Numbers (SSNs), and Employer Identification Numbers (EINs) are correct. Mistakes can lead to delays or rejections.

- Calculate Income and Deductions: Carefully compute federal taxable income, additions, and deductions. Use the appropriate lines from federal forms to ensure accuracy.

- Check for Nonrefundable Credits: Review the nonrefundable credits available. These can reduce your tax liability but cannot result in a refund.

- Review Amended Returns: If you are filing an amended return, enter the correct code and provide details about any changes made.

- Submit on Time: Ensure that the completed form is mailed to the Utah State Tax Commission before the deadline to avoid penalties.

By following these guidelines, you can complete the TC-41 form accurately and efficiently, ensuring compliance with Utah tax regulations.

Documents used along the form

The Utah TC-41 form is a crucial document for filing the Utah Fiduciary Income Tax Return. It is often accompanied by several other forms and documents that provide necessary information for accurate tax reporting. Below is a list of additional forms commonly used alongside the TC-41.

- Federal Form 1041: This is the U.S. Income Tax Return for Estates and Trusts. It reports income, deductions, gains, and losses of estates and trusts, serving as the basis for the Utah TC-41.

- Schedule A: This schedule is specifically for nonresident estates and trusts. It computes federal taxable income derived from Utah sources, helping to clarify the tax obligations for nonresidents.

- Schedule S: This supplemental schedule includes sections for additions to income, other deductions, nonrefundable credits, and refundable credits. It provides detailed information that supplements the main tax return.

- Form TC-548: This form is used to report credit for Utah income taxes prepaid. It helps taxpayers claim any prepayments made towards their Utah tax liabilities.

- Form TC-549: This is a coupon used for making payments due with the TC-41. It ensures that payments are properly processed by the Utah State Tax Commission.

- Ohio Horse Bill of Sale Form: When documenting the transfer of horse ownership, refer to our comprehensive Horse Bill of Sale form guidelines to ensure all legal criteria are met.

- Federal Form 8886: This form is used to disclose transactions that may be considered tax avoidance. If applicable, it should be noted on the TC-41 to comply with federal regulations.

In summary, these forms and schedules provide essential information that supports the completion of the Utah TC-41. They help ensure that all necessary details are reported accurately, facilitating compliance with state tax laws.

File Specifications

| Fact Name | Details |

|---|---|

| Form Purpose | The TC-41 form is used for filing the Utah Fiduciary Income Tax Return. |

| Governing Law | This form is governed by the Utah State Tax Code. |

| Contact Information | For assistance, call (801) 297-2200 or 1-800-662-4335. |

| Filing Frequency | The TC-41 is filed annually for estates and trusts. |

| Amended Returns | Amended returns require a code (1-5) to be entered on the form. |

| Due Date | The return is typically due on the 15th day of the fourth month after the end of the tax year. |

| Fiduciary Information | It requires the fiduciary's name, address, and identification numbers. |

| Income Calculation | Federal taxable income is reported from federal form 1041. |

| Credits | Nonrefundable and refundable credits can be claimed on the form. |

| Submission Address | Mail the completed form to the Utah State Tax Commission at 210 N 1950 W, Salt Lake City, UT 84134-0250. |