Fill a Valid Utah Tc 55A Template

Dos and Don'ts

When filling out the Utah TC-55A form, there are important dos and don'ts to keep in mind. Here is a list to guide you:

- Do provide accurate information in all fields, including your name, address, and vehicle identification number.

- Do ensure you calculate the correct amount of sales tax or fees you paid.

- Do attach all necessary documentation, such as receipts and canceled checks.

- Do return all registration materials related to your refund request.

- Do mail your completed form and documents to the correct address: DMV Accounting at the Utah State Tax Commission.

- Don't submit your claim without proof of payment, as this could delay processing.

- Don't forget to keep a copy of your claim and all documentation for your records.

- Don't apply for a refund after the six-month window from the original payment date has passed.

- Don't submit incomplete forms, as this may lead to rejection or delays in your claim.

More PDF Forms

How to Make a Job Application Form - Provide your current address, including street, city, and ZIP code.

When engaging in the sale of a motorcycle in Arizona, it is crucial to utilize the Arizona Motorcycle Bill of Sale form, which acts as a legal safeguard for both the buyer and seller. This document not only ensures clarity in the transaction but also provides necessary details for subsequent registration and title transfer. For those looking to acquire this essential form, more information can be found at https://arizonapdfforms.com/motorcycle-bill-of-sale/.

Utah Real Estate Purchase Contract - Sellers are safeguarded against unwanted financial risks through the due-on-sale clause.

Listed Questions and Answers

-

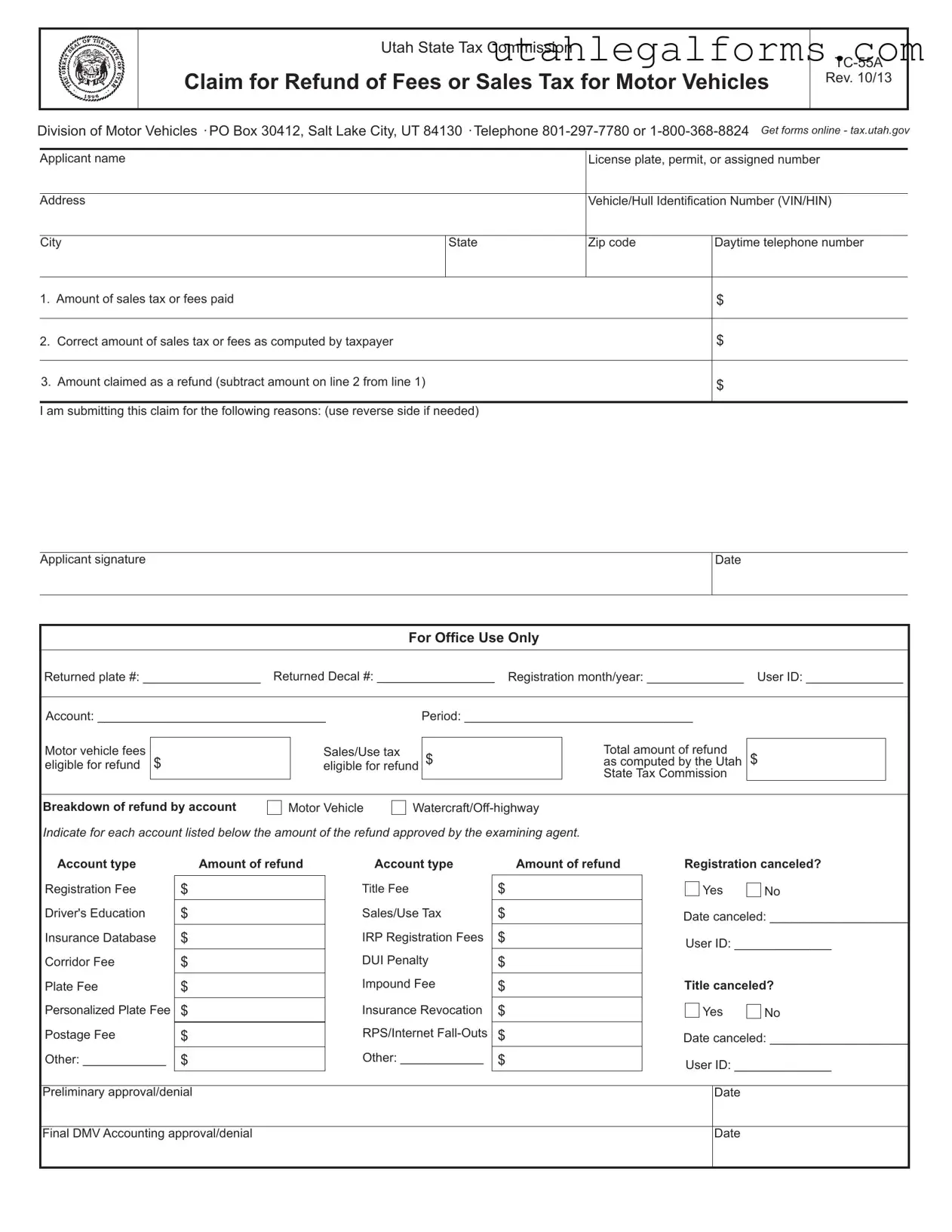

What is the purpose of the Utah TC-55A form?

The Utah TC-55A form is used to claim a refund of fees or sales tax paid for motor vehicles. This form is essential for individuals who believe they have overpaid or are eligible for a refund due to specific circumstances, such as selling or trading in a vehicle.

-

Who is eligible to file a claim using the TC-55A form?

Any individual who has paid sales tax or registration fees for a motor vehicle in Utah may be eligible to file a claim using the TC-55A form. Eligibility is often contingent on specific circumstances, such as the vehicle being sold, traded in, or rendered inoperable prior to the expiration of the registration period.

-

What information is required to complete the TC-55A form?

To complete the TC-55A form, applicants must provide personal information including their name, address, and daytime telephone number. Additionally, they must include details about the vehicle, such as the Vehicle Identification Number (VIN) or Hull Identification Number (HIN). The form also requires information about the amount of sales tax or fees paid, the correct amount as computed by the taxpayer, and the total amount claimed as a refund.

-

What documentation must be submitted with the TC-55A form?

When submitting the TC-55A form, applicants must return all registration materials related to the refund request, such as decals, registrations, and plates. They should also attach copies of receipts or canceled checks, documentation supporting the reason for the refund request, and any relevant agreements or contracts. This may include proof of sale, lease buy-out agreements, or canceled sale documentation.

-

What are the deadlines for submitting a refund claim?

According to Utah Code Section 41-1a-1203, applications for refunds of registration fees must be submitted within six months after the original payment date. It is crucial for applicants to adhere to this timeline to ensure their claim is processed.

-

What should I do if I have questions about the TC-55A form?

If you have questions regarding the TC-55A form or the refund process, you can contact the Utah State Tax Commission by calling 801-297-7780 or 1-800-368-8824. They can provide assistance and clarify any uncertainties you may have.

-

Where should I send my completed TC-55A form?

The completed TC-55A form, along with all supporting documentation, should be mailed to DMV Accounting-4th Floor at the Utah State Tax Commission, PO Box 30412, Salt Lake City, UT 84134. It is advisable to keep a copy of the refund claim and all documentation for your records.

Key takeaways

Filling out and utilizing the Utah TC-55A form can be straightforward if you keep a few key points in mind. Below are essential takeaways to help you navigate the process effectively.

- Understand the Purpose: The TC-55A form is used to claim a refund for fees or sales tax related to motor vehicles.

- Eligibility Criteria: Refunds are generally available under limited circumstances, such as vehicle sale or registration cancellation.

- Time Limit: Applications for refunds must be submitted within six months of the original payment date.

- Required Documentation: All relevant registration materials, such as decals and plates, must be returned with the claim.

- Supporting Evidence: Attach copies of receipts, canceled checks, or documentation that supports your reason for requesting a refund.

- Mailing Instructions: Send the completed form and all supporting documents to the DMV Accounting department at the Utah State Tax Commission.

- Keep Copies: Retain a copy of the completed refund claim and all documentation for your personal records.

- Contact Information: If you have questions during the process, reach out to the provided phone numbers for assistance.

By following these guidelines, you can streamline your experience with the TC-55A form and enhance the likelihood of a successful refund claim.

Documents used along the form

The Utah TC-55A form is a crucial document for individuals seeking a refund of fees or sales tax related to motor vehicles. However, it is often accompanied by several other forms and documents that help streamline the refund process. Below is a list of these additional documents, each serving a specific purpose in conjunction with the TC-55A.

- TC-656 - This is the "Application for a Motor Vehicle Title." It is necessary for individuals who need to obtain a title for a newly purchased vehicle or for a vehicle that has undergone a change in ownership.

- TC-889 - Known as the "Vehicle Registration Application," this form is used to register a vehicle in Utah. It collects information about the vehicle and the owner, ensuring that the vehicle is legally registered with the state.

- TC-65 - This is the "Notice of Sale" form. It serves as a record of the sale of a vehicle, providing important details like the sale date and the parties involved, which can be vital for refund claims.

- TC-96 - The "Affidavit of Loss" form is required when a vehicle title or registration is lost. This document helps in replacing lost materials, which may be needed when applying for a refund.

- TC-123 - This form is the "Application for Duplicate Registration." If the original registration has been misplaced, this document allows individuals to request a duplicate, which may be necessary for the refund process.

- TC-675 - The "Request for Tax Exemption" form is used when individuals believe they qualify for a tax exemption on their vehicle purchase. This form must be submitted to ensure proper processing of the refund.

- TC-44 - This is the "Application for Special Plates." If a vehicle owner is applying for personalized or specialty plates, this form is essential and may be relevant for refund claims associated with registration fees.

- TC-69 - The "Vehicle Transfer Notification" form is used to notify the state of a vehicle's sale or transfer. It helps in updating records and may support refund requests when applicable.

- TC-45 - This is the "Application for a Temporary Permit." It allows individuals to operate a vehicle legally while waiting for permanent registration or title, which can be relevant in refund situations.

- Boat Bill of Sale: A legalpdf.org boat bill of sale may be required as evidence of the transaction when purchasing a boat. It should include details such as the boat’s description, sale price, and signatures from both the buyer and seller.

- TC-22 - The "Application for Exemption from Registration Fees" form is used by qualifying individuals to apply for exemptions that may affect the fees paid, thus influencing the refund process.

Each of these documents plays a role in the broader context of vehicle registration and refund processes in Utah. When submitting a claim using the TC-55A form, it is essential to ensure that all relevant documents are included to facilitate a smooth and efficient review by the Utah State Tax Commission.

File Specifications

| Fact Name | Details |

|---|---|

| Form Purpose | The TC-55A form is used to claim a refund for fees or sales tax paid on motor vehicles in Utah. |

| Governing Law | This form is governed by Utah Code Section 41-1a-1203. |

| Submission Deadline | Claims for refunds must be submitted within six months of the original payment date. |

| Required Information | Applicants must provide their name, address, vehicle identification number (VIN), and the amount claimed. |

| Refund Eligibility | Refunds are only available in limited circumstances, such as vehicle sale or trade-in. |

| Supporting Documents | Applicants must attach receipts, canceled checks, or proof of payment when submitting the form. |

| Registration Materials | All registration materials, including decals and plates, must be returned with the claim. |

| Contact Information | For assistance, applicants can call 801-297-7780 or 1-800-368-8824. |

| Mailing Address | Refund claims should be mailed to DMV Accounting, PO Box 30412, Salt Lake City, UT 84134. |

| Record Keeping | Applicants should keep a copy of the claim and all supporting documents for their records. |