Fill a Valid Utah Tc 559 Template

Dos and Don'ts

When filling out the Utah TC-559 form, it’s important to follow certain guidelines to ensure your submission is correct and timely. Here are seven things you should and shouldn't do:

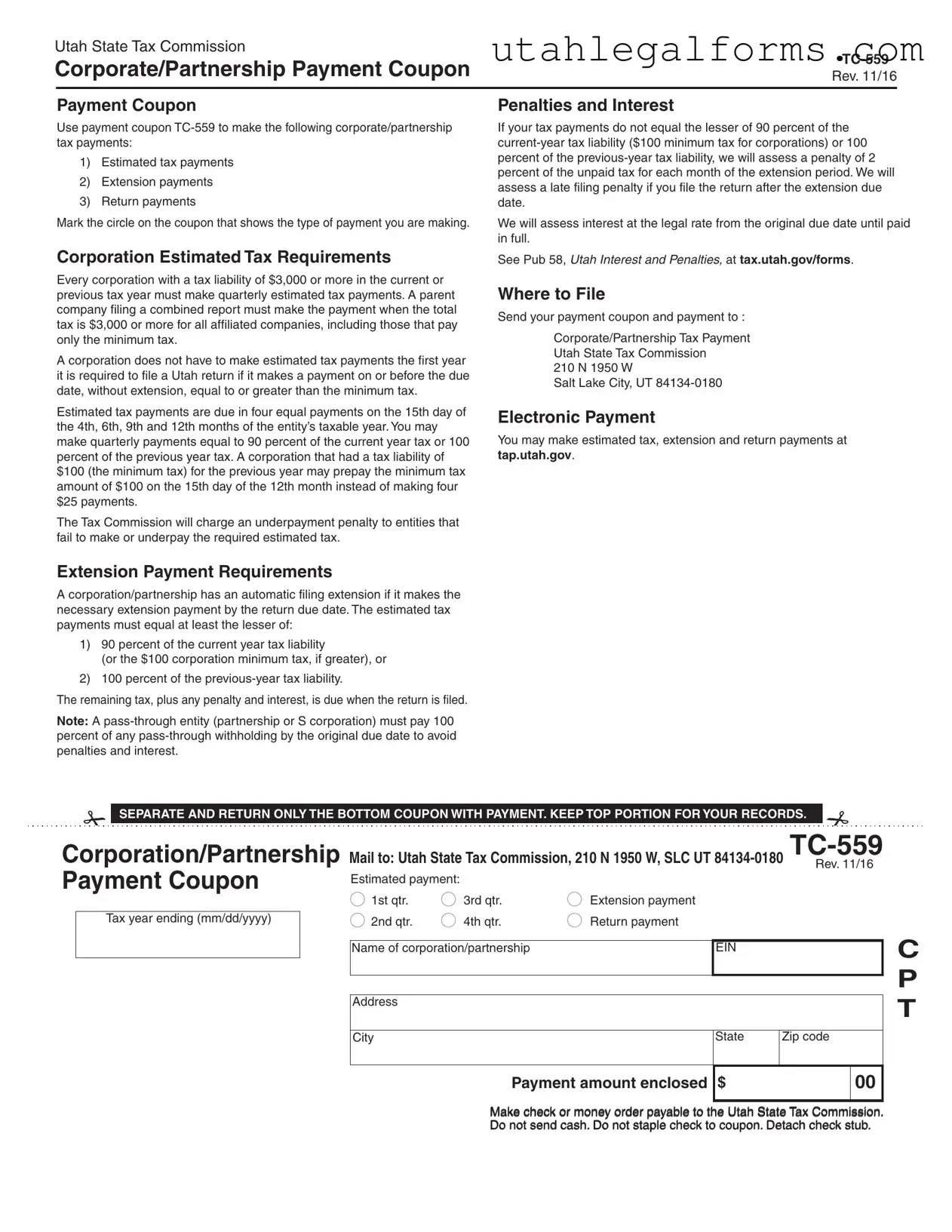

- Do mark the correct circle on the coupon to indicate the type of payment you are making.

- Don't forget to check that your payment equals at least 90 percent of the current-year tax liability or 100 percent of the previous-year tax liability.

- Do submit your payment coupon and payment to the correct address: Utah State Tax Commission, 210 N 1950 W, Salt Lake City, UT 84134-0180.

- Don't send cash with your payment. Use a check or money order made out to the Utah State Tax Commission.

- Do keep the top portion of the form for your records after detaching the coupon.

- Don't staple your check to the coupon. It should be kept separate.

- Do ensure that you make your estimated tax payments on time to avoid penalties and interest.

More PDF Forms

Utah State Withholding Form - If you're a non-U.S. citizen, you must apply in person while using the TC-69 form.

To ensure risk management during events, a well-prepared Hold Harmless Agreement can be indispensable; discovering the right Hold Harmless Agreement template can streamline the process significantly.

Utah Real Estate Purchase Contract - The seller financing addendum provides a clear structure for credit documents between buyer and seller.

Listed Questions and Answers

-

What is the purpose of the Utah TC-559 form?

The Utah TC-559 form serves as a payment coupon for corporate and partnership tax payments. It is used for various types of payments, including estimated tax payments, extension payments, and return payments. By marking the appropriate circle on the coupon, taxpayers can specify the nature of their payment.

-

Who is required to use the TC-559 form?

Any corporation or partnership that has a tax liability of $3,000 or more in the current or previous tax year must use the TC-559 form to make their tax payments. This requirement also applies to parent companies filing combined reports for all affiliated companies.

-

What are the penalties for not making estimated tax payments?

If a corporation or partnership fails to make the required estimated tax payments, a penalty of 2 percent of the unpaid tax will be assessed for each month of the extension period. Additionally, if the return is filed after the extension due date, a late filing penalty may apply. Interest will accrue at the legal rate from the original due date until the payment is made in full.

-

When are estimated tax payments due?

Estimated tax payments must be made in four equal installments on the 15th day of the 4th, 6th, 9th, and 12th months of the entity’s taxable year. Taxpayers can choose to pay either 90 percent of the current year’s tax liability or 100 percent of the previous year’s tax liability.

-

What is the minimum tax amount for corporations?

The minimum tax amount for corporations is $100. If a corporation had a tax liability of $100 in the previous year, it can choose to prepay this minimum amount on the 15th day of the 12th month instead of making four quarterly payments.

-

How can a corporation or partnership obtain an extension for filing?

A corporation or partnership can obtain an automatic filing extension by making the necessary extension payment by the return due date. This payment must meet specific criteria, such as being at least 90 percent of the current year’s tax liability or 100 percent of the previous year’s tax liability.

-

What should a pass-through entity do to avoid penalties?

A pass-through entity, such as a partnership or S corporation, must ensure that it pays 100 percent of any pass-through withholding by the original due date. Failure to do so may result in penalties and interest.

-

Where should the TC-559 form and payment be sent?

Taxpayers should send the TC-559 form and their payment to the following address:

Corporate/Partnership Tax Payment

Utah State Tax Commission

210 N 1950 W

Salt Lake City, UT 84134-0180 -

Can payments be made electronically?

Yes, taxpayers can make estimated tax, extension, and return payments electronically at tap.utah.gov. This option provides a convenient way to fulfill tax obligations without the need for paper forms.

-

What should I do with the TC-559 form after completing it?

After completing the TC-559 form, detach the bottom coupon and send it along with your payment. Keep the top portion of the form for your records. It is important to make sure that checks are not stapled to the coupon and that cash is not sent.

Key takeaways

When dealing with the Utah TC-559 form, understanding the essential aspects can help ensure compliance and avoid unnecessary penalties. Here are some key takeaways:

- Purpose of TC-559: This form is used for making various corporate and partnership tax payments, including estimated tax payments, extension payments, and return payments.

- Marking Payments: It is crucial to mark the appropriate circle on the coupon to indicate the type of payment being made.

- Penalty Awareness: If tax payments do not meet the required thresholds, a penalty of 2 percent may be assessed for each month of the extension period.

- Estimated Tax Requirements: Corporations with a tax liability of $3,000 or more must make quarterly estimated tax payments. This applies to both current and previous tax years.

- Quarterly Payment Schedule: Payments are due in four equal installments on the 15th day of the 4th, 6th, 9th, and 12th months of the taxable year.

- Minimum Tax Prepayment: Corporations with a previous year tax liability of $100 can prepay this amount on the 15th day of the 12th month instead of making multiple payments.

- Extension Payment Conditions: To qualify for an automatic filing extension, the necessary payment must be made by the return due date.

- Pass-Through Entities: Partnerships or S corporations must pay 100 percent of any pass-through withholding by the original due date to avoid penalties.

- Filing Instructions: Payments should be sent to the Utah State Tax Commission at the specified address, and electronic payments can be made online.

By following these guidelines, individuals and entities can navigate the tax payment process more effectively, ensuring timely compliance with Utah tax regulations.

Documents used along the form

The Utah TC-559 form is a crucial document for corporate and partnership tax payments in Utah. Along with this form, several other documents are commonly utilized to ensure compliance with state tax regulations. Below is a list of these forms, each serving a specific purpose in the tax payment process.

- Utah TC-20 Form: This is the Corporate Franchise or Income Tax Return form. Corporations use it to report their income, calculate tax liability, and submit their annual tax return to the Utah State Tax Commission.

- Utah TC-40 Form: This form is used for individual income tax returns. While primarily for individuals, partnerships and pass-through entities may need it to report income that is passed to individual partners or shareholders.

- Boat Bill of Sale - For those looking to sell a boat, it's important to have a formal record of the transaction. This legal document can be obtained from legalpdf.org to ensure all necessary details are captured.

- Utah TC-559R Form: This is the Corporate/Partnership Payment Coupon for estimated tax payments. It helps corporations and partnerships make their quarterly estimated tax payments, ensuring they meet their tax obligations throughout the year.

- Utah TC-850 Form: This is the Extension Payment form, used by corporations and partnerships to request an extension for filing their tax returns. It also includes the necessary payment to avoid penalties for late filing.

Understanding these forms and their purposes can help taxpayers navigate the complexities of corporate and partnership tax obligations in Utah. Proper use of these documents ensures compliance and helps avoid penalties and interest associated with late payments or filings.

File Specifications

| Fact Name | Details |

|---|---|

| Purpose of TC-559 | This form is used for making various corporate or partnership tax payments, including estimated tax payments, extension payments, and return payments. |

| Payment Deadlines | Estimated tax payments are due quarterly on the 15th day of the 4th, 6th, 9th, and 12th months of the taxable year. |

| Penalties for Non-Compliance | If tax payments do not meet certain thresholds, penalties of 2% may be assessed for each month of the extension period, along with interest from the due date until the payment is made. |

| Governing Laws | The TC-559 form is governed by Utah State tax laws, specifically the regulations regarding corporate tax payments and penalties as outlined in Utah Code Title 59. |