Fill a Valid Utah Tc 51 Template

Dos and Don'ts

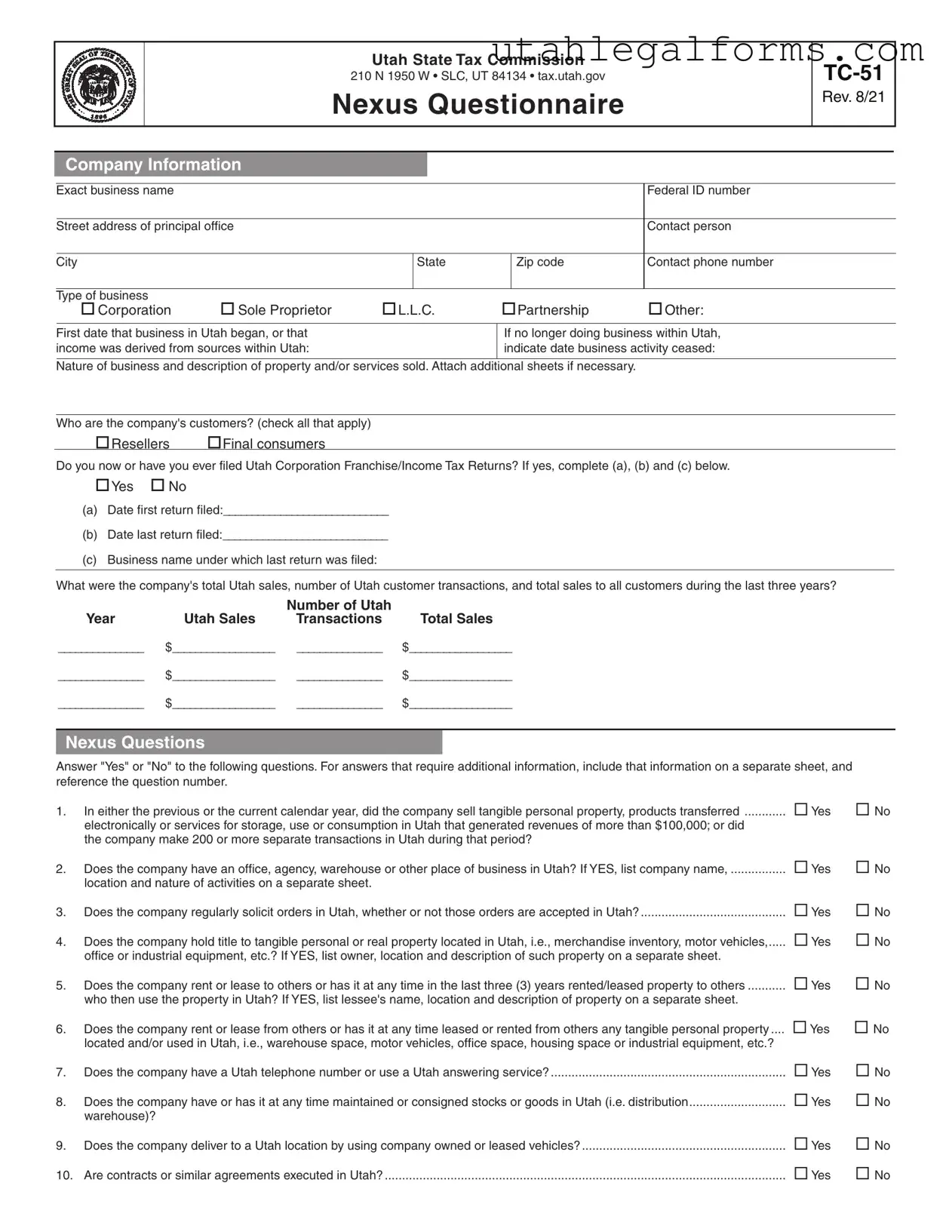

Things to Do When Filling Out the Utah TC-51 Form:

- Provide the exact business name as registered.

- Include a complete street address for the principal office.

- List the Federal ID number accurately.

- Clearly state the type of business entity.

- Indicate the first date business activity began in Utah.

- Attach additional sheets if more space is needed for descriptions.

- Answer all nexus questions honestly and completely.

- Provide accurate sales figures for the last three years.

- Ensure all signatures are dated and properly filled out.

- Double-check for any missing information before submission.

Things Not to Do When Filling Out the Utah TC-51 Form:

- Do not leave any required fields blank.

- Avoid using abbreviations that may confuse the reader.

- Do not provide false or misleading information.

- Refrain from submitting the form without a thorough review.

- Do not forget to include your contact information.

- Do not ignore the requirement to attach supporting documents if necessary.

- Do not submit without the necessary signatures.

- Avoid using outdated information from previous filings.

- Do not assume that all questions are optional; answer each one as required.

- Do not rely on verbal instructions; refer to the form guidelines instead.

More PDF Forms

Rental Agreement Utah - If the owner cannot deliver the property as scheduled, the tenant will not owe rent until possession is given.

Dopl Ap 069 - It’s crucial for applicants to retain a copy of their submitted application for personal records.

For those seeking a robust legal framework, a thorough understanding of the Hold Harmless Agreement form is crucial. This agreement serves to mitigate liability risks, ensuring that parties involved are protected. Individuals or organizations may find a detailed template for this agreement at an essential resource on Hold Harmless Agreement formats.

Dopl Ap 069 - Utilizing the Dopl Ap 069 promotes organizational efficiency.

Listed Questions and Answers

-

What is the purpose of the Utah TC-51 form?

The Utah TC-51 form, also known as the Nexus Questionnaire, is designed to help the Utah State Tax Commission determine whether a business has established a tax presence, or "nexus," in Utah. This form collects essential information about the business's activities, sales, and presence in the state, which ultimately informs tax obligations.

-

Who needs to fill out the TC-51 form?

Any business that sells products or services in Utah or derives income from Utah sources may need to complete the TC-51 form. This includes corporations, sole proprietors, partnerships, and limited liability companies (LLCs). If a business has questions about its nexus status, completing this form can provide clarity.

-

What information is required on the TC-51 form?

The form requires detailed information about the business, including:

- Exact business name and principal office address

- Federal ID number

- Contact person and phone number

- Type of business

- Nature of business and description of property/services sold

- Total sales and transactions in Utah over the last three years

Additionally, the form includes a series of questions to assess the company's nexus status based on its activities in Utah.

-

What are nexus questions, and why are they important?

Nexus questions on the TC-51 form are designed to assess the level of business activity in Utah. These questions help determine if a company has a tax obligation in the state. For instance, questions may inquire about sales volume, physical presence, and activities conducted within Utah. Answering these questions accurately is crucial for compliance with state tax laws.

-

What happens if a business does not file the TC-51 form?

Failing to file the TC-51 form when required may lead to penalties, including fines and interest on unpaid taxes. Additionally, the Utah State Tax Commission may take enforcement actions if it determines that a business is operating without fulfilling its tax obligations. Therefore, timely and accurate submission of the TC-51 is essential.

-

Can a business amend its TC-51 form after submission?

Yes, a business can amend its TC-51 form if it discovers inaccuracies or if there are changes in its operations that affect its nexus status. It is advisable to contact the Utah State Tax Commission for guidance on how to properly amend the form and ensure compliance with tax regulations.

-

Is there a deadline for submitting the TC-51 form?

While there is no specific deadline for submitting the TC-51 form, businesses should file it as soon as they determine they have a nexus in Utah. Prompt submission helps avoid potential penalties and ensures that the business is in compliance with state tax laws. It is recommended to consult the Utah State Tax Commission for any specific timelines related to tax filings.

-

Where can I find assistance with completing the TC-51 form?

Businesses can seek assistance from tax professionals, accountants, or attorneys who specialize in state tax law. Additionally, the Utah State Tax Commission provides resources and guidance on its website, which can be helpful for understanding how to complete the TC-51 form accurately.

Key takeaways

Understanding the Utah TC-51 form is essential for businesses operating in or engaging with the state. This form serves as a Nexus Questionnaire, gathering vital information about a company's operations and tax obligations in Utah.

Accurate completion of the form requires detailed company information, including the exact business name, address, and federal ID number. This information establishes the identity and location of the business for tax purposes.

Businesses must report their Utah sales and customer transactions over the past three years. This data is crucial for determining whether the company meets the thresholds for tax obligations in the state.

The form includes a series of nexus questions that help assess the company's connection to Utah. Answering these questions accurately is vital, as they determine the company's tax responsibilities based on its activities within the state.

Companies must also disclose any employees or independent contractors working in Utah. This information is necessary to evaluate the extent of business operations and compliance with state tax laws.

Finally, the form requires signatures from both an officer of the company and the preparer. This declaration underlines the importance of providing truthful and complete information, as inaccuracies can lead to penalties.

Documents used along the form

The Utah TC-51 form, known as the Nexus Questionnaire, is a crucial document for businesses operating in Utah. This form helps the state tax commission determine a company's tax obligations based on its business activities within the state. Along with the TC-51, several other forms and documents may be necessary for compliance or related processes. Below is a list of these documents, along with brief descriptions of their purposes.

- Utah Corporation Franchise/Income Tax Return (TC-20): This return is filed by corporations doing business in Utah to report income and calculate taxes owed to the state.

- Utah Sales and Use Tax Return (TC-62): Businesses must file this return to report and remit sales and use taxes collected from customers during a specific period.

- Business License Application: This application is required for businesses to obtain a license to operate legally within a municipality in Utah.

- Employer Registration Form (TC-69): Employers use this form to register for withholding tax and unemployment insurance, ensuring compliance with state employment laws.

- Utah Taxpayer Registration (TC-69): This form is used by businesses to register for various state taxes, including sales and use tax, corporate franchise tax, and others.

- Boat Bill of Sale: When purchasing a boat, ensure you complete a legalpdf.org form to document the transfer of ownership and protect your investment.

- Certificate of Good Standing: This document verifies that a business is properly registered and compliant with state regulations, often required for contracts or loans.

- Annual Report: Corporations and LLCs are typically required to file an annual report with the state, providing updated information about their business structure and operations.

These documents play a vital role in ensuring that businesses comply with state regulations and fulfill their tax obligations. It is important for business owners to be aware of these forms and their requirements to maintain good standing in Utah.

File Specifications

| Fact Name | Description |

|---|---|

| Form Purpose | The TC-51 form is a Nexus Questionnaire used by the Utah State Tax Commission to determine if a business has a tax obligation in Utah. |

| Governing Law | The form is governed by the Utah Code Title 59, Chapter 12, which pertains to sales and use tax. |

| Business Information | Businesses must provide their exact name, address, federal ID number, contact person, and type of business on the form. |

| Sales Reporting | Companies must report their total Utah sales, number of customer transactions, and total sales to all customers for the last three years. |

| Nexus Questions | The form includes a series of yes/no questions to assess the business's physical presence and activities in Utah. |

| Voluntary Seller Criteria | Businesses can identify as voluntary sellers if they meet specific criteria under the Streamlined Sales Tax Agreement. |

| Signature Requirement | Under penalty of perjury, an officer of the company must sign the form, affirming the accuracy of the information provided. |

| Submission Instructions | The completed form must be submitted to the Utah State Tax Commission at the address listed on the form. |

| Form Revision Date | The TC-51 form was last revised in August 2021, indicating the most recent updates to the questionnaire. |