Fill a Valid Utah Tc 65 Template

Dos and Don'ts

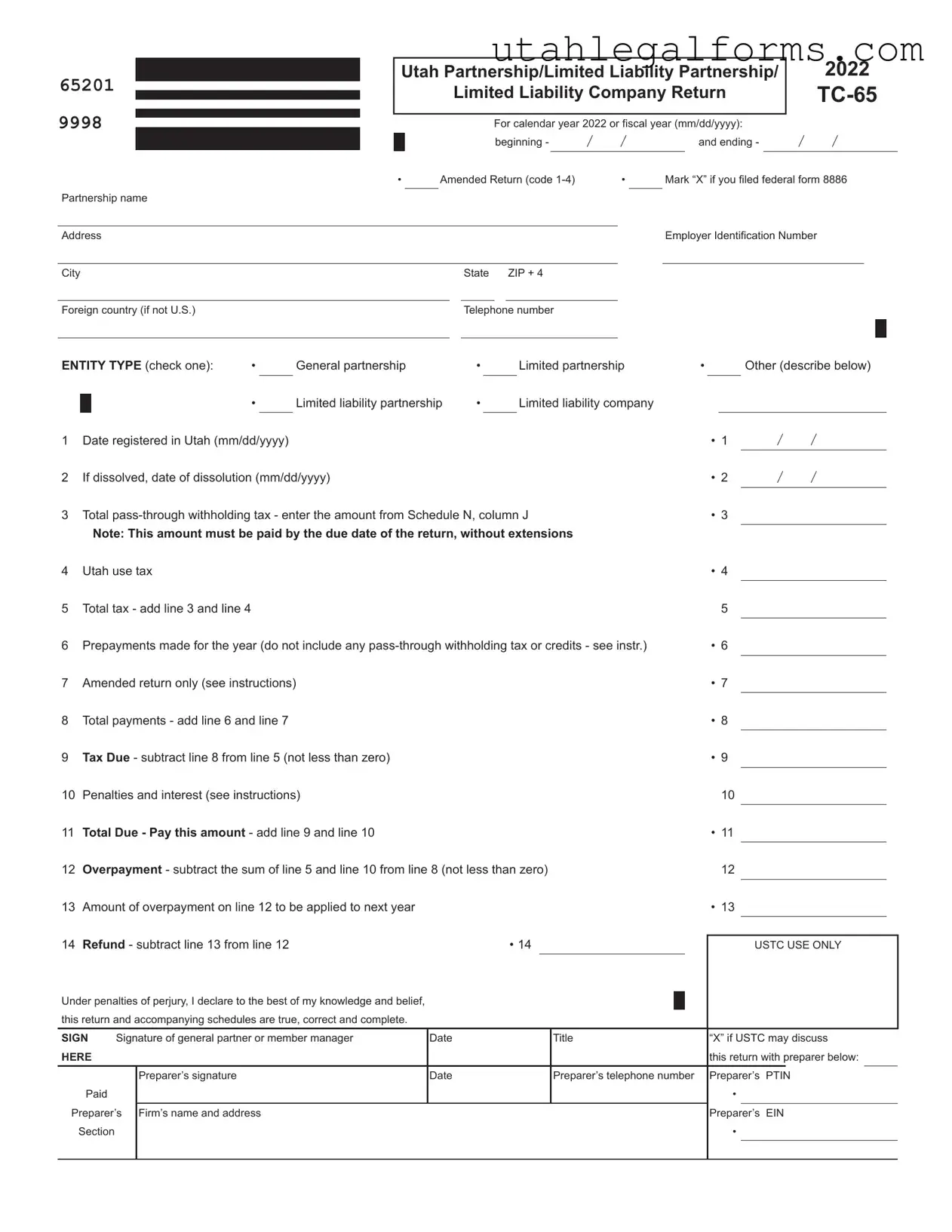

When filling out the Utah TC-65 form, it's important to follow specific guidelines to ensure accuracy and compliance. Here are six key do's and don'ts to keep in mind:

- Do double-check all entries for accuracy before submitting the form.

- Do ensure that you have included all necessary schedules and supporting documents.

- Do clearly indicate your entity type by checking the appropriate box.

- Do pay any tax due by the deadline to avoid penalties and interest.

- Don't leave any fields blank; if a question does not apply, write "N/A."

- Don't forget to sign and date the form before submission.

More PDF Forms

Dopl Price - Instructions for the Dopl Ap 116 may vary by jurisdiction.

Obtaining a Motor Vehicle Bill of Sale is essential for anyone looking to sell or purchase a vehicle in Arizona, as it legitimizes the transfer of ownership and protects both parties involved. You can find more detailed instructions and access the necessary form at arizonapdfforms.com/motor-vehicle-bill-of-sale, ensuring that all required information is correctly documented for a hassle-free transaction.

Utah Tax Form - The TC-40 requires total income calculations to determine taxable amounts.

Listed Questions and Answers

-

What is the Utah TC-65 form?

The Utah TC-65 form is a tax return specifically designed for partnerships and limited liability companies operating in Utah. It reports income, deductions, and tax liabilities for these entities. This form must be filed annually, reflecting either a calendar year or a fiscal year.

-

Who needs to file the TC-65 form?

Any partnership, limited partnership, limited liability partnership, or limited liability company that conducts business in Utah is required to file the TC-65 form. If your entity is classified as one of these types and has income to report, you must complete and submit this form.

-

What information is required on the TC-65 form?

The TC-65 form requires various details, including:

- Entity name and address

- Employer Identification Number (EIN)

- Type of entity (e.g., general partnership, limited liability company)

- Dates of registration and dissolution, if applicable

- Total pass-through withholding tax and Utah use tax

- Details of any overpayments or tax due

-

How is the tax calculated on the TC-65 form?

The tax is calculated by adding the total pass-through withholding tax and any applicable Utah use tax. After determining the total tax, any prepayments made during the year are subtracted to find the final tax due. If the total payments exceed the tax due, an overpayment may be applied to the next year or refunded.

-

What are the penalties for not filing the TC-65 form on time?

Failure to file the TC-65 form by the due date may result in penalties and interest. The penalties can accumulate, increasing the total amount owed. It is crucial to file on time to avoid these additional costs.

-

Can the TC-65 form be amended?

Yes, the TC-65 form can be amended if there are errors or changes that need to be reported. When filing an amended return, indicate the appropriate code and provide the corrected information. Be sure to submit the amended form by the required deadlines to minimize potential penalties.

Key takeaways

When dealing with the Utah TC-65 form, there are several important points to keep in mind to ensure accurate completion and compliance. Below are key takeaways that can guide you through the process.

- Understand the Entity Type: Identify whether your business is a general partnership, limited partnership, limited liability partnership, or a limited liability company. This classification affects how you fill out the form.

- Know Your Dates: Clearly indicate the beginning and ending dates of your fiscal year, or specify if you are filing for the calendar year.

- Pass-Through Withholding Tax: Make sure to calculate and report the total pass-through withholding tax. This amount must be submitted by the return's due date to avoid penalties.

- Utah Use Tax: If applicable, report any Utah use tax. This is a tax on goods purchased outside of Utah but used within the state.

- Amended Returns: If you are filing an amended return, be sure to mark the appropriate box and follow the specific instructions for amendments.

- Payment Calculations: Calculate total payments, including prepayments and any additional taxes due. It’s crucial to ensure that the total due is accurate to avoid issues with the state.

- Signature Requirement: The form must be signed by a general partner or member manager. This signature affirms that the information provided is true and complete.

- Preparer Information: If a tax preparer assists you, include their information, such as signature, telephone number, and PTIN. This helps the state to communicate with them if needed.

- Keep Records: Retain copies of the TC-65 form and any supporting documentation for your records. This is important in case of audits or future inquiries.

By following these key points, you can navigate the TC-65 form with greater confidence and ensure compliance with Utah tax requirements.

Documents used along the form

The Utah TC-65 form is an essential document for partnerships and limited liability companies operating in Utah. However, it is often accompanied by other forms and documents that provide additional information or fulfill specific requirements. Below is a list of these commonly used forms.

- Schedule A - Utah Taxable Income for Pass-through Entity Taxpayers (TC-65, Sch. A): This schedule details the taxable income for partnerships and LLCs, including net income, contributions, and foreign taxes.

- Schedule H - Utah Nonbusiness Income Net of Expenses (TC-20, Sch. H): This form is used to report nonbusiness income allocated to Utah, detailing direct and indirect expenses related to that income.

- Schedule J - Apportionment Schedule (TC-20, Sch. J): This schedule is necessary for entities doing business in multiple states. It helps determine the portion of income that should be apportioned to Utah based on property, payroll, and sales factors.

- Federal Form 1065: This is the U.S. Return of Partnership Income. It provides the IRS with details on the partnership's income, deductions, and credits, which is crucial for state tax calculations.

- Federal Form 8886: This form is used to disclose reportable transactions to the IRS. Partnerships may need to file it if they engage in certain transactions that could have tax implications.

- California Lease Agreement: A comprehensive document that outlines rental terms in California, ensuring clarity for both landlords and tenants. For more information, visit https://fastpdftemplates.com.

- Utah TC-20 Form: This is the Utah Corporate Franchise or Income Tax Return. It may be relevant for partnerships and LLCs that also operate as corporations for tax purposes.

- Utah TC-20S Form: This form is for S Corporations and may be used by entities that have elected S Corporation status, providing specific tax information relevant to that classification.

- Utah TC-65 Schedule N: This schedule reports pass-through withholding tax for partnerships and LLCs, ensuring compliance with state tax obligations.

- Preparer's Information: This includes the preparer's signature, date, and PTIN, ensuring that the tax return is completed by a qualified individual.

Understanding these forms and their purposes can greatly assist in the accurate filing of taxes for partnerships and LLCs in Utah. It is essential to ensure that all relevant documents are completed and submitted to avoid potential issues with tax compliance.

File Specifications

| Fact Name | Description |

|---|---|

| Form Purpose | The TC-65 form is used for reporting income and tax details for partnerships and limited liability companies in Utah. |

| Filing Requirement | Entities must file this form annually for the calendar year or fiscal year. |

| Amended Returns | Taxpayers can file an amended return by marking the appropriate box on the form. |

| Entity Types | The form accommodates various entity types including general partnerships, limited partnerships, and limited liability companies. |

| Tax Calculation | Tax is calculated by adding total pass-through withholding tax and Utah use tax. |

| Payment Deadline | Payments for taxes due must be made by the return's due date, without extensions. |

| Governing Law | The TC-65 form is governed by Utah state tax laws, specifically the Utah Code Title 59. |

| Signature Requirement | A signature from a general partner or member manager is required to validate the return. |