Fill a Valid Utah Tc 69 Template

Dos and Don'ts

When filling out the Utah TC-69 form, it is important to follow specific guidelines to ensure successful registration. Below are six things you should and shouldn't do:

- Do read the instructions carefully before starting.

- Do type or print your information clearly to avoid rejection.

- Do provide all required information to prevent delays in processing.

- Do contact the appropriate city or county for business licensing requirements.

- Don't skip any sections that apply to your business type.

- Don't forget to allow at least 15 business days for processing after submission.

More PDF Forms

Utah State Employer Id Number - Utah businesses should maintain consistency between TC-941 and TC-941D.

A well-prepared New York Boat Bill of Sale form not only facilitates the transfer of ownership but also protects the interests of both buyer and seller. To ensure all necessary details are properly captured, you can find a comprehensive guide and template at legalpdf.org, which makes the process smoother and more efficient.

Utah 15C - The person filling out the form must certify its accuracy with their signature.

How to Transfer a Car Title to a Family Member in Utah - Indicate the registration cancellation date if applicable in your refund claim.

Listed Questions and Answers

-

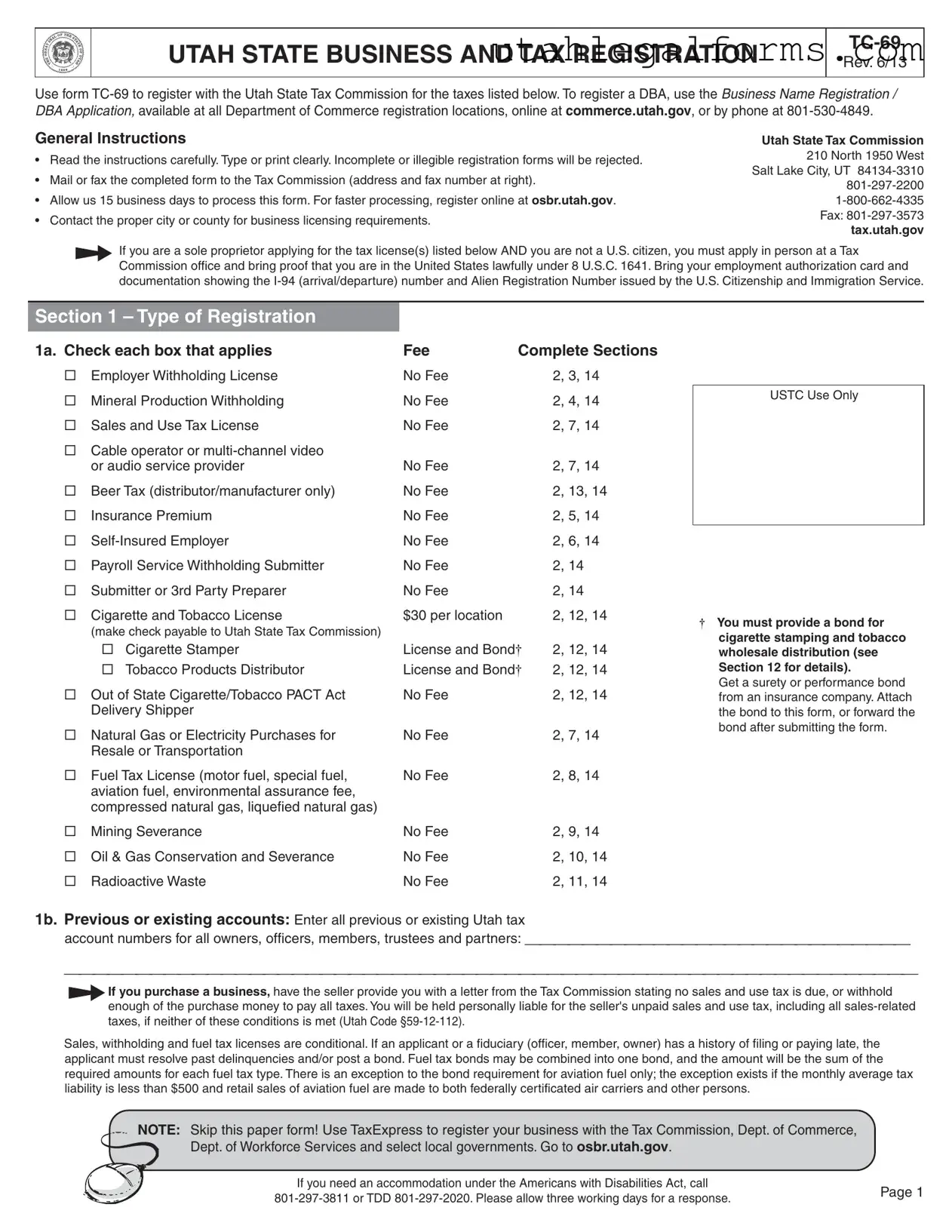

What is the purpose of the Utah TC-69 form?

The Utah TC-69 form is used to register with the Utah State Tax Commission for various taxes, including employer withholding, sales and use tax, and mineral production withholding. It is essential for businesses operating in Utah to ensure compliance with state tax laws.

-

How do I fill out the TC-69 form?

Carefully read the instructions provided with the form. Ensure that you type or print clearly. Complete all relevant sections based on your business type and activities. Incomplete or illegible forms will be rejected, so accuracy is crucial.

-

What types of registrations can I apply for using this form?

The TC-69 form allows you to register for several licenses, including:

- Employer Withholding License

- Sales and Use Tax License

- Mineral Production Withholding

- Fuel Tax License

- Cigarette and Tobacco Licenses

Make sure to check the appropriate boxes that apply to your business activities.

-

What should I do if I am not a U.S. citizen?

If you are a sole proprietor and not a U.S. citizen, you must apply in person at a Tax Commission office. Bring proof of your lawful presence in the United States, such as your employment authorization card and documentation showing your I-94 number and Alien Registration Number.

-

How long will it take to process my application?

After submitting the completed TC-69 form, you should allow 15 business days for processing. For faster processing, consider registering online at osbr.utah.gov.

-

Where do I submit the TC-69 form?

You can mail or fax the completed form to the Utah State Tax Commission at the address provided on the form. The contact details are:

- Address: 210 North 1950 West, Salt Lake City, UT 84134-3310

- Phone: 801-297-2200 or 1-800-662-4335

- Fax: 801-297-3573

-

What if I have previous or existing Utah tax accounts?

If you have previous or existing Utah tax account numbers, you must enter them on the TC-69 form. This includes accounts for all owners, officers, members, trustees, and partners associated with your business.

-

Are there any fees associated with the TC-69 registration?

Most registrations on the TC-69 form do not require a fee. However, certain licenses, such as the Cigarette and Tobacco License, incur a fee of $30 per location. Always check the specific requirements for each type of registration.

-

What if I need assistance or accommodations while filling out the form?

If you require assistance due to a disability, you can contact the Tax Commission at 801-297-3811 or TDD 801-297-2020. It is advisable to allow three working days for a response to your request for accommodations.

Key takeaways

Use the Utah TC-69 form to register with the Utah State Tax Commission for various taxes.

Before filling out the form, read the instructions carefully to avoid mistakes.

Make sure to type or print clearly; illegible forms will be rejected.

Mail or fax the completed form to the Utah State Tax Commission. The address and fax number are provided on the form.

Allow up to 15 business days for processing. For quicker service, consider registering online.

If you are a sole proprietor and not a U.S. citizen, apply in person and bring necessary documentation.

Check all applicable boxes in Section 1 to indicate the type of registration you need.

Provide your Social Security Number or Employer Identification Number (EIN) as required.

Contact local authorities to understand business licensing requirements in your area.

Documents used along the form

When registering a business in Utah, the TC-69 form is just one piece of the puzzle. Along with it, there are several other forms and documents that may be required depending on the nature of your business. Here’s a quick overview of some commonly used documents that often accompany the TC-69.

- Business Name Registration / DBA Application: This form is necessary for businesses that want to operate under a name different from their legal entity name. It's essential for branding and marketing purposes.

- Temporary Sales Tax License: If you plan to participate in special events, this license is required to collect sales tax on your sales during those events.

- Form TC-69B: This form is used to list additional business locations if you have more than one. It ensures that each location is properly registered and compliant with state regulations.

- Employer Identification Number (EIN) Application: This is needed for businesses with employees. The EIN is used for tax purposes and is essential for payroll processing.

- Sales and Use Tax Return: After registering for a sales tax license, this return must be filed periodically to report sales tax collected and to remit payment to the state.

- Local Business License Application: Many cities and counties require a local business license. This application ensures that your business meets local zoning and safety regulations.

- Fuel Tax License Application: If your business involves selling or distributing fuel, this license is necessary to comply with state fuel tax laws.

- Motorcycle Bill of Sale: To ensure a smooth transfer of motorcycle ownership in Arizona, completing the arizonapdfforms.com/motorcycle-bill-of-sale is essential. This legal document outlines the sale and protects both parties involved in the transaction.

- Insurance Premium Tax Form: If your business is an insurance provider, this form is required to report and pay taxes on premiums received from customers in Utah.

Understanding these documents and their purposes can make the registration process smoother. Being prepared with the right forms can save you time and help you avoid potential issues down the road. Always check with local authorities to ensure you have everything you need for your specific business type.

File Specifications

| Fact Name | Description |

|---|---|

| Purpose of Form | The TC-69 form is used to register with the Utah State Tax Commission for various taxes, including sales and use tax, employer withholding, and mineral production withholding. |

| Registration Process | Applicants must mail or fax the completed form to the Tax Commission. For quicker processing, online registration is available at osbr.utah.gov. |

| Processing Time | Once submitted, allow 15 business days for the Tax Commission to process the registration form. |

| Special Requirements | Sole proprietors who are not U.S. citizens must apply in person and provide proof of lawful presence in the U.S. under 8 U.S.C. 1641. |

| Governing Law | The registration process is governed by the Utah Code, specifically §59-12-112 regarding sales and use tax obligations. |