Fill a Valid Utah Tc 42 Template

Dos and Don'ts

When filling out the Utah TC-42 form, it's essential to follow certain guidelines to ensure your application is processed smoothly. Here are nine things you should and shouldn't do:

- Do ensure that your corporation is current with all tax filing and payment obligations.

- Don't submit the form if your corporation has outstanding taxes or filings.

- Do provide accurate and complete information in all fields of the form.

- Don't leave any sections blank; incomplete forms can delay processing.

- Do include the name and title of the corporate representative signing the form.

- Don't forget to sign and date the application; an unsigned form will not be accepted.

- Do provide a contact number where you can be reached for any follow-up questions.

- Don't use an incorrect mailing address; ensure it matches your corporation's records.

- Do allow 5 to 10 days for processing before inquiring about your application status.

More PDF Forms

Utah Medical Power of Attorney - If you would like to opt out of life-prolonging measures, this form allows you to do so.

When conducting a boat sale in New York, it's essential to utilize a New York Boat Bill of Sale form to ensure the transfer of ownership is documented correctly. This legal document, which you can find more information about at legalpdf.org, serves as proof of the transaction and details critical elements such as the boat's description and sale price, thereby safeguarding both the seller and buyer in the process.

Utah State Id Number for Taxes - Filing the TC-20 properly ensures corporations meet Utah's regulatory and tax obligations comprehensively.

Listed Questions and Answers

-

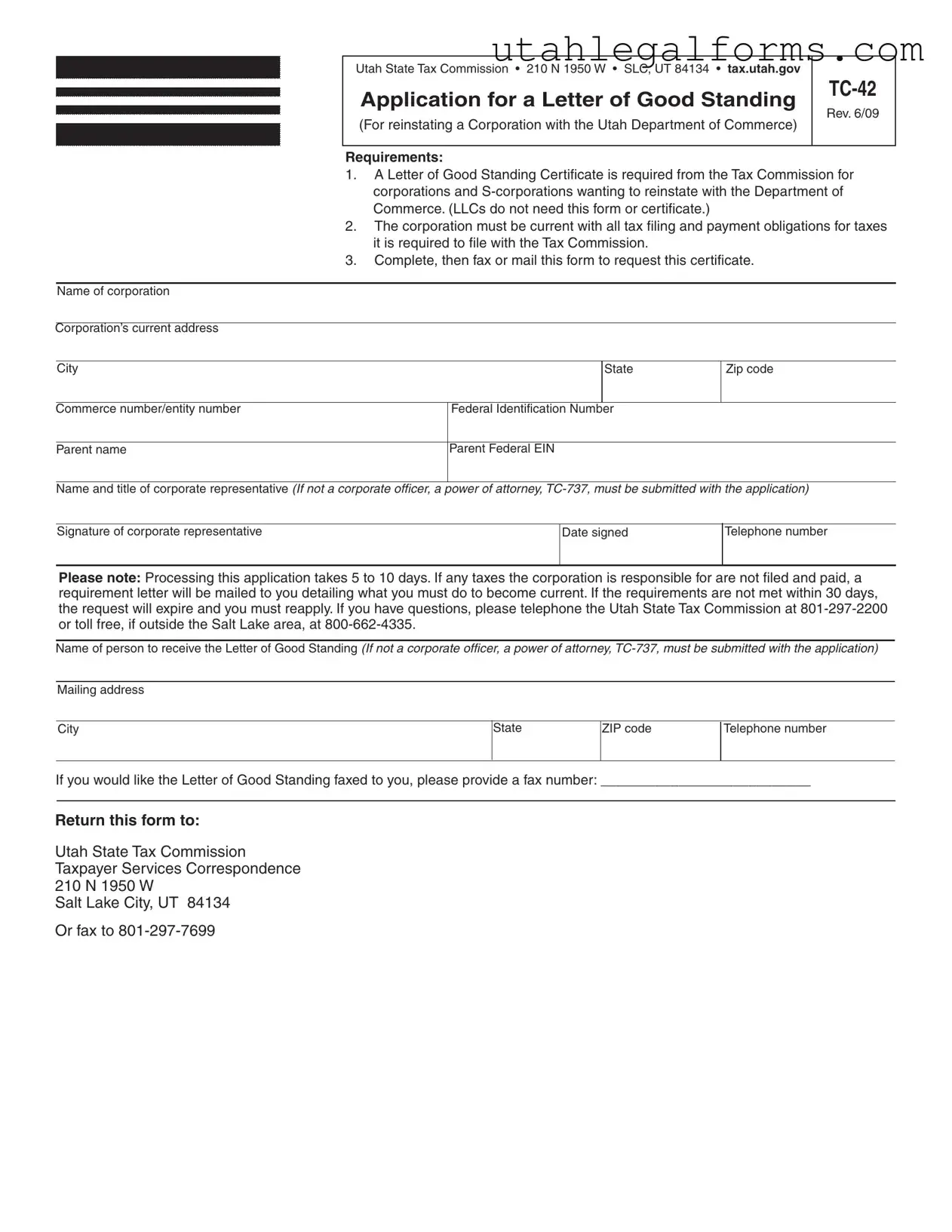

What is the purpose of the Utah TC-42 form?

The Utah TC-42 form is an application for a Letter of Good Standing. This document is essential for corporations and S-corporations that wish to reinstate their status with the Department of Commerce in Utah. It confirms that the corporation is compliant with tax obligations and is in good standing with the state.

-

Who needs to fill out the TC-42 form?

Only corporations and S-corporations are required to complete the TC-42 form when seeking reinstatement. It's important to note that Limited Liability Companies (LLCs) do not need this form or the associated Letter of Good Standing.

-

What are the requirements to obtain a Letter of Good Standing?

To receive a Letter of Good Standing, the corporation must meet several criteria:

- The corporation must be up-to-date with all tax filings and payments that are required by the Utah State Tax Commission.

- The TC-42 form must be completed and submitted either by fax or mail.

Failure to meet these requirements may lead to a requirement letter being sent, outlining what needs to be done to achieve compliance.

-

How long does it take to process the TC-42 form?

The processing time for the TC-42 form typically ranges from 5 to 10 days. If there are any outstanding tax obligations, the corporation will receive a letter detailing the necessary actions to take. If compliance is not achieved within 30 days, the request for the Letter of Good Standing will expire, and a new application must be submitted.

-

What should I do if I have questions about the TC-42 form?

If you have any questions or need assistance regarding the TC-42 form, you can reach out to the Utah State Tax Commission. They can be contacted at 801-297-2200. For those outside the Salt Lake area, a toll-free number is available at 800-662-4335.

Key takeaways

When completing and utilizing the Utah TC-42 form, several key points should be kept in mind. Understanding these takeaways can help ensure a smooth application process.

- Purpose of the Form: The TC-42 form is specifically for requesting a Letter of Good Standing, which is necessary for corporations and S-corporations seeking reinstatement with the Department of Commerce.

- Eligibility: Only corporations and S-corporations are required to submit this form. LLCs do not need a Letter of Good Standing for reinstatement.

- Tax Compliance: Corporations must be current on all tax filings and payments to the Tax Commission. Failure to meet this requirement will delay the application.

- Filing Method: After completing the form, it can be submitted either by fax or by mail to the Utah State Tax Commission.

- Processing Time: Expect the processing of your application to take between 5 to 10 days. Planning ahead is advisable.

- Requirement Letter: If any taxes are unpaid, the Tax Commission will send a requirement letter detailing necessary actions to become current.

- Expiration of Request: If the requirements are not fulfilled within 30 days of receiving the requirement letter, the request will expire, necessitating a new application.

- Contact Information: For any questions, the Utah State Tax Commission can be reached at 801-297-2200 or toll-free at 800-662-4335.

- Recipient Information: Ensure to provide accurate details for the person receiving the Letter of Good Standing, including their mailing address and phone number.

By keeping these points in mind, individuals and corporations can navigate the TC-42 form process more effectively.

Documents used along the form

The Utah TC-42 form is an important document for corporations and S-corporations seeking to reinstate their status with the Department of Commerce. In addition to this form, several other documents and forms are often required or helpful during this process. Understanding these documents can facilitate a smoother reinstatement journey.

- Power of Attorney (TC-737): This form allows a designated individual to act on behalf of the corporation. If the person submitting the TC-42 is not a corporate officer, this document must accompany the application to authorize representation.

- Certificate of Good Standing: This is a formal document issued by the state that confirms a corporation is compliant with state regulations and is authorized to conduct business. It is often required for various transactions, including banking and contracts.

- Articles of Incorporation: This foundational document outlines the corporation’s structure, purpose, and other essential details. It is often needed to verify the corporation's existence and compliance with state laws.

- Bylaws: Bylaws govern the internal management of the corporation. While not always required for reinstatement, they can provide clarity on corporate governance and decision-making processes.

- Tax Returns: Current and past tax returns may be required to demonstrate compliance with tax obligations. These documents provide evidence of the corporation’s financial activities and tax responsibilities.

- Annual Reports: Many states require corporations to file annual reports that detail their business activities. These reports help maintain good standing and can be requested during the reinstatement process.

- Motorcycle Bill of Sale - This important document serves as proof of sale in Arizona, ensuring clarity in ownership transfer between parties. For further details, visit arizonapdfforms.com/motorcycle-bill-of-sale/.

- Notice of Default: If the corporation has received a notice regarding non-compliance or other issues, this document may need to be addressed as part of the reinstatement process.

- Payment Receipts: Proof of payment for any outstanding taxes or fees is often necessary. These receipts confirm that the corporation has settled its financial obligations with the tax authority.

By gathering these documents in conjunction with the TC-42 form, corporations can effectively navigate the reinstatement process. It is advisable to ensure all required forms are completed accurately and submitted in a timely manner to avoid delays or complications.

File Specifications

| Fact Name | Details |

|---|---|

| Form Title | Application for a Letter of Good Standing |

| Governing Law | Utah Code Title 16, Chapter 10a |

| Eligible Entities | Corporations and S-corporations only; LLCs are not required to use this form. |

| Tax Compliance | The corporation must be current with all tax filing and payment obligations. |

| Submission Method | This form can be faxed or mailed to the Utah State Tax Commission. |

| Processing Time | Processing takes approximately 5 to 10 days. |

| Expiration of Request | If requirements are not met within 30 days, the request will expire. |

| Contact Information | For questions, call 801-297-2200 or 800-662-4335 (toll-free). |