Fill a Valid Utah Tc 941D Template

Dos and Don'ts

When filling out the Utah TC-941D form, it’s essential to follow certain guidelines to ensure accuracy and compliance. Here’s a list of things you should and shouldn’t do:

- Do check if you need to file an amended report.

- Do ensure that your company name and federal employer identification number are correct.

- Do accurately complete the reconciliation calculation by entering the correct amounts in each column.

- Do review the TC-941R lines 4 and 6 to confirm they do not balance before filing this form.

- Don’t leave any required fields blank; all sections must be filled out completely.

- Don’t ignore discrepancies; provide explanations for any differences noted in the amounts reported.

- Don’t submit the form without double-checking for errors in calculations.

- Don’t forget to sign and date the form before submission.

More PDF Forms

Utah Contractors License Bond - Applicants must understand the continuing responsibility to read and apply relevant laws and rules.

Billing Notice - The TC-42 form is available online for download and printing through the Utah State Tax Commission’s website.

In California, having a properly executed Bill of Sale is crucial for protecting both parties involved in a transaction. It serves as essential proof of ownership transfer and can be necessary for registration or title applications. To ensure compliance with state requirements and to understand the nuances of the form, you can refer to resources such as legalpdf.org for detailed guidance and templates that can simplify the process.

Real Estate Purchase Contract Utah - The seller retains rights to review the buyer's financial position before finalizing the financing terms.

Listed Questions and Answers

-

What is the purpose of the Utah TC-941D form?

The Utah TC-941D form serves as a Discrepancy Report for Annual Withholding Reconciliation. Businesses must use this form when they experience discrepancies between their Utah Annual Withholding Reconciliation (form TC-941R) and the W-2s or other withholding forms issued. This situation may arise if a business changes entity types or merges with another company during the tax year.

-

When should I file the TC-941D form?

You should file the TC-941D form if lines 4 and 6 of your TC-941R do not balance. This discrepancy indicates that the amounts reported do not match, which could be due to changes in your business structure, such as merging with another entity or changing from a sole proprietorship to a corporation. Filing this form is crucial to explain the discrepancy and reconcile the withholding tax returns.

-

What information do I need to provide on the TC-941D form?

On the TC-941D form, you will need to provide your company name, federal employer identification number, address, Utah withholding account number, and contact telephone number. Additionally, you must check the reason for the discrepancy, such as a business merger or a change in entity type. Accurate reporting is essential for effective reconciliation.

-

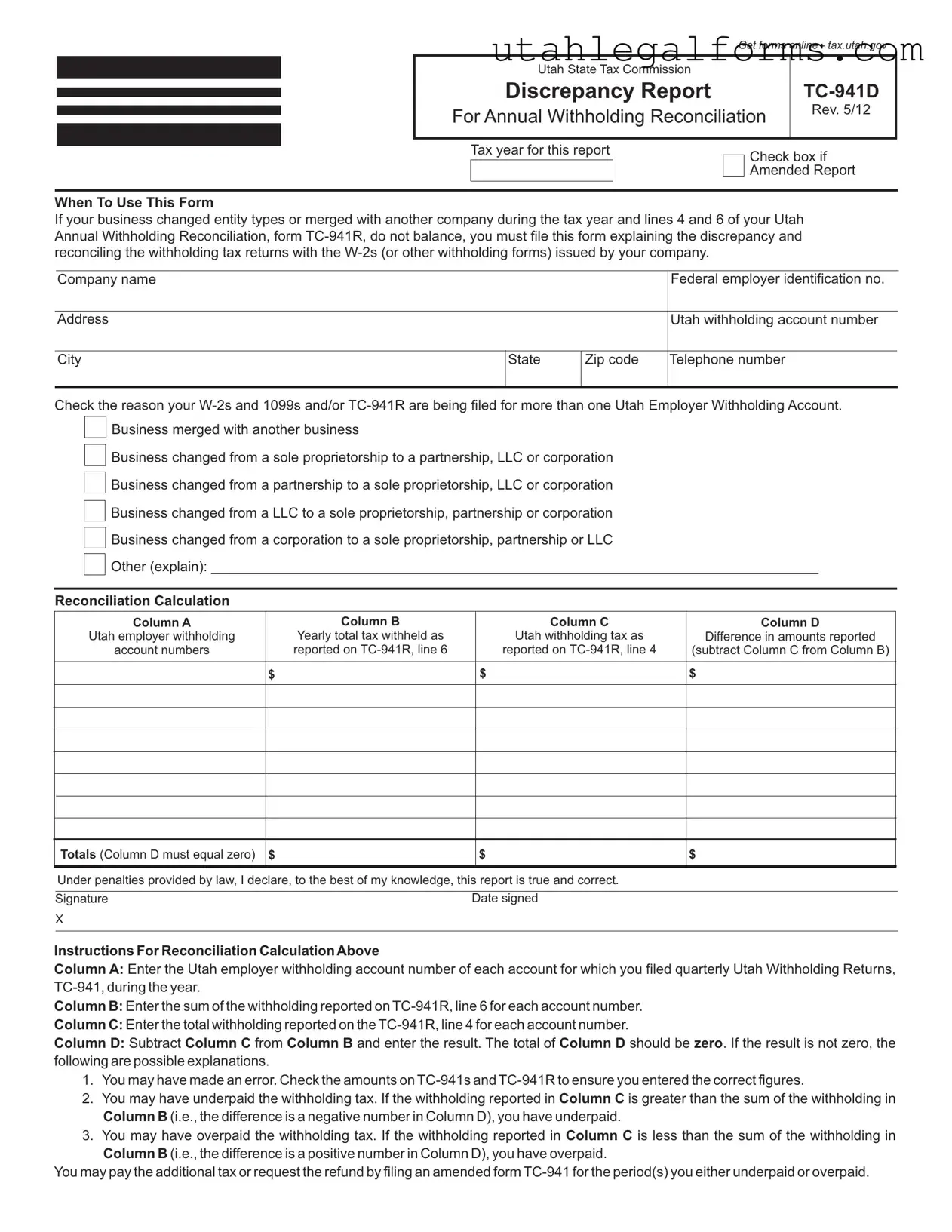

How do I calculate the reconciliation amounts?

The reconciliation calculation involves filling out four columns. Column A requires the Utah employer withholding account number. In Column B, you will enter the total tax withheld as reported on TC-941R, line 6. Column C will include the total withholding reported on TC-941R, line 4. Finally, in Column D, subtract the amount in Column C from Column B. The total for Column D must equal zero; if it does not, further investigation is necessary to determine the cause of the discrepancy.

-

What should I do if the amounts do not balance?

If the amounts do not balance, you may have made an error in your reporting. Double-check the figures on your TC-941s and TC-941R to ensure accuracy. Alternatively, you may have underpaid or overpaid your withholding tax. If you suspect underpayment, the amount in Column C will exceed Column B. Conversely, if you have overpaid, Column B will be greater than Column C. In either case, you can address the issue by filing an amended TC-941 form for the relevant periods.

Key takeaways

When dealing with the Utah TC-941D form, it is essential to understand its purpose and how to complete it accurately. Here are key takeaways to consider:

- Purpose of the Form: The TC-941D is a discrepancy report used for annual withholding reconciliation when there are discrepancies between your TC-941R and W-2s.

- When to Use: File this form if your business changed entity types or merged, and the totals on lines 4 and 6 of TC-941R do not match.

- Company Information: Ensure that you provide your company's name, federal employer identification number, and Utah withholding account number accurately.

- Reconciliation Calculation: Complete the reconciliation calculation by entering data in Columns A, B, and C, and ensure Column D equals zero.

- Possible Errors: If Column D does not equal zero, review your entries. Errors may stem from incorrect figures on TC-941s or TC-941R.

- Underpayment and Overpayment: A negative difference in Column D indicates underpayment, while a positive difference suggests overpayment of withholding tax.

- Amended Returns: If you discover an underpayment or overpayment, you may need to file an amended TC-941 for the relevant periods.

- Signature Requirement: The form must be signed and dated, affirming that the information provided is accurate to the best of your knowledge.

Documents used along the form

The Utah TC-941D form is an important document used to address discrepancies in annual withholding reconciliations. When filing this form, several other documents may also be necessary to ensure compliance and accuracy. Below is a list of forms and documents commonly used alongside the TC-941D, along with brief descriptions of each.

- TC-941R: This is the Utah Annual Withholding Reconciliation form. It summarizes the total withholding tax for the year and is essential for reporting the amounts withheld from employees' wages.

- W-2 Forms: These forms report annual wages and the taxes withheld from employee earnings. They are crucial for reconciling the amounts reported on the TC-941R.

- 1099 Forms: Used to report various types of income other than wages, salaries, and tips. These forms may also need to be reconciled with the TC-941D if they pertain to withholding.

- TC-941: This is the quarterly Utah Withholding Return. It details the amounts withheld each quarter and provides a basis for the annual reconciliation.

- Amended TC-941: If there were errors in the original TC-941, this amended form is used to correct those mistakes and ensure accurate reporting of withholding tax.

- Employer Identification Number (EIN): This is a unique number assigned to businesses for tax purposes. It is often required on various forms, including the TC-941D.

- Motorcycle Bill of Sale: This essential document records the sale and transfer of ownership of a motorcycle in Arizona. For more information, visit arizonapdfforms.com/motorcycle-bill-of-sale/.

- Payment Records: Documentation of any tax payments made throughout the year. These records help verify amounts reported on the TC-941 and TC-941R.

- Business Entity Change Documentation: If a business has changed its entity type (e.g., from a sole proprietorship to an LLC), supporting documents may be required to explain the changes during reconciliation.

These documents collectively help ensure that all withholding tax obligations are met and that discrepancies are accurately addressed. Proper organization and attention to detail will facilitate a smoother reconciliation process.

File Specifications

| Fact Name | Details |

|---|---|

| Form Purpose | The TC-941D is used to report discrepancies in annual withholding reconciliation for businesses in Utah. |

| Governing Law | This form is governed by the Utah State Tax Commission regulations. |

| When to Use | File this form if your business changed entity types or merged, and your TC-941R does not balance. |

| Amended Report | Check the box on the form if you are submitting an amended report. |

| Required Information | Include your company name, federal employer identification number, and Utah withholding account number. |

| Reconciliation Calculation | The form includes a calculation section to reconcile amounts reported on TC-941R. |

| Column Breakdown | Columns A, B, C, and D are used to report account numbers and withholding amounts. |

| Zero Totals | The total of Column D must equal zero to ensure accurate reporting. |

| Penalties | Filing false information may result in penalties as stated by law. |

| Refund Process | If you overpaid, you can request a refund by filing an amended TC-941 for the relevant period. |